- United States

- /

- Software

- /

- NasdaqGS:ALKT

Alkami Technology (ALKT): Assessing Valuation Following Strategic Partnership and Renewed Investor Focus

Reviewed by Kshitija Bhandaru

Alkami Technology (ALKT) has landed on the radar after announcing a strategic partnership with Hanscom Federal Credit Union. The news has drawn heightened investor attention and sparked interest in the company's next moves in digital banking innovation.

See our latest analysis for Alkami Technology.

Momentum around Alkami Technology has cooled recently, with the 1-year total shareholder return sitting at -30.6%, despite positive news and new partnerships. While some investors are watching for a turnaround, the company's 66% total return over the past three years suggests underlying long-term growth potential if innovation continues to pay off.

If this recent momentum shift has you interested in finding more fast-growing tech names, consider broadening your search and discovering fast growing stocks with high insider ownership

With recent analyst upgrades and the stock trading at a discount to price targets, is Alkami Technology offering an overlooked opportunity, or have investors already factored in all of its future growth potential?

Most Popular Narrative: 38.8% Undervalued

With Alkami Technology closing at $23.53 while the most-followed valuation narrative models a fair value of $38.44, bulls see significant upside if the company's digital transformation tailwinds play out as anticipated.

Growing expectations for advanced, fraud-resistant, omnichannel digital banking experiences are prompting more financial institutions to adopt Alkami's API-driven, cloud-native architecture. This platform can support secure growth and higher operating leverage. Over time, this trend should improve gross and operating margin profiles.

What if the margin magic really happens? This storyline is built on ambitious growth, product stickiness, and a profit trajectory many won't see coming. Guess which bold forecasts drive that eye-popping fair value? You'll want to find out what numbers are behind the optimism.

Result: Fair Value of $38.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition from larger fintechs and regulatory shifts could easily threaten Alkami's profitability story if not carefully managed.

Find out about the key risks to this Alkami Technology narrative.

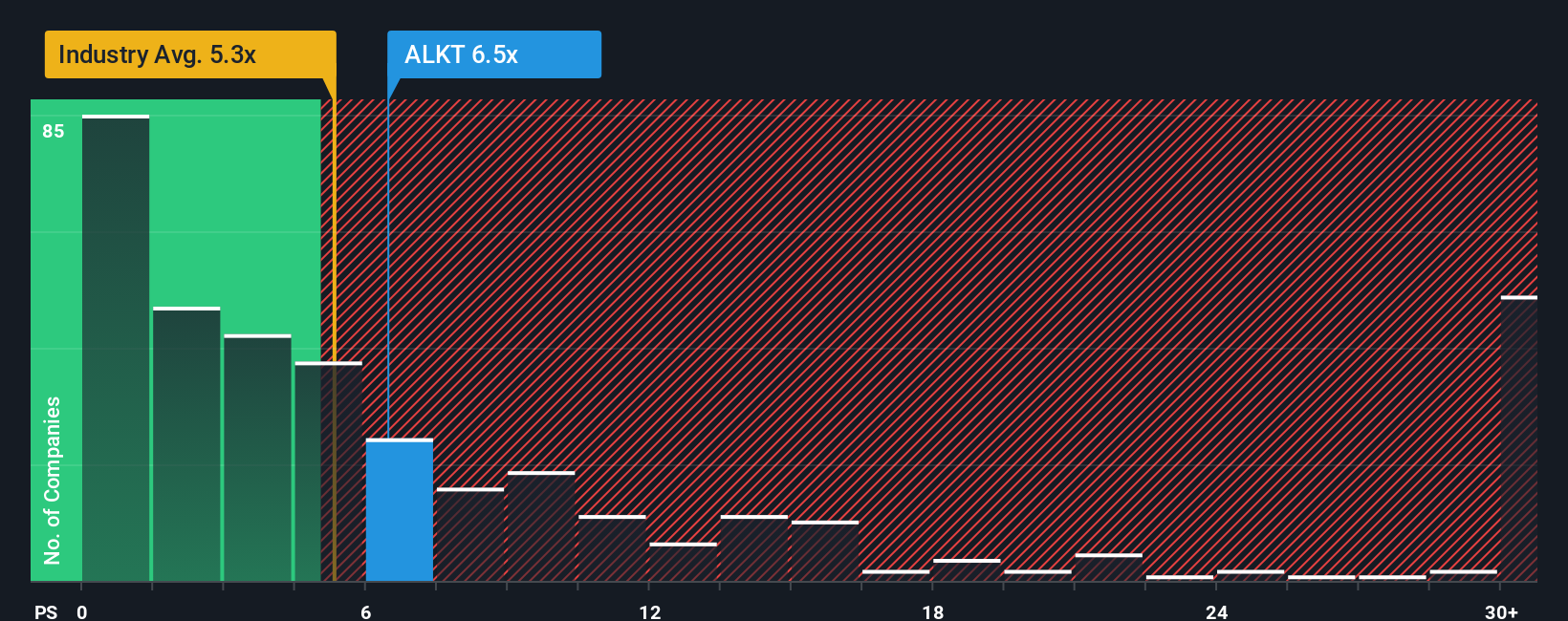

Another View: Multiples Send a Caution Signal

While the analyst consensus and SWS DCF model see upside potential, market multiples paint a riskier picture. Alkami Technology trades at a price-to-sales ratio of 6.4x, which is well above the US Software industry average of 5x and its fair ratio of 5.6x. This suggests the stock could be overvalued by market standards and highlights real downside risk if expectations fall short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alkami Technology Narrative

If you want a different angle or prefer hands-on analysis, dive into the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Alkami Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Set yourself up for portfolio success by checking out these handpicked opportunities that could propel your investing strategy further, so you never miss the next big winner.

- Unlock consistent potential for strong cash flow with these 19 dividend stocks with yields > 3% delivering yields that can give your returns a reliable boost.

- Spot breakout opportunities in rapidly growing industries through these 24 AI penny stocks featuring some of the most innovative technologies on the market.

- Take action on value before the market catches on by racking up bargains with these 892 undervalued stocks based on cash flows today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALKT

Alkami Technology

Provides cloud-based digital banking solutions in the United States.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion