- United States

- /

- Software

- /

- NasdaqGS:AGYS

Agilysys (NASDAQ:AGYS) delivers shareholders massive 36% CAGR over 5 years, surging 13% in the last week alone

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Agilysys, Inc. (NASDAQ:AGYS) share price. It's 373% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 21% gain in the last three months.

Since the stock has added US$136m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Agilysys

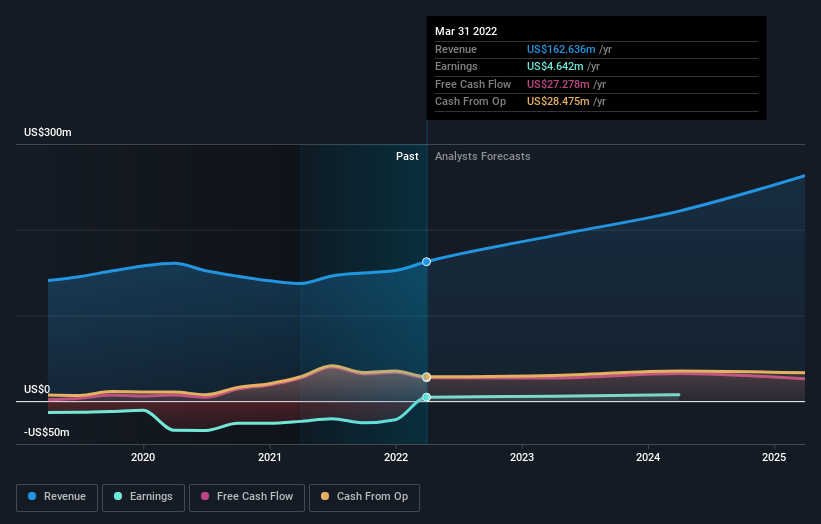

We don't think that Agilysys' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Agilysys saw its revenue grow at 4.2% per year. That's not a very high growth rate considering the bottom line. Therefore, we're a little surprised to see the share price gain has been so strong, at 36% per year, compound, over the period. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While it's never nice to take a loss, Agilysys shareholders can take comfort that their trailing twelve month loss of 14% wasn't as bad as the market loss of around 18%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 36% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. It's always interesting to track share price performance over the longer term. But to understand Agilysys better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Agilysys .

But note: Agilysys may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives