- United States

- /

- Software

- /

- NasdaqGS:ADSK

A Fresh Look at Autodesk (ADSK) Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

Autodesk (ADSK) stock has moved slightly in recent trading, catching some interest after a stretch of fluctuating performance this month. Investors have been watching how Autodesk manages steady revenue growth as market conditions continue to shift.

See our latest analysis for Autodesk.

Autodesk’s share price dipped 2.2% in the last session and is down just under 5% over the past month, even as the company has shown resilience through uneven broader market conditions. Despite a recent bout of volatility, long-term momentum is holding up. Autodesk delivered a 6.4% total shareholder return over the past year, with a standout 52.7% total return over three years reflecting its ability to create lasting value for investors.

If you’re weighing other opportunities in the tech space, consider using our screen to discover the latest innovators shaping software and AI. See the full list for free.

With Autodesk shares hovering about 20% below average analyst price targets, but still coming off several years of strong returns, investors are left to wonder if current prices offer upside or if future growth is already reflected in the stock price.

Most Popular Narrative: 16.6% Undervalued

At $303.50, Autodesk trades noticeably below what the most widely followed narrative sees as its fair value, pegged at $363.71. This sets the stage for a debate about assumptions driving that significant gap.

“Accelerating adoption of cloud-based platforms, such as Autodesk Construction Cloud and Fusion 360, and ongoing rollout of subscription and SaaS models are increasing recurring revenue, improving revenue visibility, and enhancing net margin stability due to higher operating leverage and sales efficiency improvements.”

Curious what powers this aggressive price target? It centers on a future business model fueled by recurring revenue and tech innovation. The real surprise is in the profit margin assumptions hiding behind that number. Want to unpack the bold projections behind this valuation? Read on to discover the drivers that could reshape Autodesk’s earnings story.

Result: Fair Value of $363.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from open-source platforms and evolving customer preferences could threaten Autodesk’s pricing power and dampen its projected long-term growth trajectory.

Find out about the key risks to this Autodesk narrative.

Another Take: What Does Our DCF Model Say?

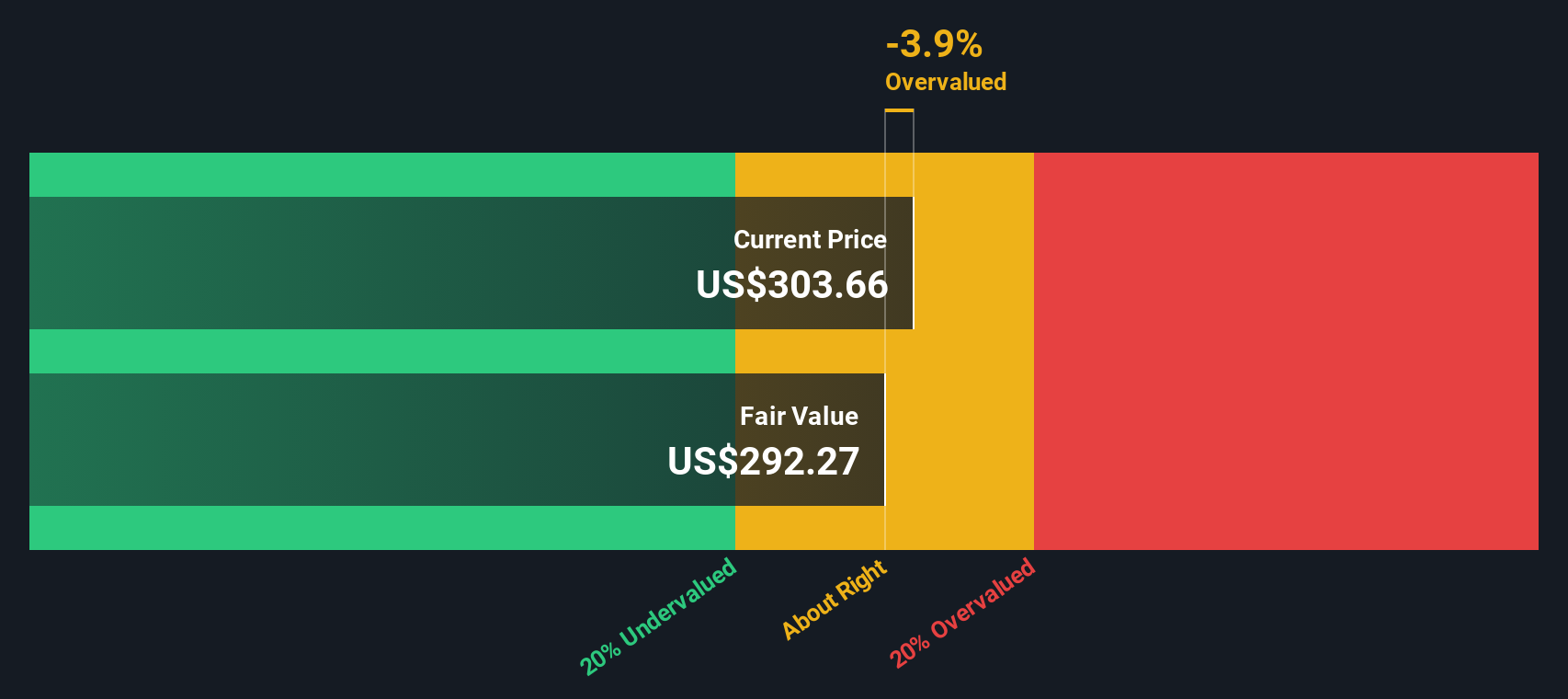

While analysts’ consensus points toward Autodesk being 16.6% undervalued, our DCF model gives a more reserved outlook. In fact, it finds the current share price sits above our estimate of fair value. This suggests Autodesk could be slightly overvalued based on projected future cash flows. Could that mean the market is already betting on higher growth than fundamentals justify?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Autodesk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Autodesk Narrative

If you’d rather dig into the numbers firsthand or want to shape the story your way, you can quickly craft your own perspective with our tools using Do it your way.

A great starting point for your Autodesk research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. Supercharge your strategy with ready-built screens tailored for unique growth, value, and innovation angles that could set your portfolio apart.

- Target high potential by acting early on these 3586 penny stocks with strong financials with strong financials before they hit the radar of mainstream investors.

- Tap into future-shaping breakthroughs in healthcare by focusing on these 33 healthcare AI stocks which make medical innovation accessible and scalable.

- Lock in attractive yields with these 19 dividend stocks with yields > 3% designed to help you find income opportunities topping 3% and supported by robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026