- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD): Evaluating Valuation After 100 MW Polaris Forge Expansion and New Funding Initiatives

Reviewed by Simply Wall St

Applied Digital’s latest milestone at its Polaris Forge 1 AI Factory Campus is drawing fresh interest from investors. Now that Building 1 has reached its full 100 MW operational capacity, attention is turning to the company’s expansive roadmap for AI infrastructure deployment.

See our latest analysis for Applied Digital.

Recent weeks have been a whirlwind for Applied Digital, with a surge in investor attention following its campus expansion, successful funding rounds, and strong sector momentum. The share price leapt 28.5% over the past week as part of an eye-catching 247% year-to-date price return, while the one-year total shareholder return stands at 168%. Investors have noticed the combination of rapid growth and strategic wins, fueling talk that momentum may be building again.

If tracking this kind of rapid progress inspires you, consider broadening your perspective and discover See the full list for free.

Yet with the stock’s meteoric rise and recent business wins, the crucial question remains: is Applied Digital’s current share price leaving room for upside, or are investors already pricing in all of its future growth potential?

Most Popular Narrative: 38% Undervalued

With the most widely-followed narrative estimating Applied Digital's fair value at $43.70, the last closing price of $27.10 looks striking by comparison. There's a bold thesis behind this target, driven by the company’s runway for expansion and highly ambitious forecasts.

The company has recently secured long-term (15-year) leasing agreements with CoreWeave, a major AI hyperscaler, for its purpose-built AI/HPC data center campus, Polaris Forge 1. This represents a total of $7 billion in contracted revenue and a multi-year, recurring, and predictable revenue stream that directly supports future revenue growth and cash flow stability. Momentum in the data center segment is underpinned by surging demand for AI infrastructure, and Applied Digital is leveraging its streamlined proprietary building designs to reduce build times from 24 months to 12 to 14 months. This enables faster scaling of capacity and greater capital efficiency, which is likely to benefit both revenue growth and net margin expansion.

Want to know the secret sauce behind this aggressive price target? The narrative leans on transformative growth assumptions and a future profitability leap. Discover the core projections that could rewrite how the market values Applied Digital.

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real risks. Applied Digital remains exposed to volatile crypto markets and depends heavily on a handful of large, concentrated customers.

Find out about the key risks to this Applied Digital narrative.

Another View: Comparing with Market Ratios

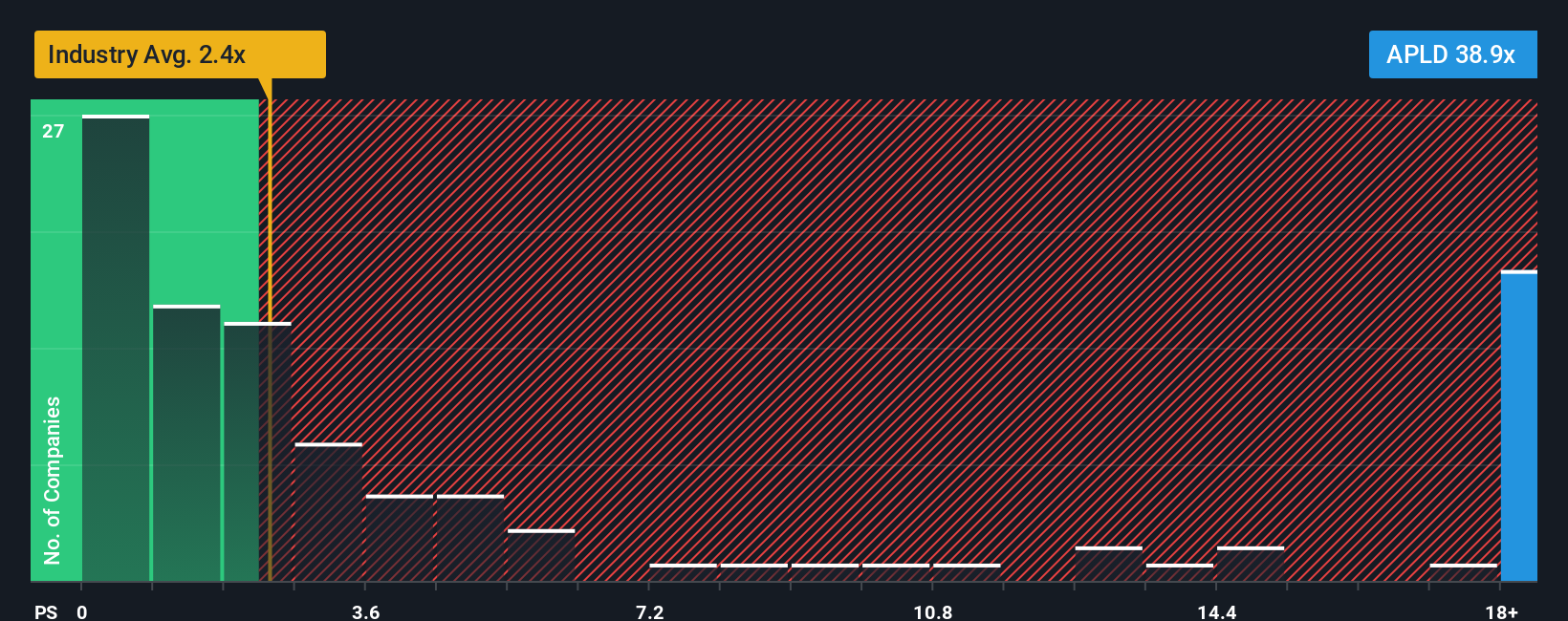

While the fair value estimate paints a bullish picture, it is worth noting that Applied Digital’s price-to-sales ratio stands at 44.6x. This is dramatically higher than both its industry peers at 4.2x and the US IT industry average of 2.7x. It is also above the fair ratio suggested by regression analysis at 20.4x. Such a premium could signal heightened valuation risk if growth slows or expectations reset. Is the market expecting too much too soon, or is there still more room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you have your own perspective or want to put the numbers to the test, you can quickly build your own view in just a few minutes. Do it your way

A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and secure every chance to be ahead. The market is buzzing with untapped opportunities, so now is the time to take control of your portfolio.

- Unlock tomorrow’s trends by checking out these 25 AI penny stocks powering artificial intelligence innovation across industries.

- Boost your returns with these 15 dividend stocks with yields > 3% offering attractive yield potential for lasting portfolio growth.

- Seize the chance to buy undervalued leaders with these 921 undervalued stocks based on cash flows before they hit everyone’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.