- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (NasdaqGS:APP) Sees 13% Rise Over Last Week Despite Legal Challenges

Reviewed by Simply Wall St

AppLovin (NasdaqGS:APP) has experienced a stock price increase of 13%, potentially reflecting ongoing market reactions to recent corporate events. The company is grappling with serious legal challenges, including a class action lawsuit claiming securities fraud, and accusations of ad fraud that have reportedly impacted share value. Despite these issues, AppLovin's active share repurchase program, which has now repurchased over 75 million shares, could be contributing to the stock's recent performance. The broader market dynamics also show a recovery trend with a 3% increase over the last week, which aligns with AppLovin's positive price movement among tech stocks.

AppLovin has 3 weaknesses we think you should know about.

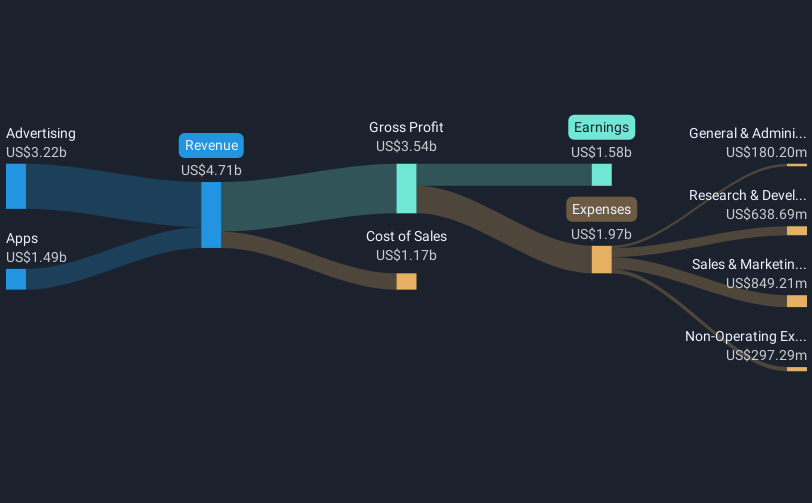

Over the past three years, AppLovin has achieved an impressive total return of 455.69%, reflecting significant increases in shareholder value. The company's performance has outpaced the broader market, driven by earnings growth and strategic shifts. One pivotal factor was AppLovin’s transition to focus on high-margin advertising, utilizing AI to optimize operations and expand its global presence. This strategic realignment included divesting from the Apps business, which allowed the company to consolidate resources and improve its net margins.

In the last year, AppLovin's earnings grew significantly, contrasting with a declining US Software industry. This growth was supported by continuous AI enhancements and substantial share buybacks totaling US$3.57 billion, reducing shares outstanding and enhancing earnings per share. Legal challenges have cast a shadow recently but have not hindered the firm’s trajectory over the three-year period. AppLovin’s ability to post strong financial results amidst such challenges illustrates its operational resilience and strategic foresight.

Assess AppLovin's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives