- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

High Growth Tech Stocks in US for May 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of cautious optimism, with major indices like the Dow Jones and S&P 500 experiencing minor fluctuations amid anticipation of Nvidia's earnings report, investors are keenly observing how trade policies and economic indicators impact market sentiment. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and innovation in adapting to shifting economic landscapes and technological advancements.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Agora (NasdaqGS:API)

Simply Wall St Growth Rating: ★★★★☆☆

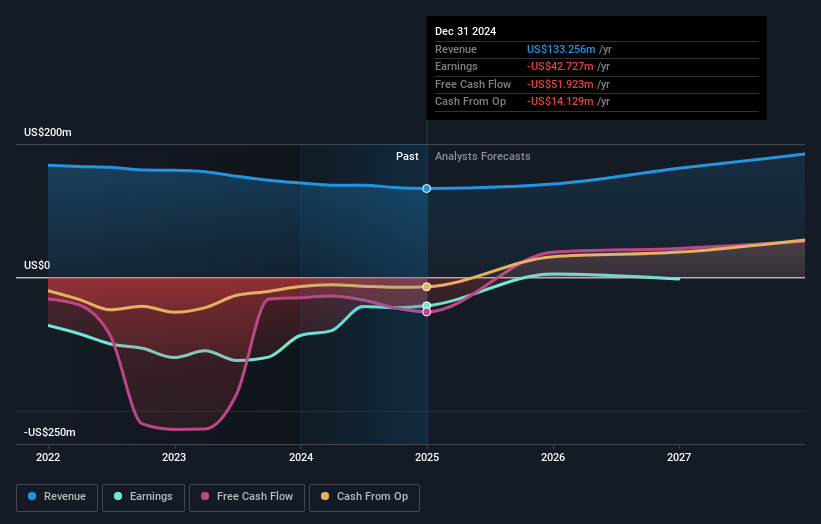

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and other international markets with a market cap of $335.70 million.

Operations: Agora, Inc. generates revenue primarily from its Internet Telephone segment, which brought in $133.26 million. The company operates across the U.S., China, and other international markets with a focus on real-time engagement solutions.

Agora's recent pivot towards profitability is notable, with a significant reduction in net losses and a modest net income of $0.407 million this quarter, compared to a net loss of $9.46 million in the same period last year. This shift is underscored by an earnings per share improvement from a loss of $0.4 to gains of $0.016, reflecting tighter operational control and perhaps a more strategic approach to market demands. Looking ahead, Agora forecasts Q2 revenues between $33 million and $35 million, signaling confidence in sustained growth amidst competitive pressures. This projection not only highlights their recovery trajectory but also aligns with their R&D commitment which remains integral to innovation and market expansion within the tech sector.

- Navigate through the intricacies of Agora with our comprehensive health report here.

Examine Agora's past performance report to understand how it has performed in the past.

Corsair Gaming (NasdaqGS:CRSR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corsair Gaming, Inc. is a company that designs and sells gaming and streaming peripherals, components, and systems across various regions including Europe, North America, and the Asia Pacific with a market capitalization of approximately $871.44 million.

Operations: Corsair Gaming generates revenue through two primary segments: Gamer and Creator Peripherals, contributing $477.73 million, and Gaming Components and Systems, accounting for $871.14 million. The company operates in diverse regions including Europe, North America, the Middle East, North Africa, Latin America, and the Asia Pacific.

Corsair Gaming is steering towards profitability with a notable shift in its financial trajectory, evidenced by a reduction in net loss from $11.57 million to $10.46 million year-over-year and an increase in sales from $337.26 million to $369.75 million in the first quarter of 2025. This improvement aligns with their recent product expansions, such as the innovative Stream Deck Everywhere ecosystem, which enhances user connectivity and control capabilities—key factors likely influencing future revenue streams and market presence. Additionally, Corsair's commitment to R&D is pivotal as it continues developing cutting-edge technologies that cater to evolving consumer demands within the tech landscape, positioning them for potential growth despite current unprofitability and market volatility.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

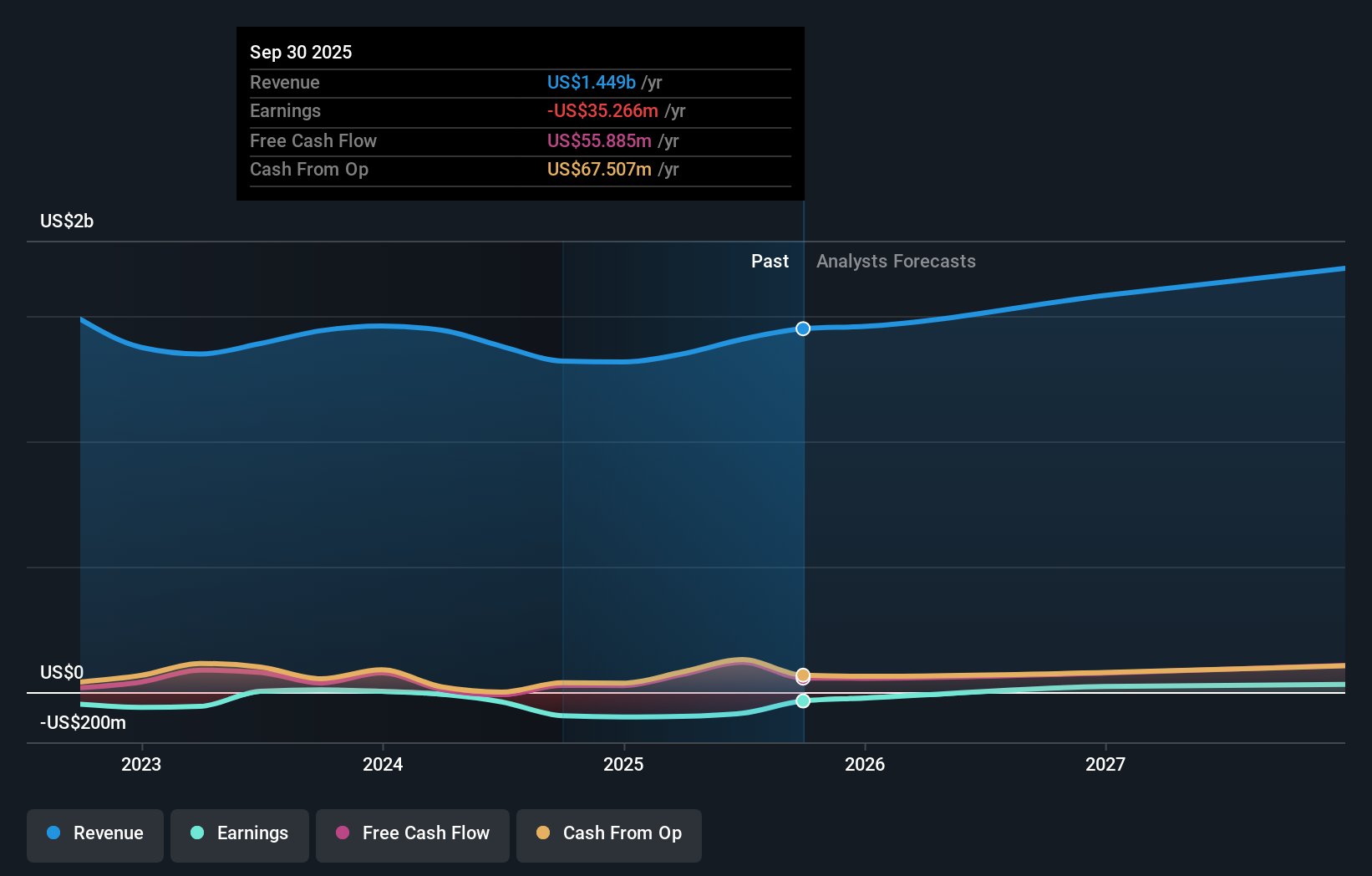

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of $10.12 billion.

Operations: The company generates revenue primarily through its Platform segment, which accounts for $3.65 billion, and its Devices segment, contributing $603.44 million.

Roku, transitioning towards profitability, anticipates a net loss reduction from $50.86 million to $27.43 million in Q1 2025 compared to the previous year, alongside a revenue jump from $881.47 million to $1,020.67 million. This growth is supported by innovative product launches such as the Roku Streaming Stick and enhanced software features aimed at personalizing user experience. Despite current unprofitability, Roku's R&D commitment is evident with an annualized earnings forecast growth of 55.92%, positioning it for potential market gains amidst competitive pressures and executive transitions like Louise Pentland's recent resignation as Senior Vice President and General Counsel.

- Unlock comprehensive insights into our analysis of Roku stock in this health report.

Gain insights into Roku's historical performance by reviewing our past performance report.

Summing It All Up

- Investigate our full lineup of 231 US High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion