Last Update07 May 25

Key Takeaways

- Strategic partnerships and AI-driven solutions enhance efficiency and customer retention, potentially boosting revenues and margins.

- Focus on higher-tier plans and strategic investments aims to increase user revenue, enhance product offerings, and drive long-term earnings growth.

- AppFolio's investment in AI and strategic partnerships, despite potential risks and upfront costs, aims to enhance customer adoption and operational efficiency amidst competitive pressures.

Catalysts

About AppFolio- Provides cloud-based platform for the real estate industry in the United States.

- AppFolio's strategic partnership with Second Nature and the integration of their services aims to enhance the resident experience, potentially driving higher customer retention and increasing occupancy rates for property managers. This is expected to support higher future revenues.

- The adoption of AI-driven solutions like Realm-X is improving operational efficiency and conversion rates, helping property managers save time and resources. This could lead to a positive impact on net margins by reducing operating costs and increasing automation.

- The introduction of features such as the simplified rental application and integrations with platforms like Zillow is designed to streamline the leasing process, reduce vacancy times, and improve lead quality. This could result in increased revenue by more effectively attracting and retaining tenants.

- AppFolio's focus on upgrading existing customers to higher-tier plans (Plus and Max) is expected to increase the average revenue per user (ARPU), bolstering future revenue streams as more customers adopt enhanced product offerings.

- The recent acquisition of a minority equity interest in Second Nature and the new $300 million stock repurchase program demonstrate a commitment to strategic investments and shareholder value, potentially driving long-term earnings growth through enhanced product ecosystems and share repurchases.

AppFolio Future Earnings and Revenue Growth

Assumptions

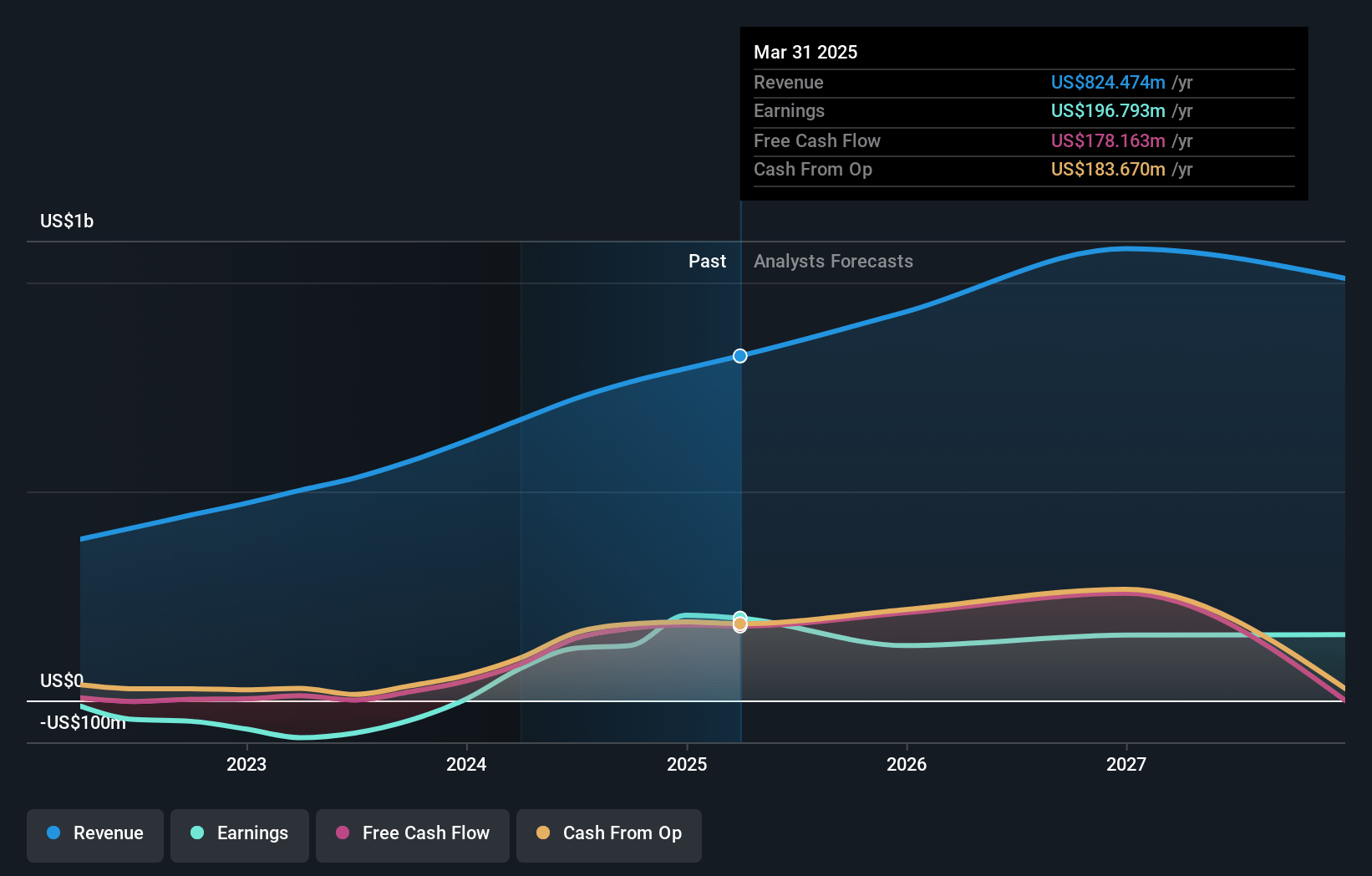

How have these above catalysts been quantified?- Analysts are assuming AppFolio's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.9% today to 11.8% in 3 years time.

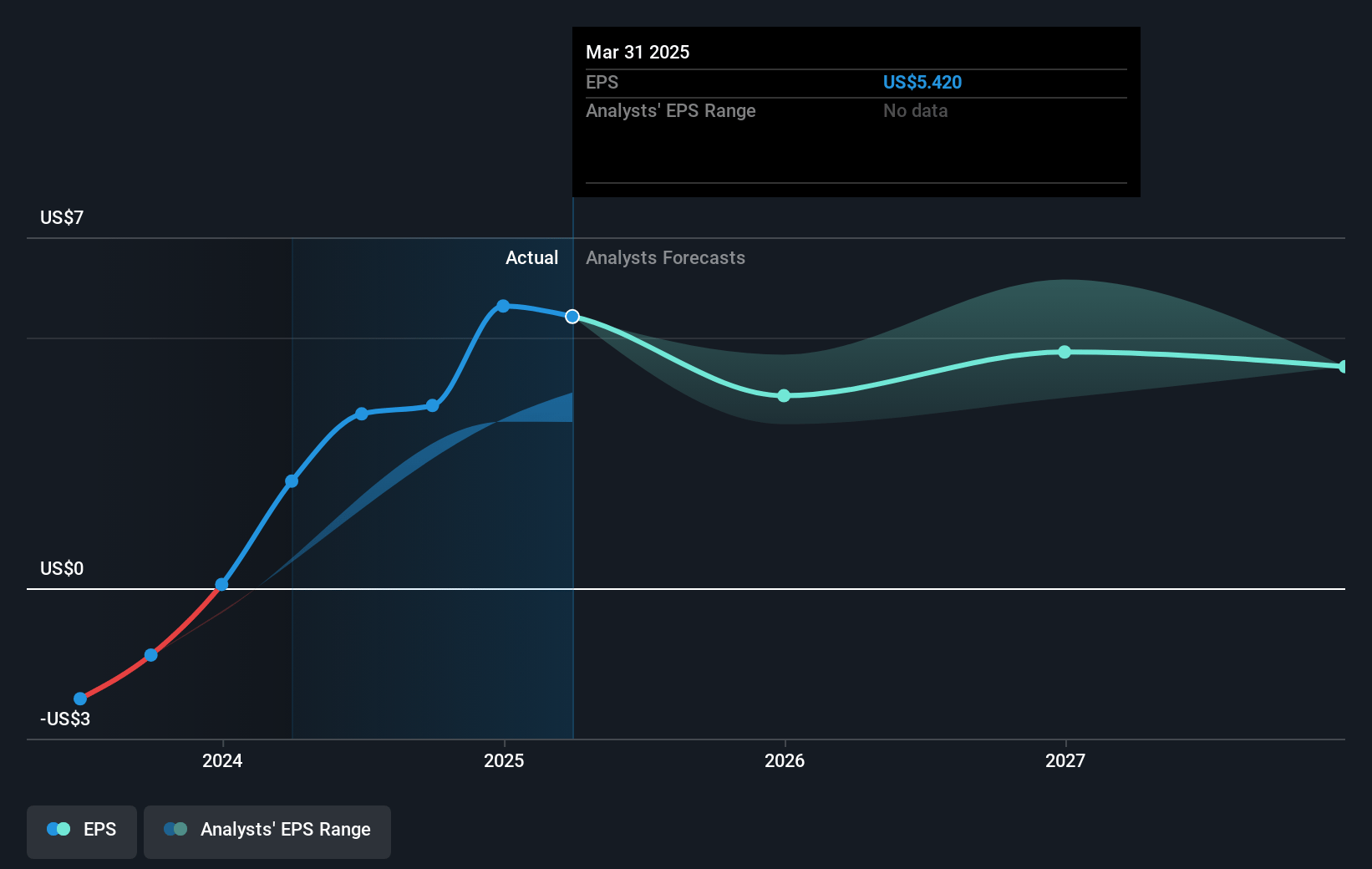

- Analysts expect earnings to reach $141.4 million (and earnings per share of $4.46) by about May 2028, down from $196.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.9x on those 2028 earnings, up from 39.0x today. This future PE is greater than the current PE for the US Software industry at 33.3x.

- Analysts expect the number of shares outstanding to decline by 0.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

AppFolio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AppFolio's growth in revenue and net cash provided by operating activities appears to be supported by new customer acquisition and increased adoption of value-added services, yet these numbers could be adversely affected by competitive pressures or shifts in customer preferences, impacting future revenue and earnings.

- The reduction in fees associated with certain card-based payments has already impacted the revenue mix and contributed to higher costs as a percentage of revenue, potentially affecting net margins if such trends continue.

- The headcount growth at AppFolio is projected to be less than revenue growth, but if operational efficiencies are not realized as expected, this could lead to increased operational costs, impacting operating margins.

- AppFolio's strategy to invest heavily in AI and partnerships like the one with Second Nature involves significant upfront costs and the risk of uncertain returns, which could impact profitability if these investments do not yield the expected increases in customer adoption or operational savings.

- The stock repurchase program and strategic equity investments, such as the $75 million investment in Second Nature, reduce cash reserves, which could impact financial flexibility and potentially risk the ability to fund future growth initiatives or weather economic downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $252.352 for AppFolio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $205.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $141.4 million, and it would be trading on a PE ratio of 77.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $213.2, the analyst price target of $252.35 is 15.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives