- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

3 Prominent Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the wake of a sharp downturn in major U.S. stock indexes, fueled by a significant drop in technology shares and broader economic uncertainties, investors are increasingly seeking stability and potential growth through companies with strong insider ownership. In this environment, stocks with high insider ownership can offer a compelling advantage, as insiders' vested interests often align closely with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 51.6% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 59.4% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 45.3% |

| Bitdeer Technologies Group (BTDR) | 37.3% | 85.8% |

| Atour Lifestyle Holdings (ATAT) | 18.1% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 27.1% |

| AppLovin (APP) | 27.6% | 26.6% |

Here we highlight a subset of our preferred stocks from the screener.

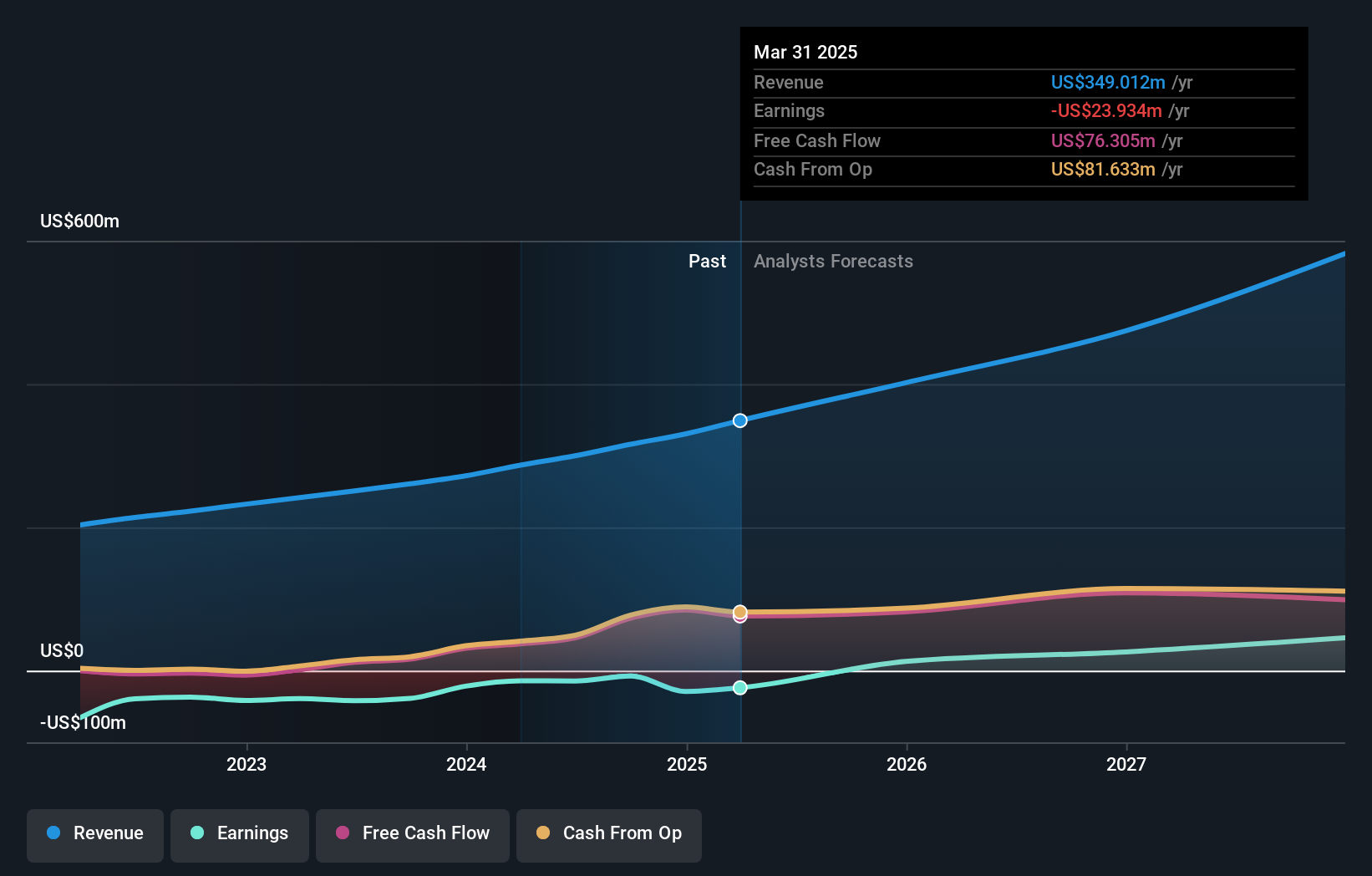

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of $2.81 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling $394 million.

Insider Ownership: 27.6%

AvePoint's strong insider ownership aligns with its impressive growth trajectory, as evidenced by a significant earnings increase, with net income rising from US$2.62 million to US$13.02 million year-over-year for Q3 2025. Despite past shareholder dilution, the company forecasts robust annual earnings growth of 75.8%, outpacing the broader market. Recent strategic partnerships and product enhancements further bolster its position in digital transformation and data protection sectors, while raised revenue guidance underscores confidence in sustained expansion.

- Take a closer look at AvePoint's potential here in our earnings growth report.

- According our valuation report, there's an indication that AvePoint's share price might be on the expensive side.

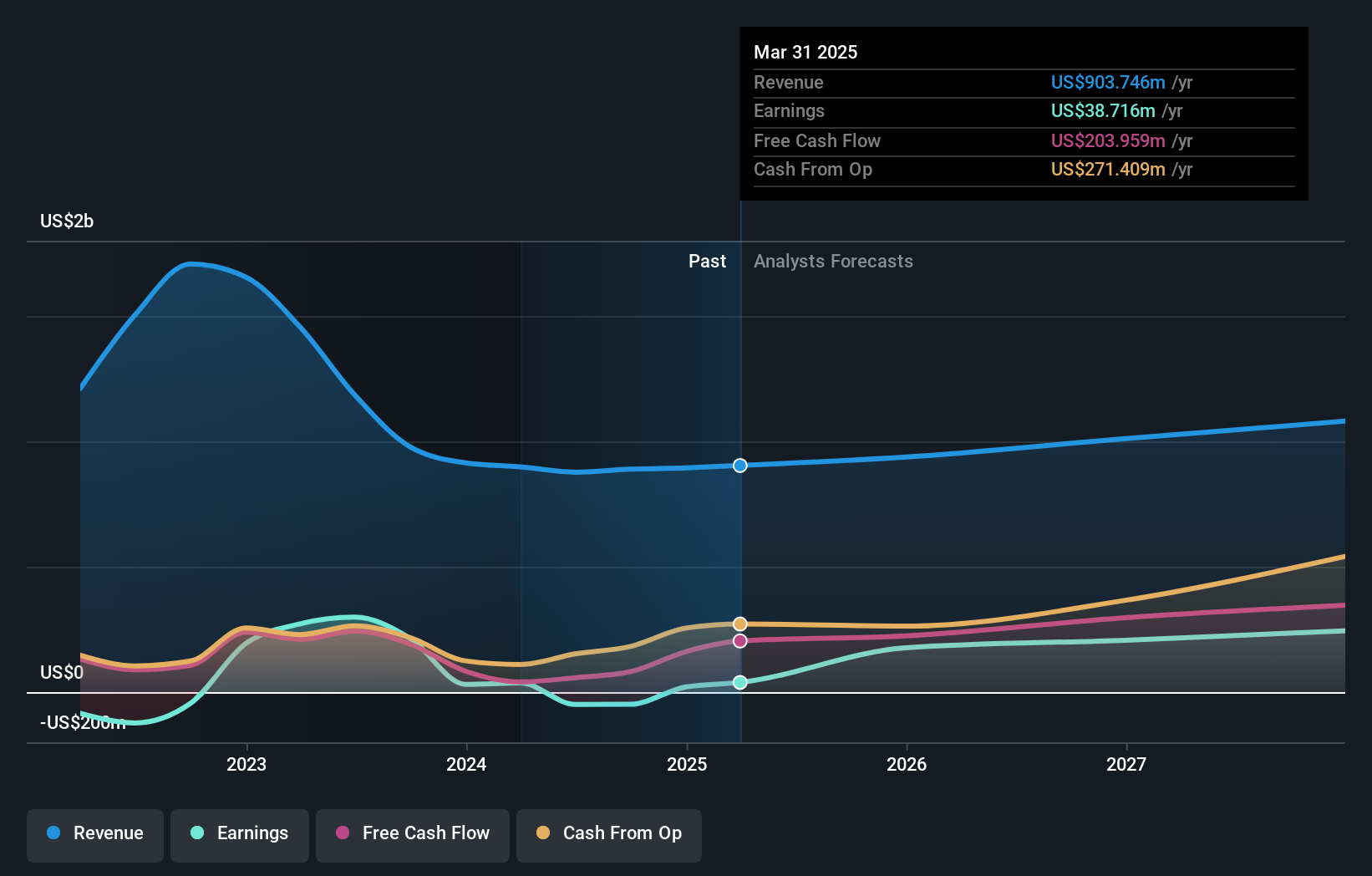

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CarGurus, Inc. operates an online automotive platform facilitating the buying and selling of vehicles both in the United States and internationally, with a market cap of approximately $3.40 billion.

Operations: The company's revenue segments include U.S. Marketplace generating $801.72 million and Digital Wholesale contributing $50.35 million.

Insider Ownership: 13.9%

CarGurus demonstrates strong growth potential with significant insider ownership, reflected in its Q3 2025 results showing net income of US$44.72 million, doubling from the previous year. Despite revenue growth forecasted at a slower pace than the market, earnings are expected to grow significantly at 24.1% annually, surpassing market averages. The company completed a substantial share buyback program and maintains high return on equity projections, indicating confidence in its financial health and future profitability.

- Get an in-depth perspective on CarGurus' performance by reading our analyst estimates report here.

- The analysis detailed in our CarGurus valuation report hints at an inflated share price compared to its estimated value.

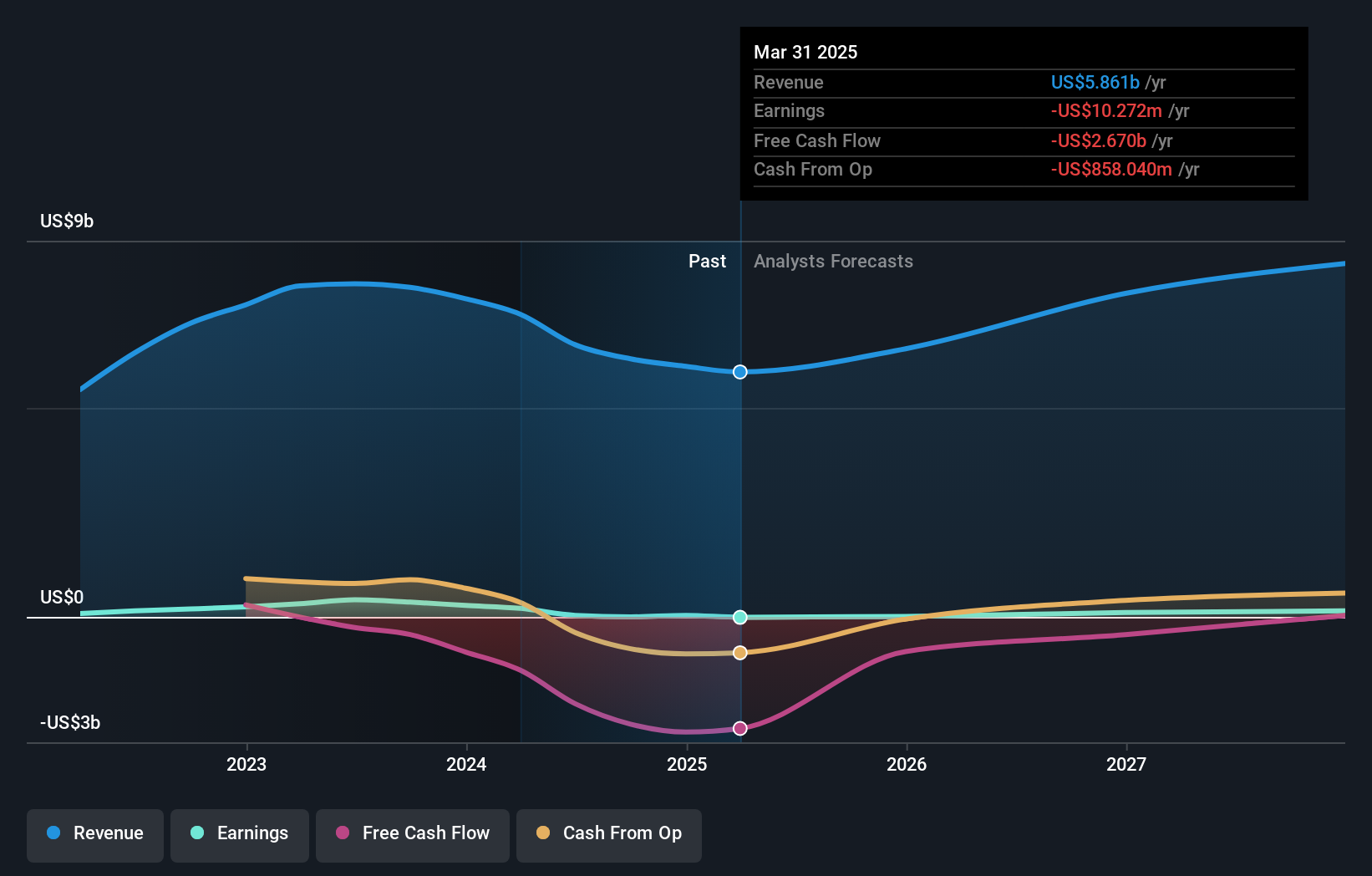

Canadian Solar (CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc. operates globally, offering solar energy and battery storage products and solutions, with a market cap of approximately $1.91 billion.

Operations: Canadian Solar Inc.'s revenue comes from providing solar energy and battery storage products and solutions across Asia, the Americas, Europe, and other international markets.

Insider Ownership: 21.2%

Canadian Solar shows potential for growth with substantial insider ownership, despite a volatile share price. The company is forecasted to grow earnings by 104.65% annually, although revenue growth of 11.1% per year lags behind the desired threshold for high-growth companies. Recent Q3 results show improved net income of US$8.99 million from a prior loss, and its innovative Low Carbon modules highlight a commitment to sustainable technology advancements in the solar industry.

- Unlock comprehensive insights into our analysis of Canadian Solar stock in this growth report.

- In light of our recent valuation report, it seems possible that Canadian Solar is trading behind its estimated value.

Seize The Opportunity

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 186 companies by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives