- United States

- /

- Healthcare Services

- /

- NYSE:HNGE

November 2025's Top Insider Owned Growth Companies

Reviewed by Simply Wall St

As the U.S. stock market rebounds with major indices like the Dow and S&P 500 snapping their recent losing streaks, investors are keenly observing the implications of Nvidia's earnings on broader market sentiment, particularly in relation to AI-driven valuations. In this fluctuating environment, companies that combine robust growth potential with high insider ownership can offer a unique appeal, as they often reflect strong internal confidence and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 21.9% | 73.4% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 27.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Underneath we present a selection of stocks filtered out by our screen.

Agora (API)

Simply Wall St Growth Rating: ★★★★☆☆

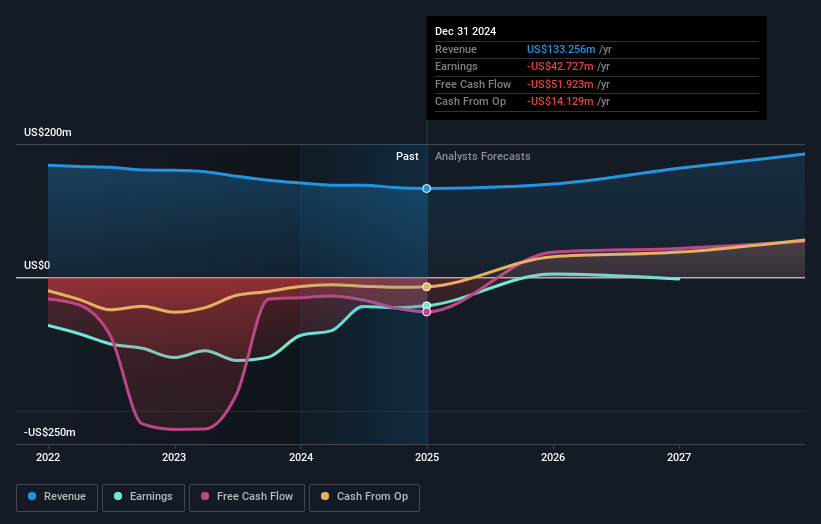

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service with operations in the United States, China, and internationally, and has a market cap of $298.49 million.

Operations: The company generates revenue primarily from its Internet Telephone segment, which amounts to $133.55 million.

Insider Ownership: 24.8%

Earnings Growth Forecast: 152.2% p.a.

Agora, Inc. demonstrates strong growth potential with its recent earnings report showing a significant turnaround from a net loss to a net income of US$2.74 million for Q3 2025. The company's integration with OpenAI's Realtime API enhances its platform capabilities, positioning it well in the AI sector. While insider trading activity is limited, Agora's revenue is expected to grow faster than the US market average, indicating promising future prospects for investors interested in growth companies.

- Navigate through the intricacies of Agora with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Agora's share price might be too optimistic.

Tesla (TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

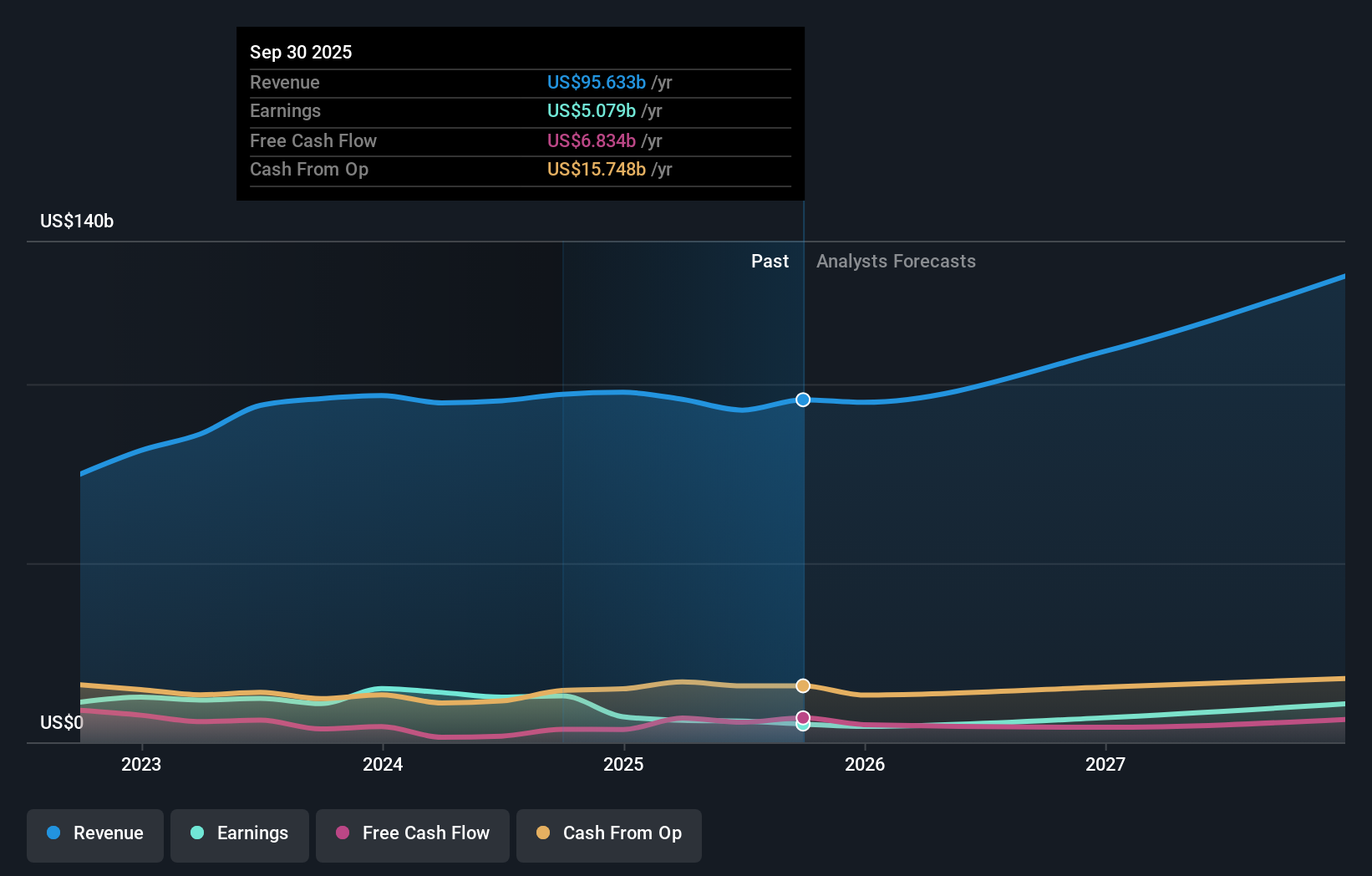

Overview: Tesla, Inc. is involved in the design, development, manufacturing, leasing, and sale of electric vehicles and energy generation and storage systems globally with a market cap of $1.34 trillion.

Operations: Tesla's revenue primarily comes from its Automotive segment, generating $83.64 billion, and its Energy Generation and Storage segment, contributing $11.99 billion.

Insider Ownership: 28.2%

Earnings Growth Forecast: 35.4% p.a.

Tesla's high insider ownership aligns with its growth trajectory, as insiders have been net buyers over the past three months. Despite a decline in profit margins from 13.3% to 5.3%, Tesla's earnings are expected to grow significantly at 35.4% annually, outpacing the US market average of 15.9%. Recent developments include Tesla's strategic expansion of its Supercharger network access to other EV brands like Faraday Future, enhancing its competitive edge in the electric vehicle sector.

- Take a closer look at Tesla's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Tesla shares in the market.

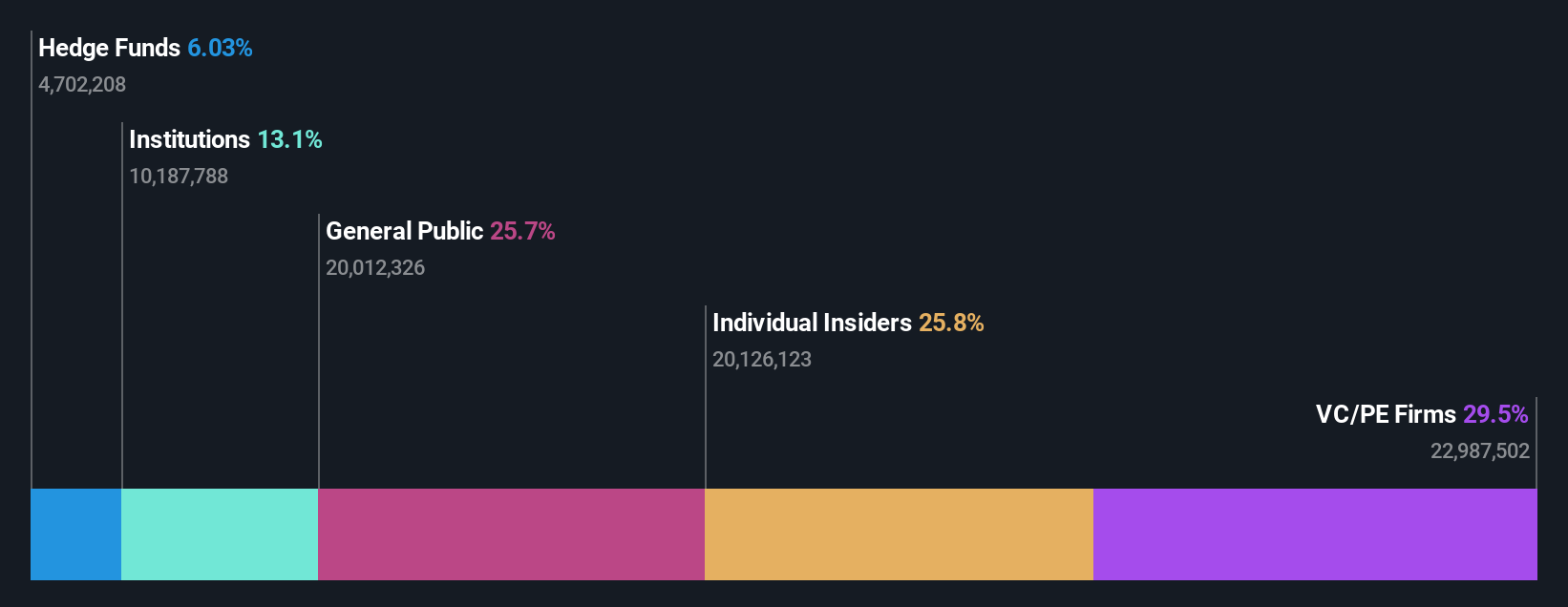

Hinge Health (HNGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hinge Health, Inc. specializes in scaling and automating the delivery of healthcare services, with a market cap of approximately $3.20 billion.

Operations: The company generates revenue from its healthcare software segment, amounting to $534.39 million.

Insider Ownership: 17.4%

Earnings Growth Forecast: 103% p.a.

Hinge Health's significant insider ownership is complemented by robust revenue growth, with a 46.1% increase over the past year. Despite recent net losses, the company raised its full-year revenue guidance to US$572-574 million and announced a US$250 million share buyback program funded by existing cash resources. The introduction of AI-powered tools like Movement Analysis and Robin enhances its competitive position in musculoskeletal care, while analysts anticipate profitability within three years, outpacing market expectations.

- Click to explore a detailed breakdown of our findings in Hinge Health's earnings growth report.

- In light of our recent valuation report, it seems possible that Hinge Health is trading behind its estimated value.

Summing It All Up

- Reveal the 194 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Looking For Alternative Opportunities? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hinge Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNGE

Hinge Health

Focuses on scaling and automating the delivery of healthcare services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives