- United States

- /

- Professional Services

- /

- NasdaqGS:TASK

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.9% drop, yet it remains up by 17% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that not only show strong potential for future earnings but also demonstrate resilience amid short-term market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.79% | 27.57% | ★★★★★★ |

| Travere Therapeutics | 28.44% | 65.05% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Blueprint Medicines | 22.38% | 55.75% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Agora (NasdaqGS:API)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agora, Inc. operates in the real-time engagement technology sector across China, the United States, and internationally with a market cap of $515.62 million.

Operations: Agora focuses on real-time engagement technology, providing communication solutions across various regions including China and the United States. The company supports applications that enable video and voice interaction, facilitating seamless communication experiences for users globally.

Agora's recent performance and strategic moves paint a nuanced picture of its growth trajectory. Despite a slight revenue dip in Q4 2024 to $34.45 million from $36.04 million the previous year, the company has turned around its bottom line, reporting a net income of $0.158 million compared to a loss of $2.61 million, indicating significant operational improvements. Looking ahead, Agora forecasts Q1 2025 revenues between $31 million and $33 million, suggesting stability despite phasing out low-margin products. Notably, Agora's aggressive share repurchase program completed in September 2024 underscores confidence in its financial health and shareholder value enhancement—repurchasing 40.35 million shares for approximately $113.75 million over two years.

- Delve into the full analysis health report here for a deeper understanding of Agora.

Gain insights into Agora's historical performance by reviewing our past performance report.

HashiCorp (NasdaqGS:HCP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HashiCorp, Inc. provides multi-cloud infrastructure automation solutions on a global scale and has a market capitalization of approximately $7.04 billion.

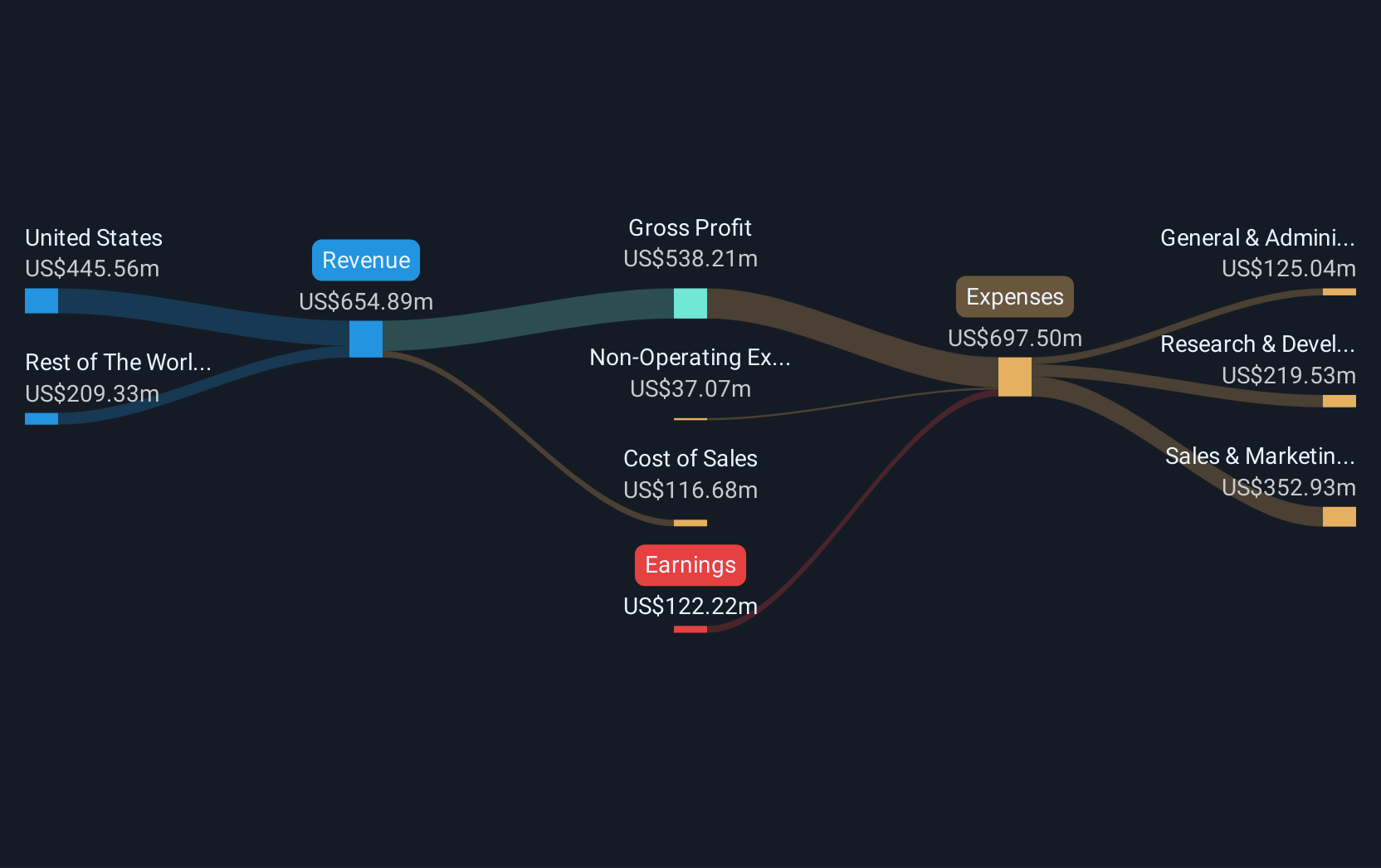

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $654.89 million.

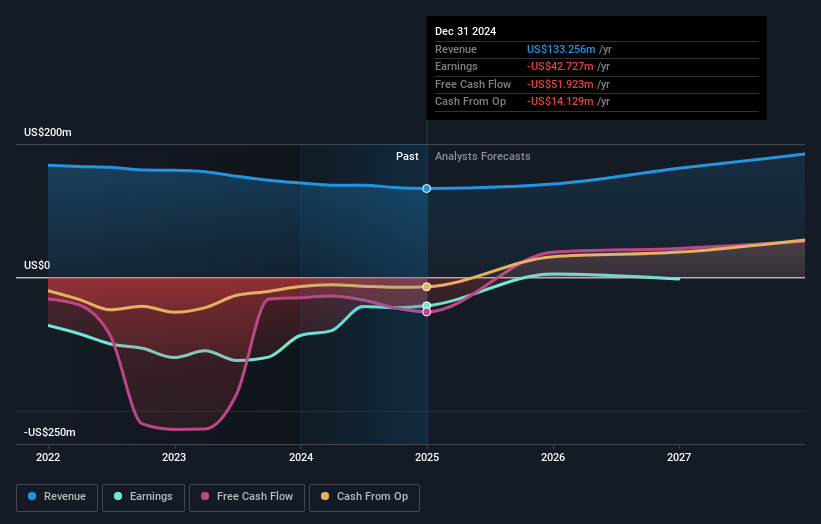

HashiCorp's trajectory in the high-growth tech sector is underscored by a robust increase in revenue, up to $499.11 million over nine months, marking a year-over-year growth of 14.4%. This performance is complemented by a significant reduction in net loss to $90.6 million from the previous year's $159.05 million, reflecting tighter operational control and efficiency gains. The firm's commitment to innovation is evident from its recent special calls discussing advancements in secrets management with Vault and Terraform, positioning it well for future tech demands despite current unprofitability. With an expected turn towards profitability within three years and revenue growth outpacing the US market average, HashiCorp demonstrates potential amidst challenges.

- Click here and access our complete health analysis report to understand the dynamics of HashiCorp.

Understand HashiCorp's track record by examining our Past report.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. offers digital outsourcing services across the Philippines, United States, India, and other international markets with a market capitalization of approximately $1.31 billion.

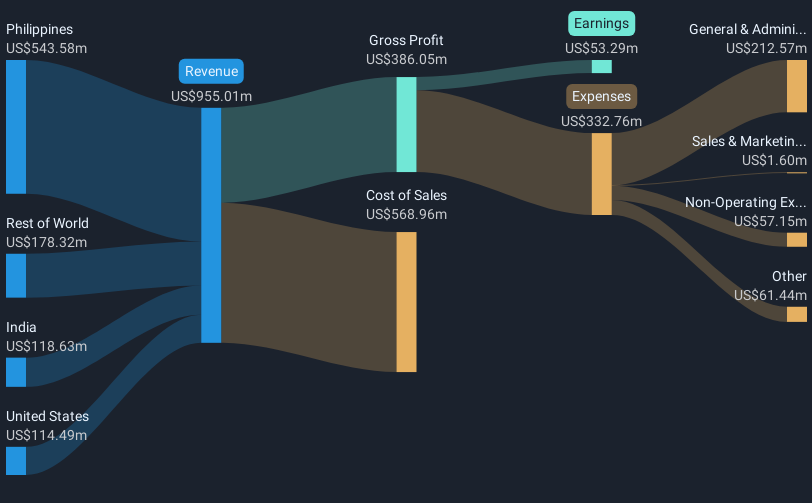

Operations: TaskUs, Inc. generates revenue primarily through its direct marketing segment, which accounts for $955.01 million.

TaskUs has demonstrated a robust trajectory in the high-growth tech sector, marked by a notable 21.3% forecasted annual earnings growth and an 18% increase in earnings over the past year, outpacing its industry's average. This performance is bolstered by strategic alliances, such as the partnership with Red Points, which merges AI technology with human expertise to combat digital fraud—a significant issue costing brands globally around $2 trillion annually. Their innovative approach not only enhances brand protection but also drives down operational costs, offering clients both enhanced security and economic efficiency. This blend of strong financial growth and strategic innovation positions TaskUs well within the competitive landscape of tech services.

- Unlock comprehensive insights into our analysis of TaskUs stock in this health report.

Review our historical performance report to gain insights into TaskUs''s past performance.

Next Steps

- Click this link to deep-dive into the 225 companies within our US High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaskUs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TASK

TaskUs

Provides outsourced digital services for companies in Philippines, the United States, India, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives