- United States

- /

- Specialty Stores

- /

- NYSE:CANG

Agora And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.4%, yet it remains up by 11% over the past year, with earnings forecasted to grow annually by 14%. In light of these conditions, identifying stocks with strong financials and growth potential becomes crucial for investors seeking opportunities. While often considered a relic of past market eras, penny stocks represent affordable entry points into smaller or newer companies that may offer significant upside when paired with solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (OTCPK:SDCH) | $0.0456 | $12.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Perfect (NYSE:PERF) | $1.85 | $182.31M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.02 | $176.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Mofy AI (NasdaqCM:GMM) | $2.93 | $54.16M | ✅ 2 ⚠️ 4 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.38 | $55.02M | ✅ 1 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.48 | $87.41M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.51 | $21.81M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.847 | $5.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.21 | $70.83M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.8462 | $28.25M | ✅ 3 ⚠️ 6 View Analysis > |

Click here to see the full list of 733 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Agora (NasdaqGS:API)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and internationally with a market cap of $331.96 million.

Operations: The company's revenue is primarily generated from its Internet Telephone segment, amounting to $133.26 million.

Market Cap: $331.96M

Agora, Inc. has demonstrated resilience in the penny stock arena with a market cap of US$331.96 million and a revenue stream primarily from its Internet Telephone segment, totaling US$133.26 million annually. The company maintains a strong balance sheet, with short-term assets of US$328.1 million exceeding both short- and long-term liabilities significantly, and more cash than total debt. Despite being currently unprofitable, Agora has reduced its losses by 17.3% per year over the past five years and forecasts earnings growth of 136.4% annually moving forward. Recent developments include a shelf registration filing for US$172.54 million to potentially bolster financial flexibility further.

- Get an in-depth perspective on Agora's performance by reading our balance sheet health report here.

- Evaluate Agora's prospects by accessing our earnings growth report.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cango Inc. operates an automotive transaction service platform connecting dealers, manufacturers, car buyers, and other industry participants primarily in China and internationally, with a market cap of approximately $472.24 million.

Operations: Cango Inc. does not report distinct revenue segments, focusing on its automotive transaction service platform that links various stakeholders in the automotive industry primarily in China and internationally.

Market Cap: $472.24M

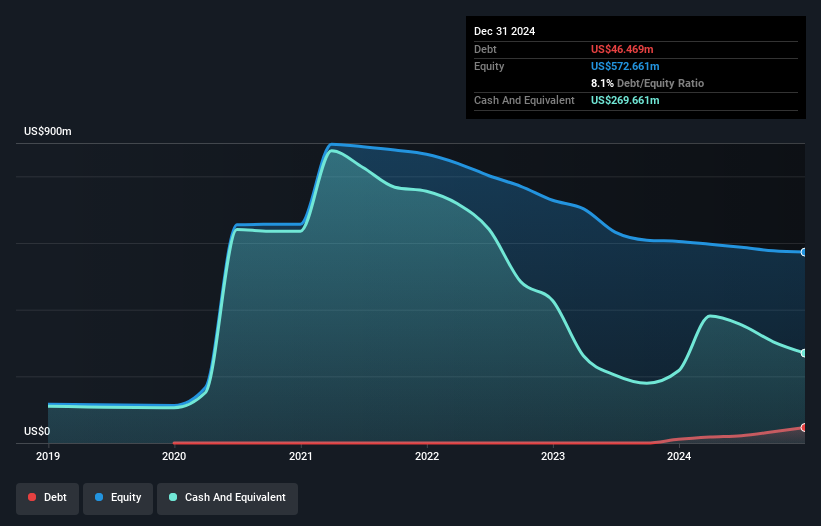

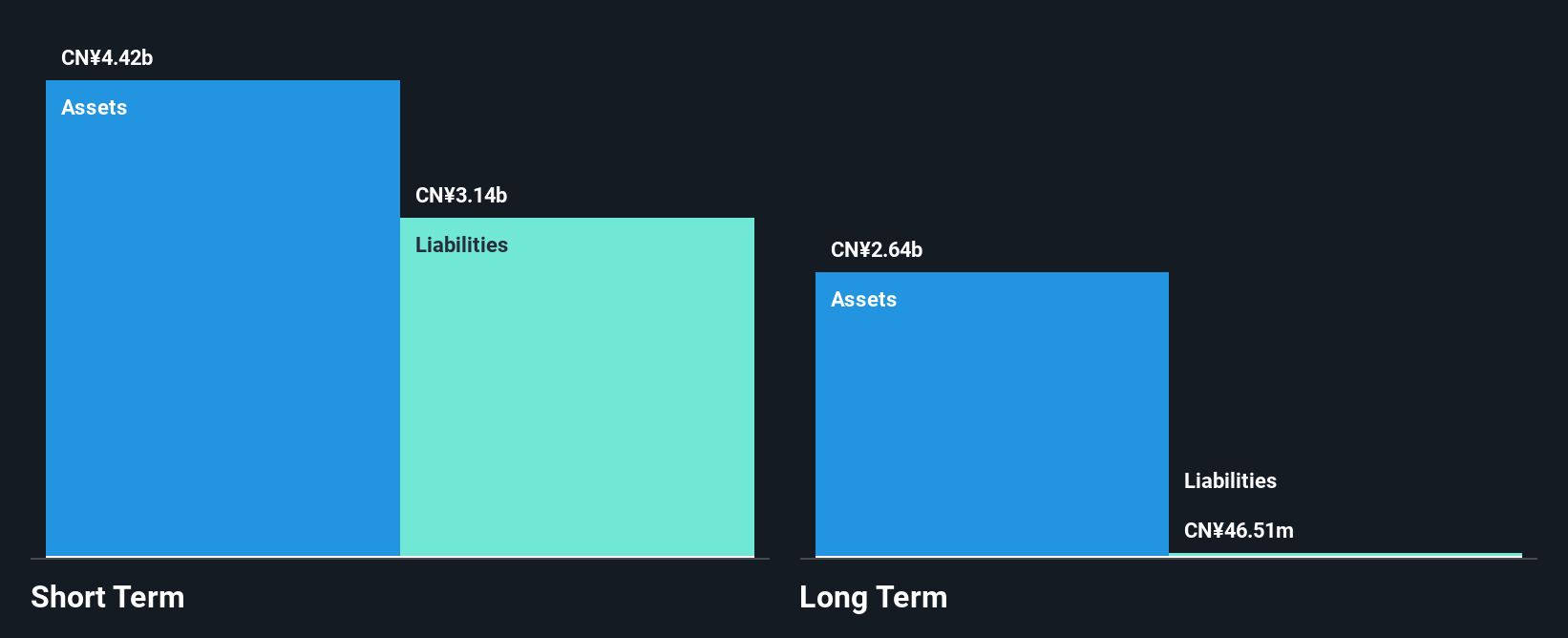

Cango Inc. has shown volatility in the penny stock market, with a significant market cap of approximately US$472.24 million. The company reported revenue of CNY 1,053.88 million for Q1 2025 but faced a net loss of CNY 207.36 million, contrasting with profits from the previous year. Despite this setback, Cango's balance sheet remains robust with short-term assets exceeding liabilities and more cash than debt. Its recent share repurchase program aims to enhance shareholder value by buying back up to US$30 million worth of shares over the next year, indicating confidence in its financial position despite earnings challenges.

- Click here to discover the nuances of Cango with our detailed analytical financial health report.

- Learn about Cango's future growth trajectory here.

SES AI (NYSE:SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation focuses on developing and producing AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and drones, with a market cap of $344.18 million.

Operations: SES AI Corporation has not reported any revenue segments.

Market Cap: $344.18M

SES AI Corporation, with a market cap of US$344.18 million, is navigating the penny stock landscape with its focus on AI-enhanced battery technologies. The company recently launched Molecular Universe MU-0, an innovative platform aimed at advancing battery development. Despite being unprofitable and facing increased losses over the past five years, SES reported Q1 2025 sales of US$5.79 million and reduced net losses compared to last year. It remains debt-free with sufficient cash runway for more than a year and has initiated a US$30 million share repurchase program amidst compliance challenges regarding NYSE listing standards due to its low share price.

- Click here and access our complete financial health analysis report to understand the dynamics of SES AI.

- Gain insights into SES AI's future direction by reviewing our growth report.

Summing It All Up

- Gain an insight into the universe of 733 US Penny Stocks by clicking here.

- Curious About Other Options? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, car buyers, and other industry participants in the People’s Republic of China, British Virgin Islands, and internationally.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives