- United States

- /

- Software

- /

- NasdaqGM:APPN

A Fresh Look at Appian (APPN) Valuation as Investors Weigh Recent Performance Trends

Reviewed by Kshitija Bhandaru

Appian (APPN) has seen shares move slightly this week, with investors weighing performance over the past month along with ongoing sector trends. The stock’s recent movements invite a closer look at what is driving its valuation.

See our latest analysis for Appian.

Looking at the bigger picture, Appian’s share price momentum hasn’t made significant moves over the last year, and total shareholder return shows a nearly 10% drop for the period. Despite sector shifts and brief upticks in recent months, long-term performance suggests investors are still waiting to see signs of a sustained turnaround or renewed growth narrative taking hold.

If you’re open to broadening your watchlist, this could be a great moment to explore fast growing stocks with high insider ownership.

With shares having trended lower for the past year even as revenues grew, the key question now is whether investors are overlooking Appian’s intrinsic value or if the outlook for future growth is already reflected in the price.

Most Popular Narrative: 9.3% Undervalued

The most popular narrative pegs Appian’s fair value at $33.80, just above the recent close of $30.66. This points to modest upside potential based on forward-looking earnings growth and margins. It sets up a deeper look into the quantitative factors and future projections shaping the consensus perspective on where the stock should be trading.

Broad enterprise demand for application modernization and workflow automation is accelerating, with AI seen as a catalyst that dramatically lowers modernization costs and complexity. This positions Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

Want to uncover why analysts believe Appian’s platform could drive larger deals and potentially reshape its financial trajectory? The key ingredient powering this optimistic calculation mixes rapid automation demand with a bold future margin target only hinted at in their top-line estimates. What are the specific growth levers and financial dynamics making this price target possible? Dive into the details and see which forecasts truly move the needle.

Result: Fair Value of $33.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer down-sells and intensifying competition from larger software vendors could quickly challenge Appian’s growth outlook and margin expansion story.

Find out about the key risks to this Appian narrative.

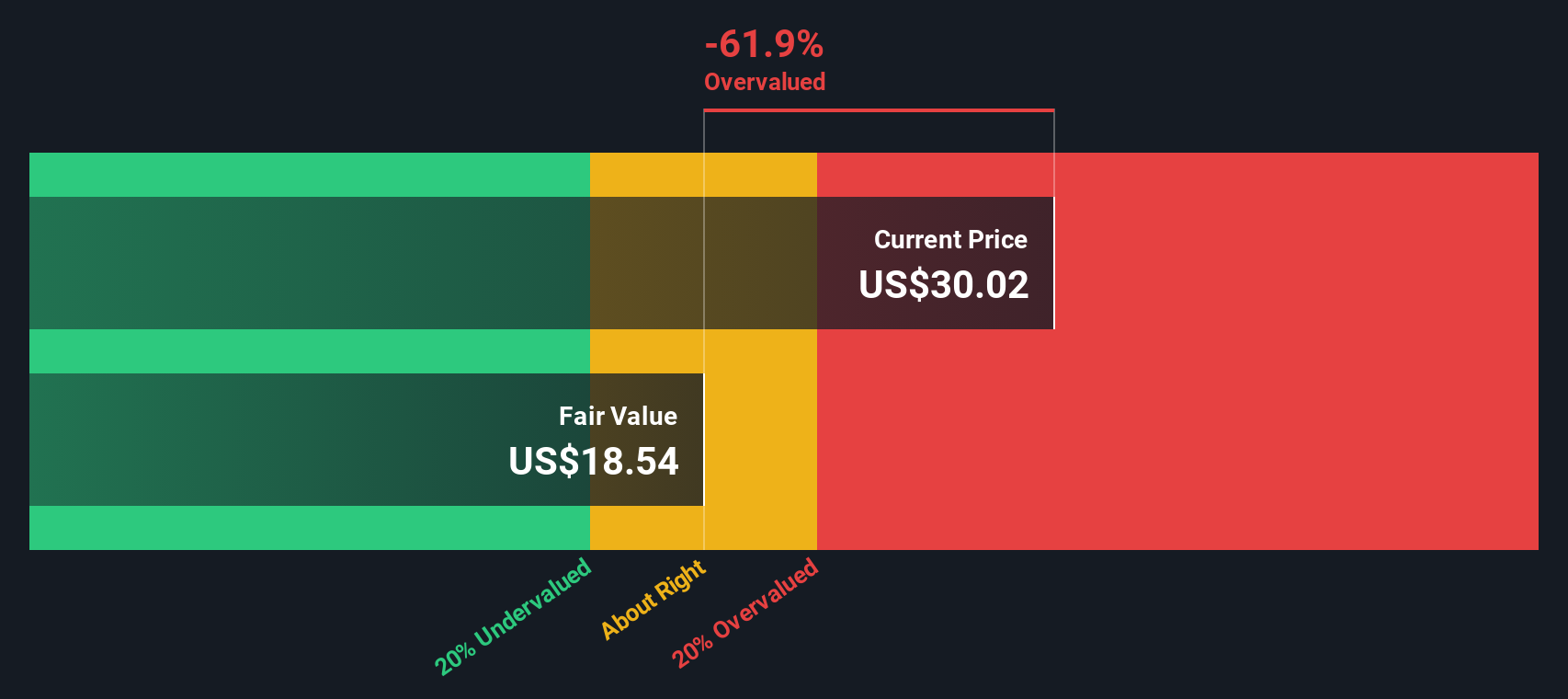

Another View: SWS DCF Model Shows Overvaluation

While the consensus price target points to moderate upside, our DCF model comes to a starkly different result. According to its cash flow projections, Appian’s fair value is much lower. This estimate suggests shares are actually trading well above what its fundamentals support today. Which method tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Appian Narrative

Feel free to dig into the numbers and craft your own take on Appian’s outlook. You can easily create a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Appian research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to take your portfolio to the next level? Don’t let new opportunities slip by. Put Simply Wall Street's screeners to work and discover stocks that match your goals right now.

- Fuel your strategy with steady income by checking out these 19 dividend stocks with yields > 3% delivering yields over 3%, perfect for building long-term wealth.

- Tap into the future of health by using these 31 healthcare AI stocks to spot companies at the forefront of medical technology and AI innovation.

- Jump ahead of the curve with these 909 undervalued stocks based on cash flows and spot potential gems trading below their intrinsic worth before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives