- United States

- /

- Software

- /

- NasdaqGS:AGYS

Rising Revenue but Lower Earnings Might Change The Case For Investing In Agilysys (AGYS)

Reviewed by Simply Wall St

- Agilysys, Inc. recently reported its first quarter 2025 earnings, with revenue rising to US$76.68 million from US$63.51 million a year ago, while net income decreased to US$4.89 million from US$14.11 million over the same period.

- This combination of increased revenue but lower net income underscores ongoing profitability pressures even as the company expands its top line.

- We'll examine how Agilysys's higher sales but sharply lower earnings might influence its investment outlook and growth story.

Find companies with promising cash flow potential yet trading below their fair value.

Agilysys Investment Narrative Recap

To be an Agilysys shareholder, you need to believe that its ongoing shift toward cloud-native solutions and recurring subscription revenue will position the company for long-term growth, despite current volatility in earnings. The recent Q1 2025 report, showing impressive revenue growth but a steep drop in net income, spotlights current profitability pressures. While this development underscores the risk that earnings growth could lag in the short term, it does not materially affect the most important short-term catalyst, which remains Agilysys's progress in cloud product adoption. The company recently raised its fiscal year 2026 guidance, forecasting subscription revenue growth of 27% and projecting total revenue of US$308 million to US$312 million. With this updated outlook, investor attention will likely stay focused on Agilysys's ability to convert topline expansion into sustainable profit margins, especially as cloud adoption ramps up. In contrast, one risk that investors should not overlook relates to the challenge of transitioning customers from legacy POS systems to modern solutions...

Read the full narrative on Agilysys (it's free!)

Agilysys' narrative projects $431.7 million revenue and $57.7 million earnings by 2028. This requires 17.9% yearly revenue growth and a $35.4 million earnings increase from $22.3 million currently.

Uncover how Agilysys' forecasts yield a $123.35 fair value, a 5% upside to its current price.

Exploring Other Perspectives

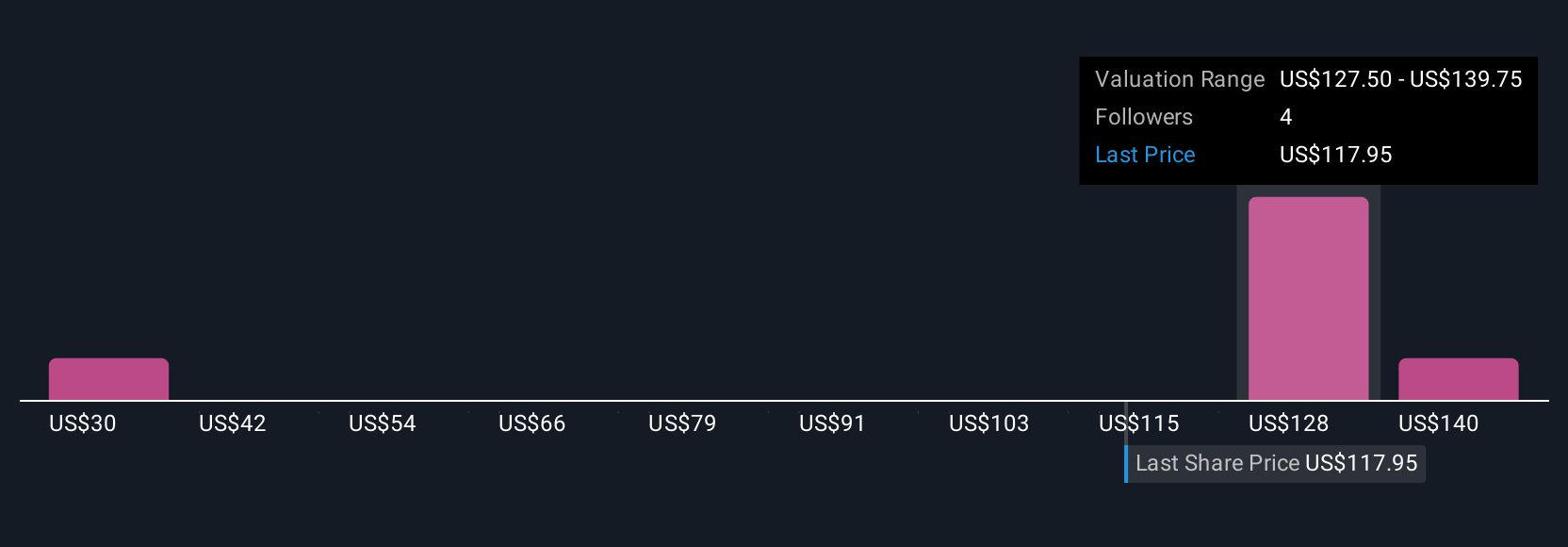

Simply Wall St Community members offered three fair value estimates ranging widely from US$29.52 to US$152. Some see strong potential in the company’s recurring revenue focus, though concerns around near-term margin compression remain relevant for many.

Build Your Own Agilysys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilysys research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Agilysys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilysys' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives