- United States

- /

- Software

- /

- NasdaqGS:ALKT

Can Rapid Digital Wins Offset Regulatory and Earnings Questions for Alkami Technology (ALKT)?

Reviewed by Sasha Jovanovic

- In early November 2025, Jeanne D'Arc Credit Union announced the completion of its digital transformation with Alkami Technology’s full Digital Sales & Service Platform, incorporating MANTL’s Onboarding & Account Opening Solution to enhance efficiency and member experience.

- This move highlights the accelerating demand among financial institutions for streamlined, omnichannel digital account opening capabilities as digital transformation becomes increasingly essential in community banking.

- We'll explore how the investigation into securities law violations and missed earnings is impacting Alkami Technology’s investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Alkami Technology Investment Narrative Recap

To be a shareholder in Alkami Technology, one needs to believe in the long-term demand for digital banking transformation among smaller financial institutions, supported by Alkami’s integration and onboarding platforms. While the Jeanne D'Arc Credit Union announcement reinforces Alkami's market relevance and product adoption, the recent investigation into possible securities law violations and missed earnings remains the most important risk in the short term, and so far, the partnership news does not appear to materially shift this risk profile.

Of the recent company milestones, the Jeanne D’Arc Credit Union deployment stands out, as it directly demonstrates continued appetite for Alkami’s integrated, cross-sell solutions in community banking. This is especially relevant given analyst consensus that accelerated platform integration and digital onboarding are the primary catalysts supporting Alkami's recurring revenue growth outlook.

However, investors should also be mindful that, despite these wins, regulatory investigations and missed earnings may bring...

Read the full narrative on Alkami Technology (it's free!)

Alkami Technology's outlook anticipates $743.3 million in revenue and $62.2 million in earnings by 2028. This scenario implies 24.5% annual revenue growth and a $100.7 million increase in earnings from the current loss of $38.5 million.

Uncover how Alkami Technology's forecasts yield a $32.56 fair value, a 59% upside to its current price.

Exploring Other Perspectives

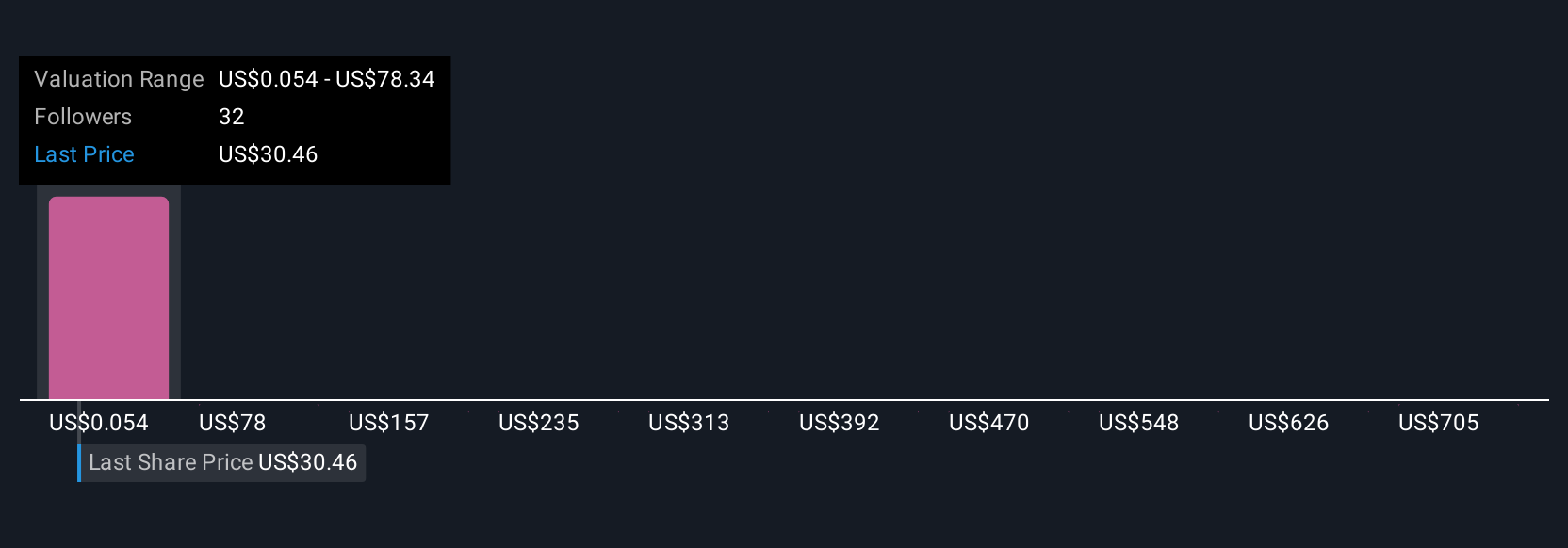

Simply Wall St Community members have produced 11 fair value estimates for Alkami, with targets spanning from US$16.54 to US$122.14 per share. Despite this diversity, the accelerating adoption of Alkami’s digital onboarding platforms remains a key factor shaping forecasts, so consider how much these differing outlooks depend on continued cross-sell success and client momentum.

Explore 11 other fair value estimates on Alkami Technology - why the stock might be worth 19% less than the current price!

Build Your Own Alkami Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkami Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkami Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkami Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives