- United States

- /

- Software

- /

- NasdaqGM:APPF

A Look at AppFolio’s (APPF) Valuation as New Integration Boosts Automation and Efficiency

Reviewed by Simply Wall St

SnapInspect’s integration with AppFolio (APPF) is now live, offering automation tools and real-time updates designed to simplify property management. This collaboration highlights AppFolio’s ongoing effort to streamline operations for industry professionals.

See our latest analysis for AppFolio.

AppFolio’s latest integration comes at a time when investors are facing a more challenging period. The stock is down 8% year-to-date and has logged a 1-year total shareholder return of -10%. Its 3-year total return of 90% highlights the longer-term momentum that remains. Recent automation moves like this could help renew investor optimism and support a shift in sentiment.

If the pace of innovation grabs your attention, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with AppFolio shares trading below analyst targets and posting mixed returns, the key question for investors is clear: Is today’s price an opportunity to buy into future growth, or is the market already factoring it in?

Most Popular Narrative: 28% Undervalued

AppFolio’s most widely followed narrative puts fair value at $317, a significant premium to the latest close of $228.16. This perspective frames current pricing as a rare entry point ahead of potential upside tied to platform innovation and expanding product lines.

Accelerating adoption of AI-powered workflow automation within property management, demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions, positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

Curious what kind of assumptions justify this bold premium? The path to this fair value hinges on lightning-fast revenue growth and a dramatic shift in profitability. Find out what powers these projections inside the full narrative.

Result: Fair Value of $317 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the company’s heavy reliance on domestic growth and the potential for rising competition within the AI-powered SaaS market.

Find out about the key risks to this AppFolio narrative.

Another View: Price Ratios Tell a Different Story

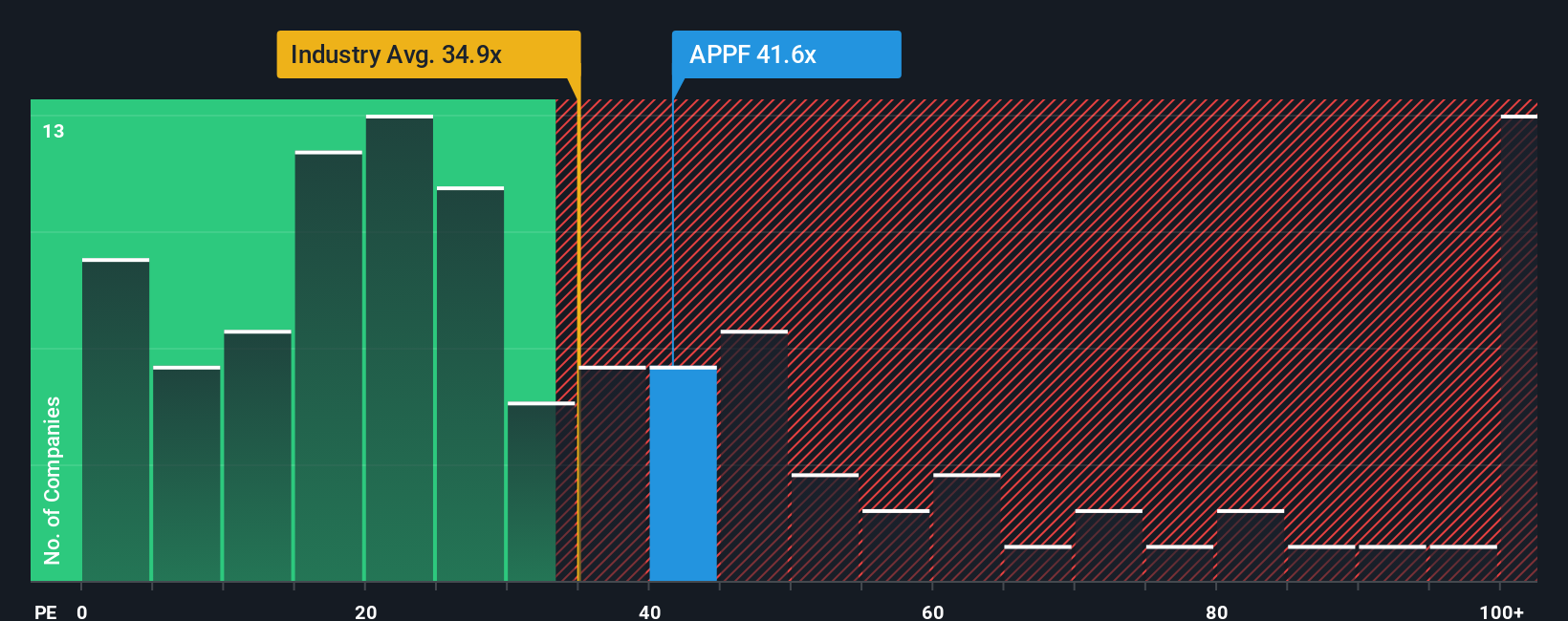

Using price-to-earnings comparisons, AppFolio stands out as expensive. Its ratio of 40.2x is meaningfully higher than both the US Software industry average of 29.2x and the peer group’s 21.1x. The so-called fair ratio is 27.9x. This suggests current pricing could leave little room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AppFolio Narrative

If you think there is more to the story or would rather base decisions on your own analysis, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your AppFolio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Step ahead of the crowd and boost your portfolio with fresh ideas just a few clicks away. Don’t let great opportunities slip past you.

- Tap into the next big trend in artificial intelligence when you check out these 25 AI penny stocks, which are positioned for innovation and advancement.

- Find value others might miss by searching these 923 undervalued stocks based on cash flows that demonstrate solid fundamentals and appealing price points.

- Secure reliable income and potential long-term growth through these 15 dividend stocks with yields > 3%, featuring consistent payouts and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud-based platform for the real estate industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.