- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (NasdaqGS:APP) Reports US$189 Million Goodwill Impairment Against Rising Q1 Earnings

Reviewed by Simply Wall St

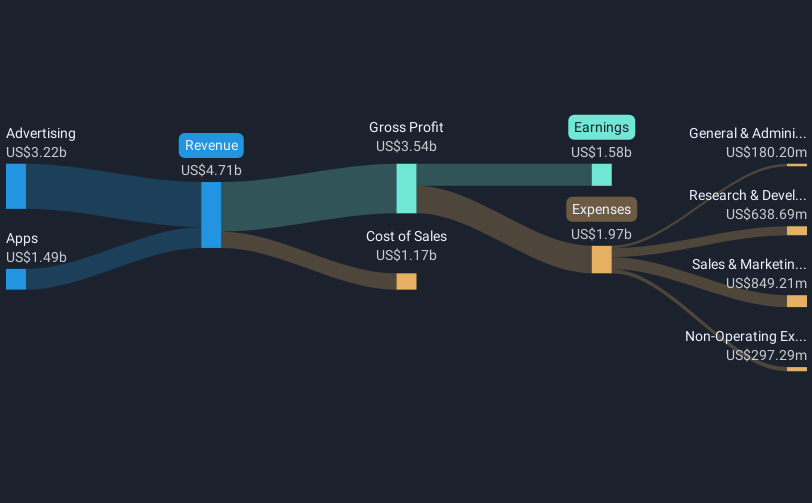

AppLovin (NasdaqGS:APP) recently reported strong first-quarter results with significant sales and net income increases, alongside issuing positive guidance for the second quarter, which seems to align with the company's impressive 31% share price increase last month. During this period, AppLovin faced a class action lawsuit, which could have introduced volatility, but market trends favored technology stocks as a whole, as demonstrated by the broader 2% rise in the Nasdaq Composite. Moreover, the strategic sale of its mobile game business further solidified investor confidence, all amid a pivotal time of market optimism spurred by U.S. trade developments.

AppLovin has 3 warning signs we think you should know about.

The recent developments concerning AppLovin, including the strategic sale of its mobile game business and stronger-than-expected first-quarter results, could significantly influence current narratives around the company's shift towards focusing on high-margin advertising and automation. This news has contributed positively to its growth story by potentially enhancing operational efficiency and boosting net margins as the company leverages AI capabilities within the advertising sector.

AppLovin's shares have exhibited an impressive total return of over 1000% during a three-year period, reflecting not only the company's growth but also investor confidence during this transformative phase. Despite this substantial gain, it's important to contextualize these returns with the company's more recent performance relative to its peers. Over the past year, AppLovin's returns have outpaced both the US Software industry and the broader market, which saw annual returns of 14.1% and 7.7% respectively.

The positive forecast and past performance have directly impacted revenue and earnings expectations, with analysts forecasting annual revenue growth of 19.6% over the next three years and significant profit margin improvement. However, the stock's price movement—up 31% last month—positions it closer to, yet still below, the consensus price target of US$432.90, offering potential room for further valuation growth if the company meets or exceeds earnings forecasts.

Review our growth performance report to gain insights into AppLovin's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AppLovin, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives