- United States

- /

- IT

- /

- NasdaqGS:APLD

Assessing Applied Digital (APLD) Valuation After Strong AI Data Center Growth And Quarterly Earnings Surge

Applied Digital (APLD) drew fresh attention after reporting second quarter results that showed revenue of US$126.59 million and a sharply smaller net loss, helped by new AI focused data center capacity coming online.

See our latest analysis for Applied Digital.

The strong quarterly update has arrived alongside a powerful share price move, with a 1-day share price return of 17.97% and a year-to-date share price return of 34.04%. The 1-year total shareholder return is very large and suggests momentum has been building over a longer period.

If you are looking for more AI infrastructure stories off the back of Applied Digital's move, this could be a good moment to check out high growth tech and AI stocks.

After a surge like this and with analyst targets sitting above the current US$37.68 share price, the key question is whether Applied Digital is still priced for catch up or if the market already reflects years of future growth.

Most Popular Narrative: 13.8% Undervalued

With the latest fair value estimate of US$43.70 sitting above the US$37.68 close, the most widely followed narrative sees more upside already reflected in its model.

The accelerating industry need for high density, geographically distributed data centers to support AI and machine learning workloads places Applied Digital in a favorable position, capitalizing on digital transformation trends that are set to drive ongoing utilization growth, improved asset values, and ultimately earnings expansion over the next several years.

It is worth understanding what earnings, revenue growth, and margin profile are reflected in that fair value line. The narrative leans on bold assumptions and a rich future multiple. Investors may want to see exactly what is driving that US$43.70 number and how sensitive it is to those inputs.

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could unravel if the crypto-exposed hosting business remains volatile or if debt-funded expansion and concentrated hyperscaler contracts do not ramp as expected.

Find out about the key risks to this Applied Digital narrative.

Another View: Price Tag Looks Full

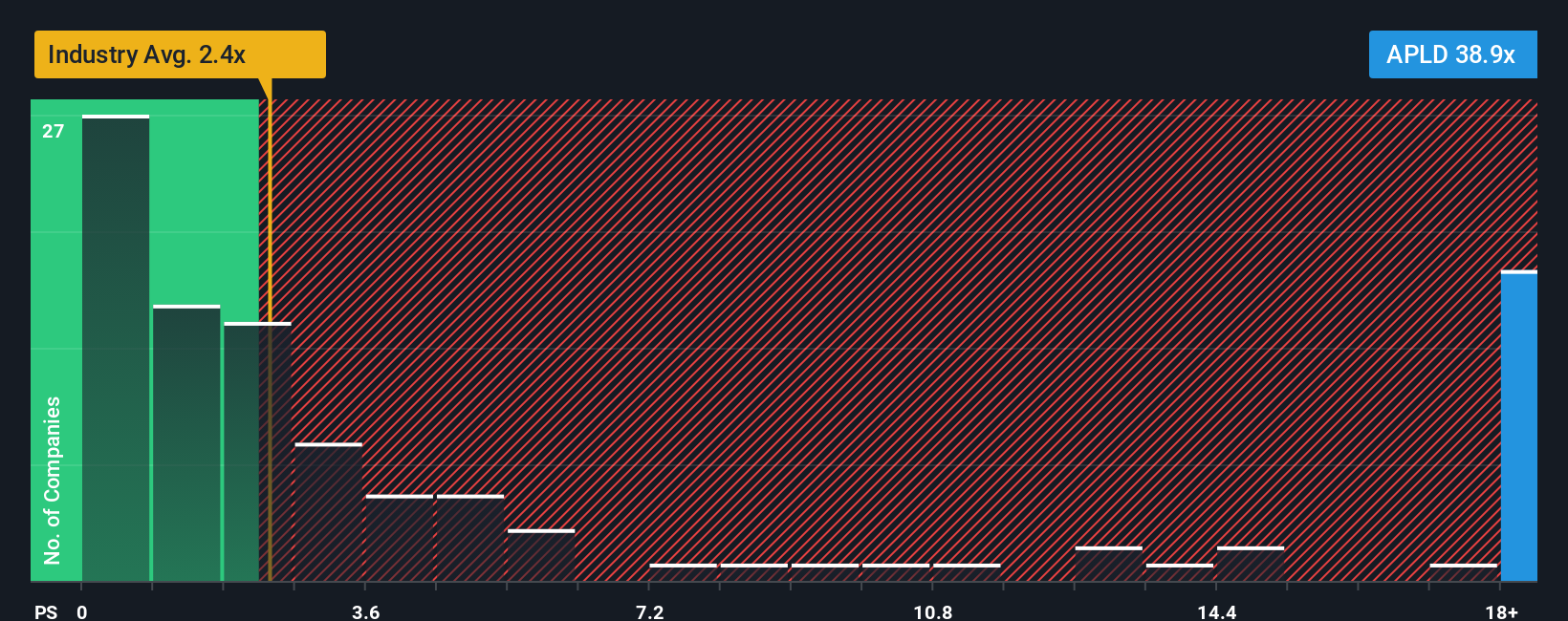

That US$43.70 fair value line suggests upside, but the current P/S ratio of 39.9x tells a different story. It sits well above the estimated fair ratio of 9x, the US IT industry at 2.3x, and peers at 4.2x. This points to meaningful valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can create a personalised Applied Digital narrative in just a few minutes, then Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Applied Digital has caught your eye, do not stop here. The next move could come from a completely different corner of the market, so give yourself more options.

- Spot potential value with a margin of safety by scanning these 882 undervalued stocks based on cash flows that screen for strong cash flow support.

- Ride the AI buildout by checking these 28 AI penny stocks that sit at the intersection of computing power and real world demand.

- Position your portfolio for income potential by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion