- United States

- /

- Interactive Media and Services

- /

- NasdaqGM:EVER

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant 25% increase over the past year, with earnings projected to grow by 15% annually. In this promising environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and potential to capitalize on expanding market opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

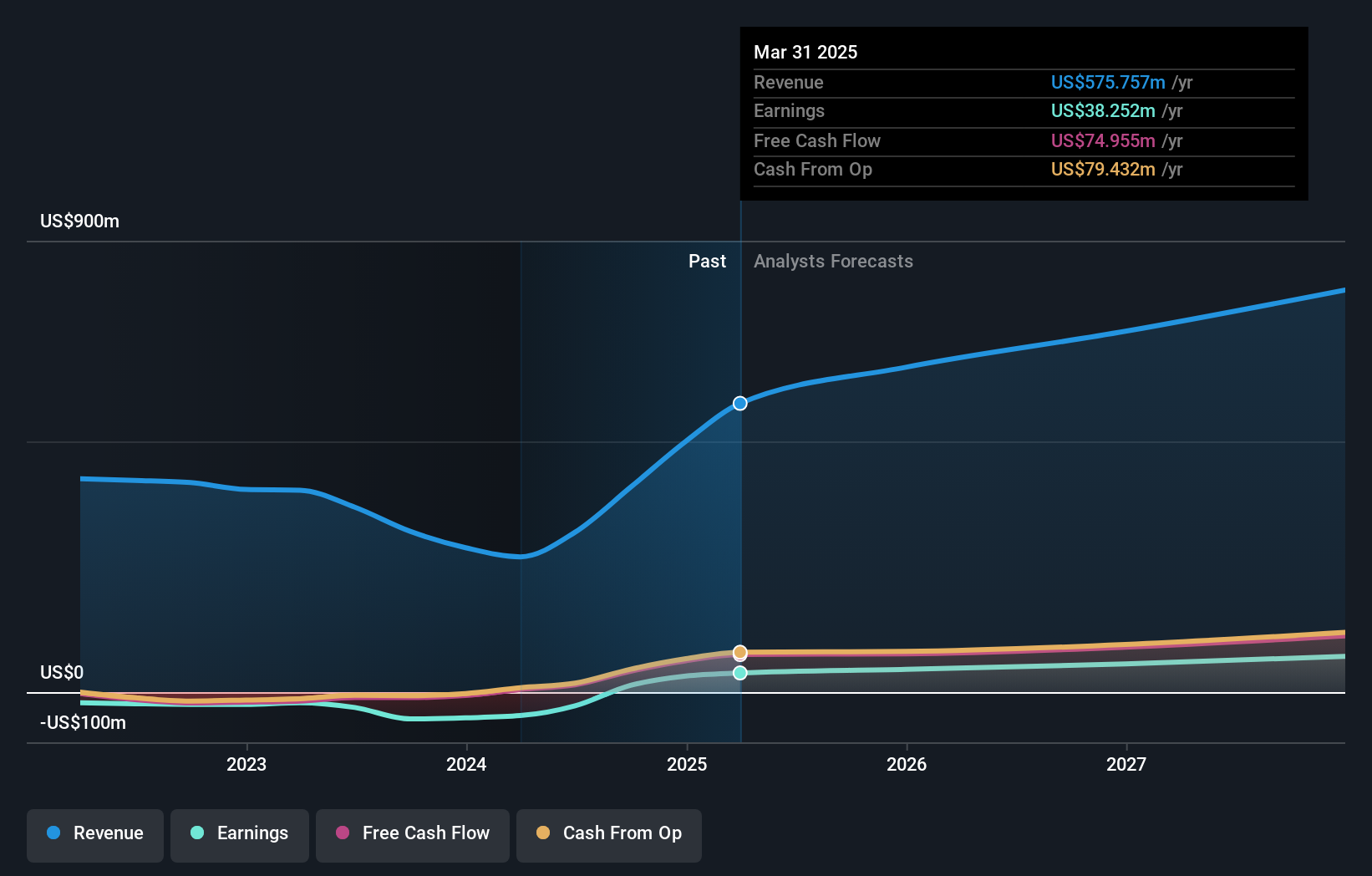

EverQuote (NasdaqGM:EVER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EverQuote, Inc. operates an online marketplace for insurance shopping in the United States with a market cap of $647.64 million.

Operations: The company generates revenue primarily through its Internet Information Providers segment, which accounted for $408.44 million. The business model focuses on connecting consumers with insurance providers, leveraging a digital platform to facilitate transactions and enhance customer acquisition for insurers.

EverQuote has demonstrated a robust turnaround, transitioning from a net loss to generating $19.86 million in net income over nine months, reflecting its strategic adaptations and operational efficiency. With an impressive 140% year-over-year revenue growth forecast for Q4 2024, the company is capitalizing on market dynamics effectively. Recent presentations at high-profile conferences underscore EverQuote's growing influence in the tech sector, suggesting strong future prospects as it continues to outpace average industry growth rates and enhance shareholder value through significant earnings expansions projected at 23.1% annually.

- Navigate through the intricacies of EverQuote with our comprehensive health report here.

Assess EverQuote's past performance with our detailed historical performance reports.

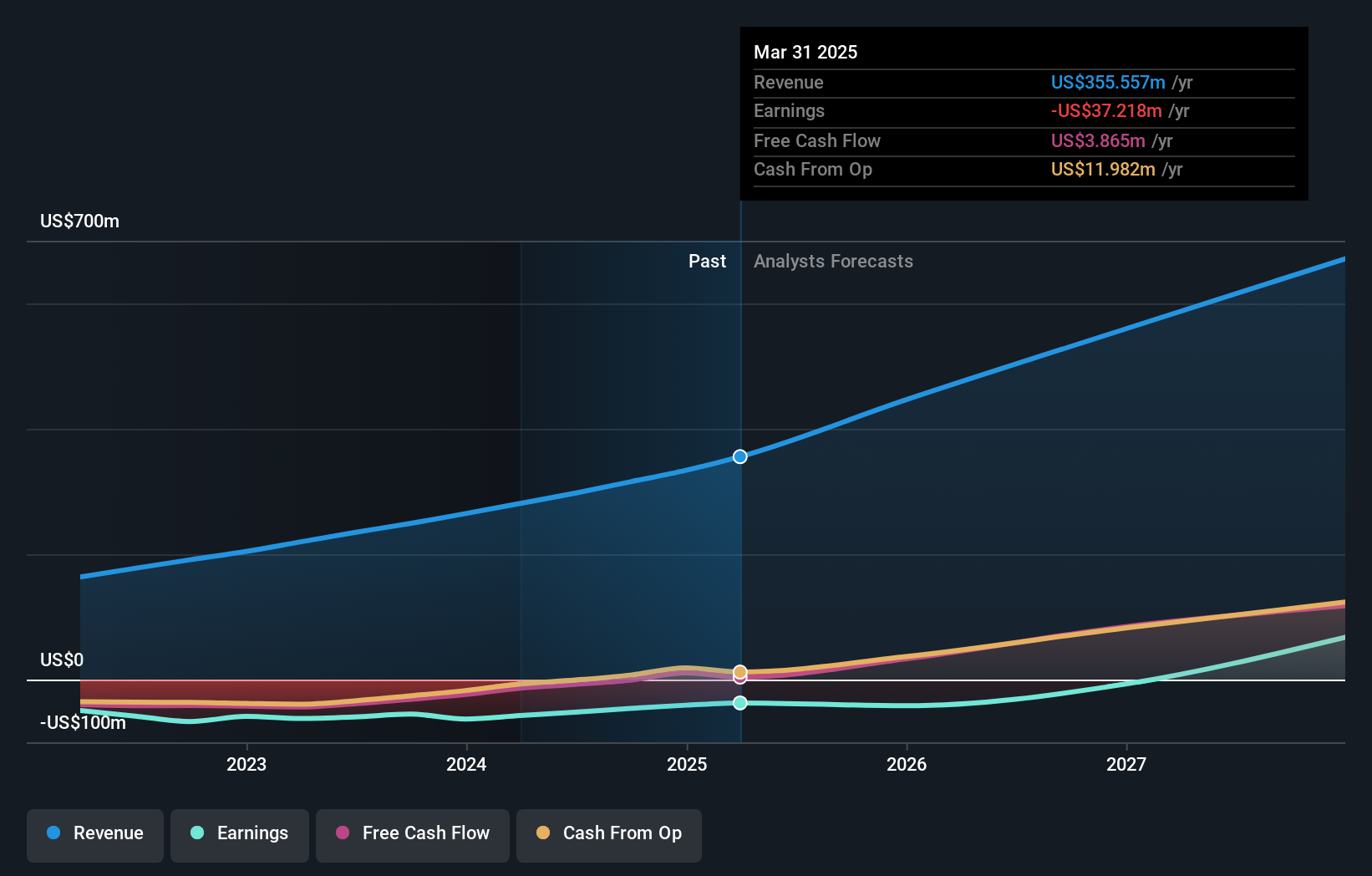

Alkami Technology (NasdaqGS:ALKT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States with a market capitalization of approximately $3.98 billion.

Operations: Alkami Technology, Inc. generates revenue primarily from its Internet Software & Services segment, amounting to $315.56 million. The company focuses on providing cloud-based digital banking solutions across the United States.

Alkami Technology, Inc. is navigating the high-growth tech landscape with strategic partnerships and innovative product enhancements that bolster its market position. Recently, Alkami enhanced its Data & Marketing Solutions platform, introducing advanced behavioral data tags to deepen financial institutions' client insights—a move aligning with the increasing demand for sophisticated digital banking experiences. This innovation is pivotal as it supports cross-departmental strategies to drive revenue and strengthen customer loyalty. Financially, Alkami reported a 22% annual revenue growth forecast and an impressive projection of earnings growth at 102.7% per year, signaling robust future prospects despite current unprofitability. The company's commitment to R&D is evident from its recent product launches and updates, ensuring it remains competitive in a rapidly evolving sector.

- Delve into the full analysis health report here for a deeper understanding of Alkami Technology.

Examine Alkami Technology's past performance report to understand how it has performed in the past.

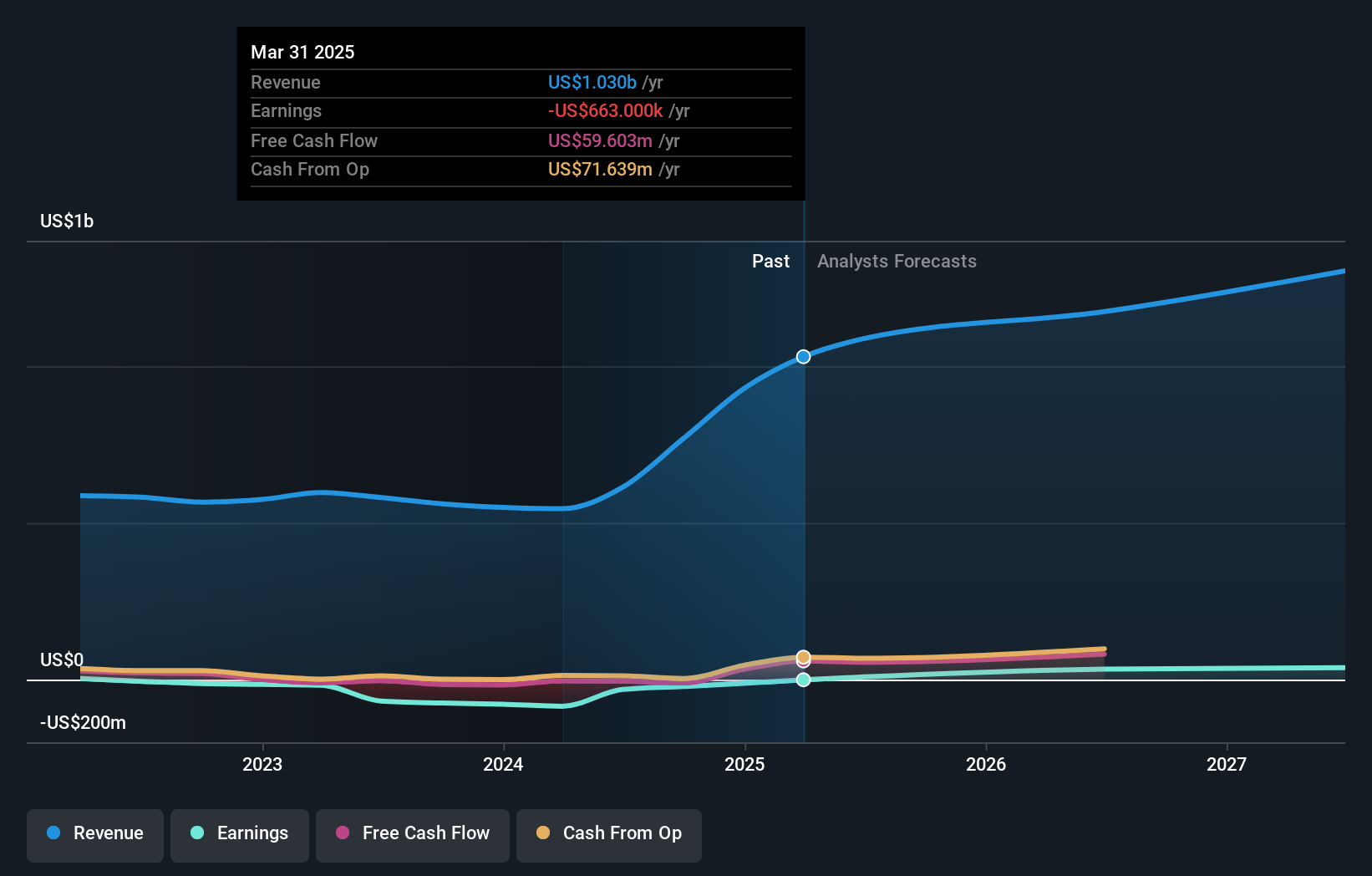

QuinStreet (NasdaqGS:QNST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services to clients both in the United States and internationally, with a market cap of approximately $1.32 billion.

Operations: QuinStreet generates revenue primarily through its Direct Marketing segment, which accounts for $768.81 million. The company's business model focuses on providing customer acquisition services across various industries.

QuinStreet's strategic maneuvers in the competitive Interactive Media and Services sector are underscored by its focus on innovative marketing solutions, which is evident from its presentation at various industry conferences. Despite being unprofitable, QuinStreet forecasts a revenue growth of 16.3% annually, outpacing the US market's average of 9.1%, and anticipates turning profitable within three years with an expected earnings surge of 105% per annum. The firm has not engaged in significant share repurchases recently, reflecting a cautious approach to capital allocation amid its growth trajectory. This prudent financial management coupled with robust projected earnings growth positions QuinStreet uniquely within its industry, despite current profitability challenges.

- Click to explore a detailed breakdown of our findings in QuinStreet's health report.

Review our historical performance report to gain insights into QuinStreet's's past performance.

Where To Now?

- Unlock our comprehensive list of 237 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EverQuote, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EverQuote might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EVER

EverQuote

Operates an online marketplace for insurance shopping in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives