- United States

- /

- Software

- /

- NasdaqGS:APP

Did AppLovin's (APP) Russell Top 200 Inclusion Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- In late June 2025, AppLovin was added to the Russell Top 200 Indexes while being removed from the Russell Midcap Growth and Midcap Indexes, increasing its relevance for large-cap investors.

- This shift, paired with positive analyst commentary highlighting the company’s innovation and global advertising focus, underscores AppLovin's evolving role within the software sector.

- Now, we'll explore how AppLovin's inclusion in major Russell indexes could reinforce its investment narrative and global growth ambitions.

AppLovin Investment Narrative Recap

To see AppLovin as a compelling investment, you need confidence in its ability to expand beyond gaming and capture global advertising growth, while scaling efficiently through automation. The recent move to the Russell Top 200 Index strengthens its profile with large-cap funds, but doesn't immediately change the biggest near-term catalyst, successful transition of its focus to broader ad markets, or the main risk of execution challenges as operations scale rapidly. The reshuffling of index membership could, however, mean greater attention from institutional investors and more trading activity, which may influence short-term movements but doesn't directly address operational risks or potential for competitive pressure in non-gaming advertising verticals.

AppLovin's ongoing share repurchase program stands out, with over 74 million shares bought back since early 2022, totaling more than US$3,401 million. This sustained buyback signals continued confidence from management in the company's longer-term potential, even as the stock adjusts to large-cap index status and the catalysts ahead rely on successfully growing advertising revenue beyond gaming.

Yet, in contrast to its index promotion, investors should be aware of possible hiccups as AppLovin's automation efforts scale up to meet ...

Read the full narrative on AppLovin (it's free!)

AppLovin's outlook anticipates $8.9 billion in revenue and $4.9 billion in earnings by 2028. This is based on an annual revenue growth rate of 20.3% and a $3.0 billion increase in earnings from the current $1.9 billion.

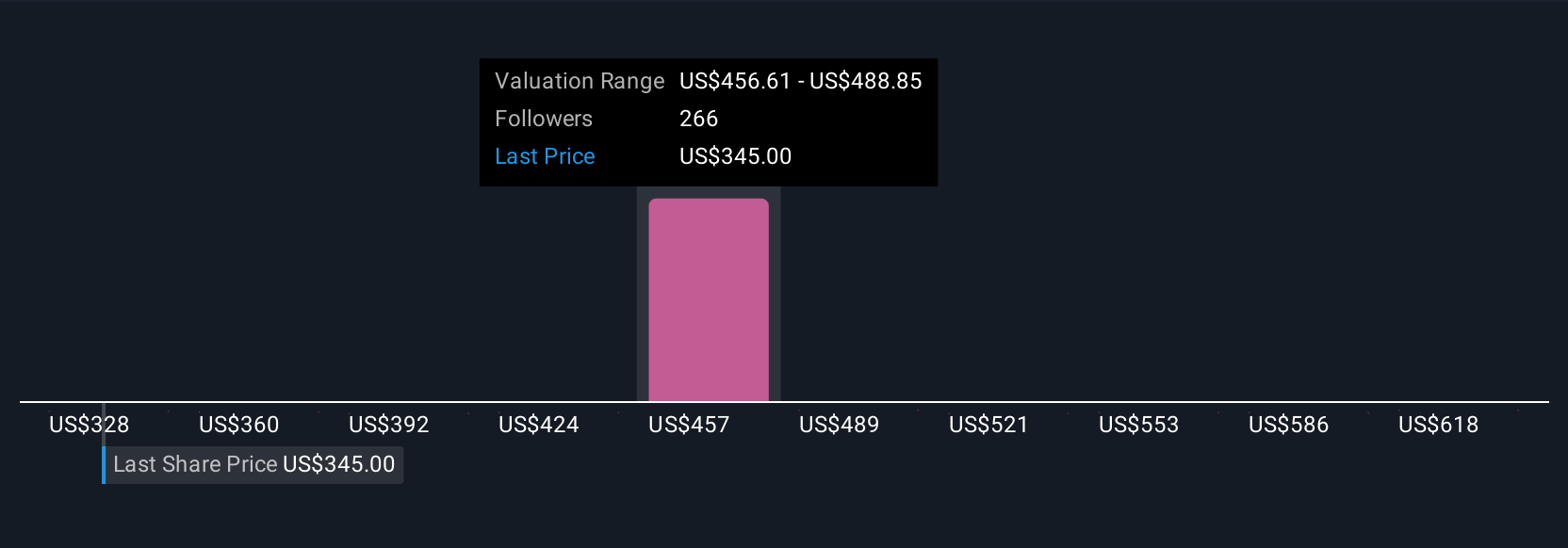

Uncover how AppLovin's forecasts yield a $463.88 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$327.69 to US$650, gathered from 18 private investors before recent news. Many focus on the company's push to capture new advertising markets, but the diversity highlights how views on future execution and competition can shift perceptions, explore several perspectives to see how your own analysis compares.

Build Your Own AppLovin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AppLovin research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AppLovin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AppLovin's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives