- United States

- /

- Software

- /

- NasdaqGS:APP

How Investors May Respond To AppLovin (APP) Index Moves Amid Legal Scrutiny On Advertising Practices

- AppLovin Corporation has been added to the Russell Top 200 Growth Index and Russell Top 200 Index, while being removed from the Russell Midcap and Midcap Growth Indexes, against the backdrop of a shareholder class action lawsuit alleging it inflated installation and profit metrics through questionable advertising practices.

- The combination of index reclassifications and legal scrutiny highlights shifting investor sentiment and could influence institutional ownership and trading activity around AppLovin.

- We’ll look at how allegations around advertising practices and legal investigations could reshape AppLovin’s investment narrative.

AppLovin Investment Narrative Recap

To be a shareholder in AppLovin today, you’d need to believe in the company’s ability to capture new growth as it pushes further into global advertising, while managing both legal scrutiny and shifting index representation. The recent addition to the Russell Top 200 Growth Index, despite a class action lawsuit alleging inflated app metrics, does not materially alter the biggest short term catalyst, expansion of its advertising platform, or the most immediate risk, which remains ongoing legal investigations into its business practices.

Among recent announcements, AppLovin’s May partnership with LoopMe to integrate Chartboost’s in-app bidding into MAX stands out. This could directly support the company’s growth catalyst by making its platform more attractive to publishers and advertisers, even as legal headwinds stir in the background.

In contrast, investors should not overlook the evolving legal case that could have deeper ramifications for AppLovin’s future access to major advertising partners...

Read the full narrative on AppLovin (it's free!)

AppLovin's narrative projects $9.5 billion revenue and $5.1 billion earnings by 2028.

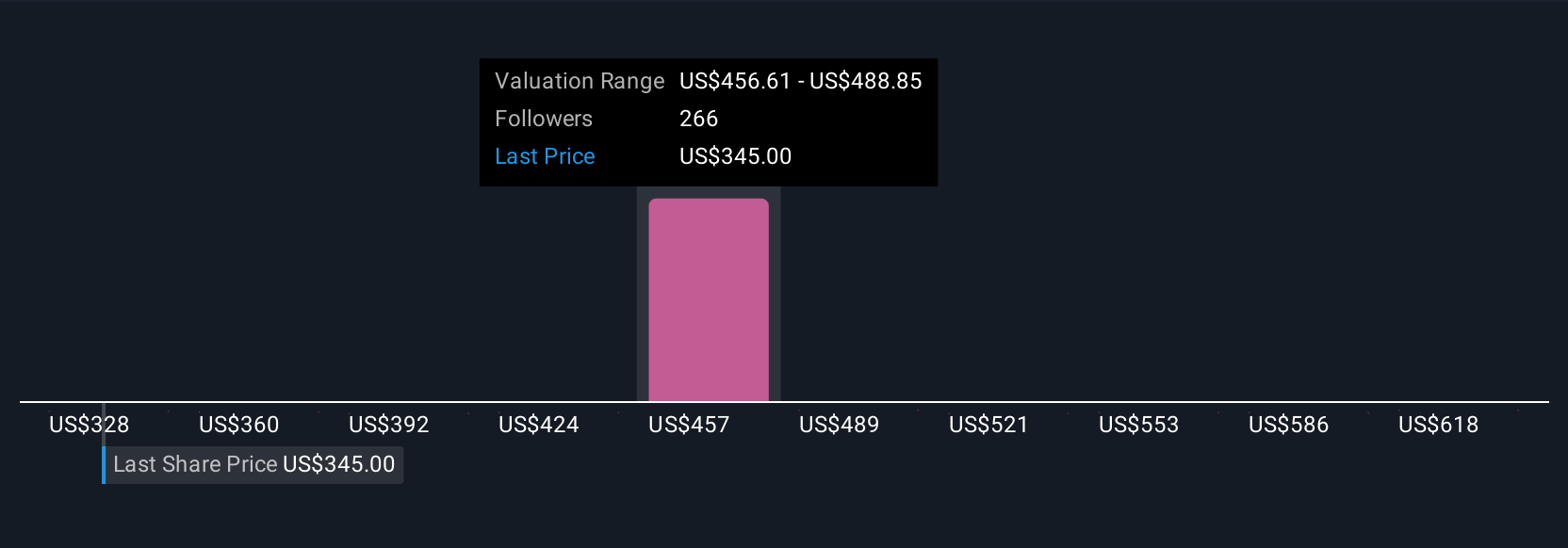

Uncover how AppLovin's forecasts yield a $465.49 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Eighteen individual Simply Wall St Community fair value estimates for AppLovin range from US$327.69 to US$650 per share. While you weigh these diverging opinions, keep in mind that regulatory probes tied to reported advertising metrics may shape outcomes beyond recent performance gains.

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppLovin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives