- United States

- /

- Software

- /

- NasdaqGS:AGYS

Does Chary’s Arrival Signal a New Era for Agilysys’ (AGYS) Product Innovation Strategy?

Reviewed by Sasha Jovanovic

- Agilysys, Inc. recently appointed Sudharshan Chary, a Hospitality Financial and Technology Professionals International Technology Hall of Fame inductee and co-founder of Datavision Technologies, to its executive leadership team as Senior Vice President, Product Strategy.

- Chary's addition brings specialized business intelligence expertise that may strengthen Agilysys' capabilities in delivering modern, data-driven technology solutions to the hospitality sector.

- We'll explore what Chary's hospitality business intelligence background could mean for Agilysys' ongoing transformation and investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Agilysys Investment Narrative Recap

To own Agilysys, an investor must believe that the long-term shift toward cloud-native, integrated hospitality software will support sustained growth, even amid higher operating costs and international expansion challenges. The appointment of Sudharshan Chary adds business intelligence expertise but is unlikely to materially affect the near-term financial catalyst: accelerating SaaS revenue and ARR growth; nor does it lower core risks such as heavy exposure to North America and competitive pressure from larger players.

Among recent company announcements, Agilysys confirmed its raised FY26 revenue guidance, projecting 27% subscription growth and total revenue between US$308 million and US$312 million. This is directly relevant to short-term catalysts, as maintaining double-digit recurring revenue growth is critical for offsetting high reinvestment and the risk of compressed profit margins if top-line momentum slows.

But while many are focused on technology enhancements, investors should also be aware of rising cost pressures from sustained investment in sales and innovation, which...

Read the full narrative on Agilysys (it's free!)

Agilysys' narrative projects $425.1 million in revenue and $60.4 million in earnings by 2028. This requires 13.8% yearly revenue growth and a $46.4 million earnings increase from $14.0 million today.

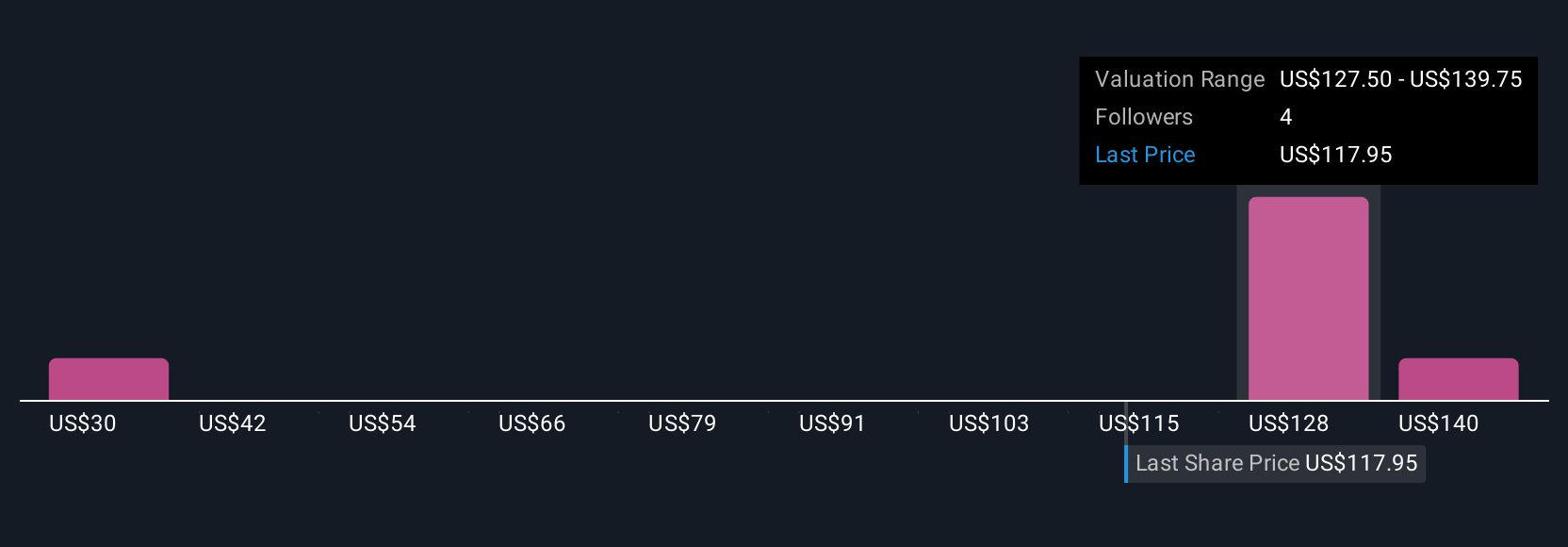

Uncover how Agilysys' forecasts yield a $130.40 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$29.52 to US$152 across three perspectives, revealing broad disagreement about Agilysys’s worth. While the share price sits well above many community fair values, recurring revenue growth remains a key support for performance, yet investors view the upside and risks quite differently.

Explore 3 other fair value estimates on Agilysys - why the stock might be worth as much as 51% more than the current price!

Build Your Own Agilysys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilysys research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Agilysys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilysys' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives