- United States

- /

- Software

- /

- NasdaqGS:AGYS

Agilysys (AGYS): Evaluating Valuation Following Strategic Executive Hire and Cloud Innovation Drive

Reviewed by Kshitija Bhandaru

Agilysys (AGYS) has just welcomed Sudharshan Chary to its executive team as Senior Vice President, Product Strategy. This appointment highlights the company’s continued focus on data-driven cloud solutions for the hospitality sector. This move comes as Agilysys expands its growth strategy.

See our latest analysis for Agilysys.

The addition of Sudharshan Chary comes during a period of momentum-building for Agilysys. The share price has pulled back a little in recent months but still boasts an impressive 5-year total shareholder return of 282%. Investors have responded positively to the company’s sustained profitability and renewed focus on cloud-based innovation, which could support long-term value creation as Agilysys continues to expand its footprint in hospitality tech.

If this kind of strategic leadership shift sparks your interest, it’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

The question for investors now is whether Agilysys’s recent strategic moves and profitable growth mean the stock still has room to run, or if the market has already priced in its future success.

Most Popular Narrative: 19.6% Undervalued

Agilysys's most watched valuation narrative puts its fair value at $130.40, a strong premium over the last close of $104.84. Here is what is fueling the conviction behind these numbers:

Accelerated sales momentum across multiple verticals (hotels, casino gaming, food service management, international) and a record high backlog of implementations, combined with recently expanded sales capacity, indicate a strong pipeline that is expected to drive robust top-line revenue growth and sustained increases in subscription ARR.

Want to know what underpins this bullish price target? The narrative bets big on major profit expansion and market-defying growth, plus one surprising assumption about subscription revenue. Uncover what really justifies this valuation leap.

Result: Fair Value of $130.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as intensified competition and heavy reliance on the hospitality sector could dampen growth if economic or industry conditions shift unexpectedly.

Find out about the key risks to this Agilysys narrative.

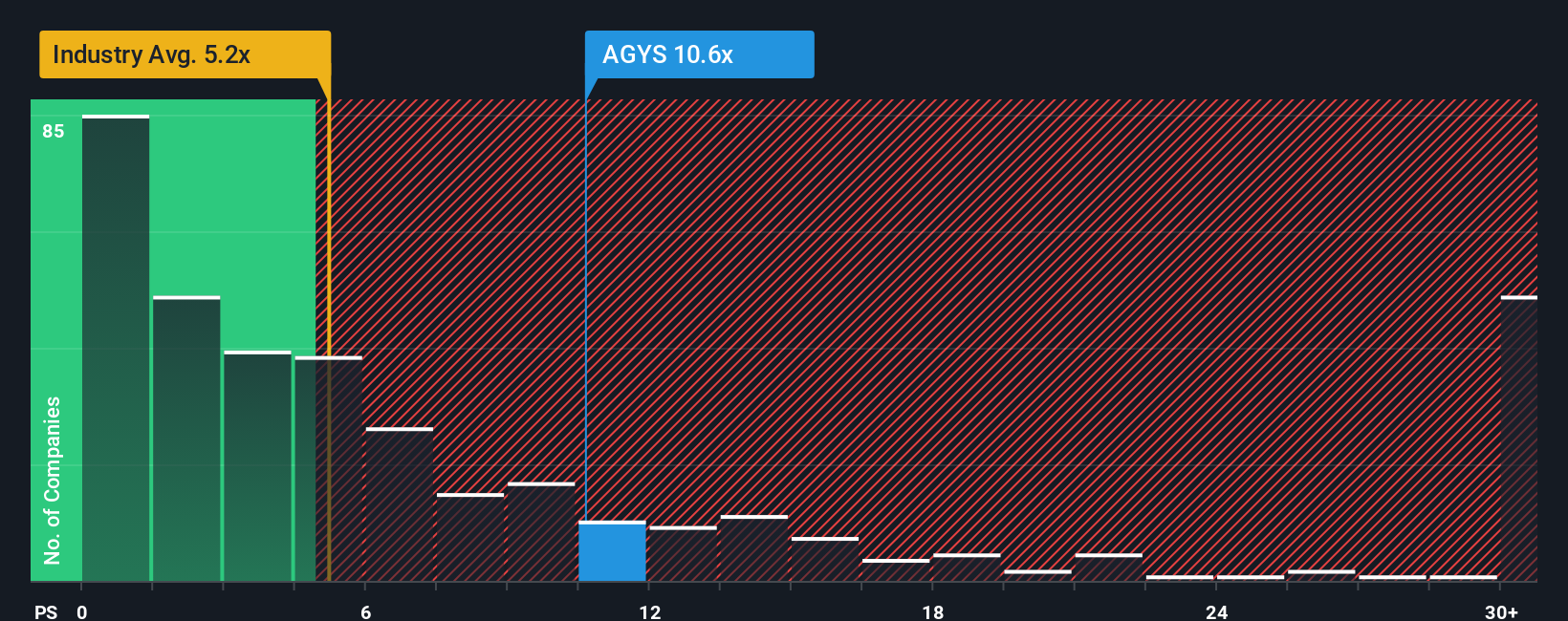

Another View: Multiples Suggest a Tougher Valuation

While the popular narrative sees considerable upside, a closer look at the price-to-sales metric paints a different picture. Agilysys trades at 10.1 times sales, well above both the industry average of 5.3 and its own fair ratio of 4.4. This premium could signal valuation risk rather than untapped value, especially if growth expectations stumble. Which story will the market believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agilysys Narrative

If you want to test these assumptions or prefer your own hands-on research, you can quickly create your own perspective from the data in just a few minutes, and Do it your way.

A great starting point for your Agilysys research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Unlock a world of new ideas before the market catches on. The Simply Wall Street Screener features smartly selected stocks with outsized potential and hidden advantages for sharp investors like you.

- Capture compelling cash flow potential and get ahead of market trends with these 896 undervalued stocks based on cash flows that trade below their intrinsic value.

- Zero in on future industry disruptors by targeting these 24 AI penny stocks that leverage breakthrough artificial intelligence technologies.

- Ride the unstoppable wave of passive income by checking out these 19 dividend stocks with yields > 3% for a collection of stocks offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives