- United States

- /

- Software

- /

- NasdaqCM:ARQQ

Will Arqit Quantum's (ARQQ) S&P Global BMI Addition Elevate Its Standing With Institutional Investors?

Reviewed by Sasha Jovanovic

- Arqit Quantum Inc. (NasdaqCM: ARQQ) was recently added to the S&P Global BMI Index, expanding its exposure to international investors and index-tracking funds.

- This inclusion often signals broader recognition and can attract increased institutional and retail interest due to the index's global prominence.

- We'll explore how greater visibility through index inclusion shapes Arqit Quantum's investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Arqit Quantum's Investment Narrative?

If you’re considering Arqit Quantum, it’s important to believe in the company’s vision of enabling quantum-safe security solutions, especially as global cybersecurity requirements intensify. The recent addition of Arqit to the S&P Global BMI Index could boost market visibility and may provide short-term support from institutional flows, but it doesn’t immediately change the fundamental challenges facing the business. Rising awareness can amplify catalysts already in play, such as recent high-profile contracts, a revamped leadership team, and rapid revenue growth forecasts. However, the biggest risks haven’t disappeared: Arqit remains unprofitable, with losses narrowing but still sizable, and its financial position is tight with less than a year of cash runway. The stock has been volatile, and past shareholder dilution still weighs on confidence, so the new index inclusion mainly strengthens the investment case for those already watching these fast-moving trends.

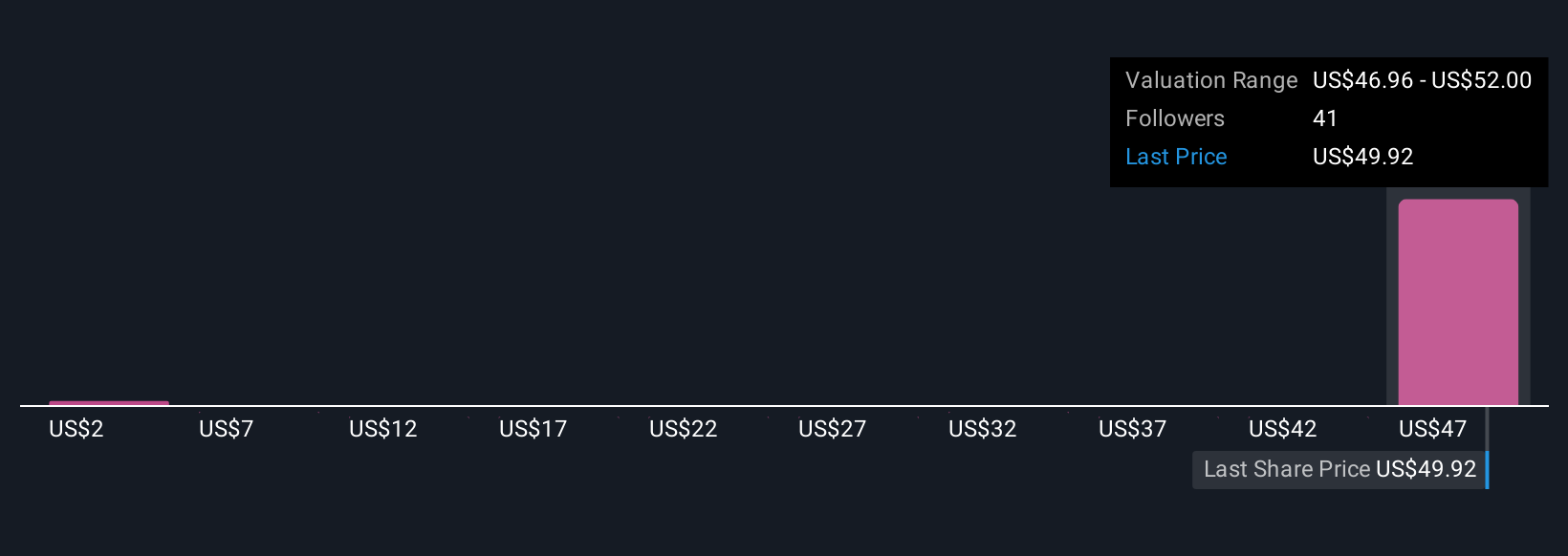

But the company’s narrow cash reserves remain a crucial risk that investors should keep in mind. Our valuation report unveils the possibility Arqit Quantum's shares may be trading at a premium.Exploring Other Perspectives

Explore 6 other fair value estimates on Arqit Quantum - why the stock might be worth as much as $52.00!

Build Your Own Arqit Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arqit Quantum research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Arqit Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arqit Quantum's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ARQQ

Arqit Quantum

Provides cybersecurity services through satellite and terrestrial platforms in the United Kingdom.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives