- United States

- /

- Software

- /

- NasdaqGM:APPF

How Strong Q2 Results and Mixed First Half Shape AppFolio’s (APPF) Long-Term Growth Story

Reviewed by Simply Wall St

- AppFolio reported its second quarter 2025 earnings in the past week, revealing US$235.58 million in sales and a net income of US$35.98 million, both higher than the same period last year.

- While second quarter growth was strong, net income for the first half of 2025 did not increase from the prior year, pointing to mixed momentum across reporting periods.

- We’ll examine how robust quarterly sales growth influences AppFolio’s investment outlook, especially amid ongoing technology and efficiency initiatives.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

AppFolio Investment Narrative Recap

If you believe in AppFolio’s ability to drive steady sales growth through technology upgrades and market partnerships, the latest quarterly earnings are likely reassuring, especially as sales and net income both rose year-over-year. However, the lack of improvement in first-half net income and ongoing risks to net margins suggest that while strong sales momentum is a short-term catalyst, maintaining margin discipline remains the most important risk, this news does not materially change that fundamental concern.

The introduction of AppFolio Realm-X Performers, which automate leasing and maintenance, is especially relevant given the company’s recent focus on technological efficiency. These product enhancements directly align with the sales-driven outlook but will need to deliver meaningful savings to offset potential cost pressures as the business scales up offerings and customer support.

On the other hand, it’s worth noting that investors should be aware of how competitive pressures on revenue and margins could still...

Read the full narrative on AppFolio (it's free!)

AppFolio's narrative projects $1.2 billion revenue and $141.4 million earnings by 2028. This requires 13.3% yearly revenue growth and a $55.4 million earnings decrease from $196.8 million today.

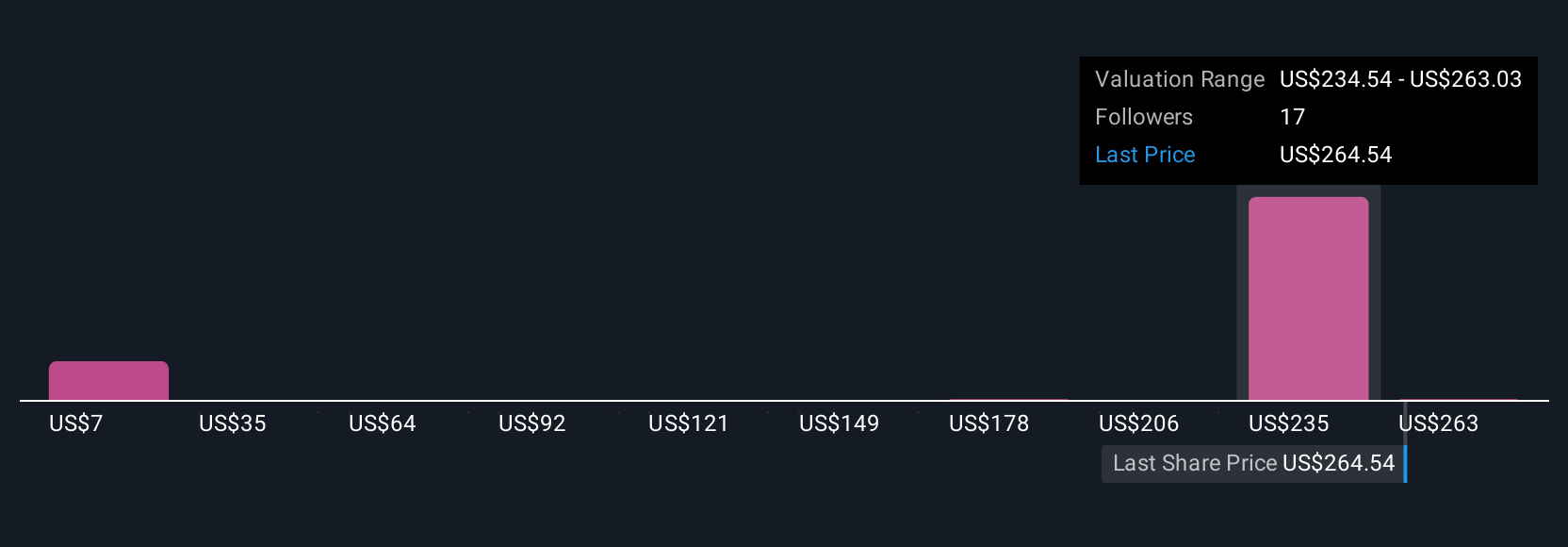

Uncover how AppFolio's forecasts yield a $248.94 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared 4 fair value estimates for AppFolio ranging from US$192.61 to US$291.52. While many see upside, concerns remain around whether AppFolio’s growing sales will consistently translate into stronger profitability over time, making it useful to consider a variety of perspectives on the company’s future performance.

Explore 4 other fair value estimates on AppFolio - why the stock might be worth 28% less than the current price!

Build Your Own AppFolio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppFolio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AppFolio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppFolio's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives