- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

With EPS Growth And More, Automatic Data Processing (NASDAQ:ADP) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Automatic Data Processing (NASDAQ:ADP). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Automatic Data Processing

How Fast Is Automatic Data Processing Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Automatic Data Processing has grown EPS by 15% per year. That's a good rate of growth, if it can be sustained.

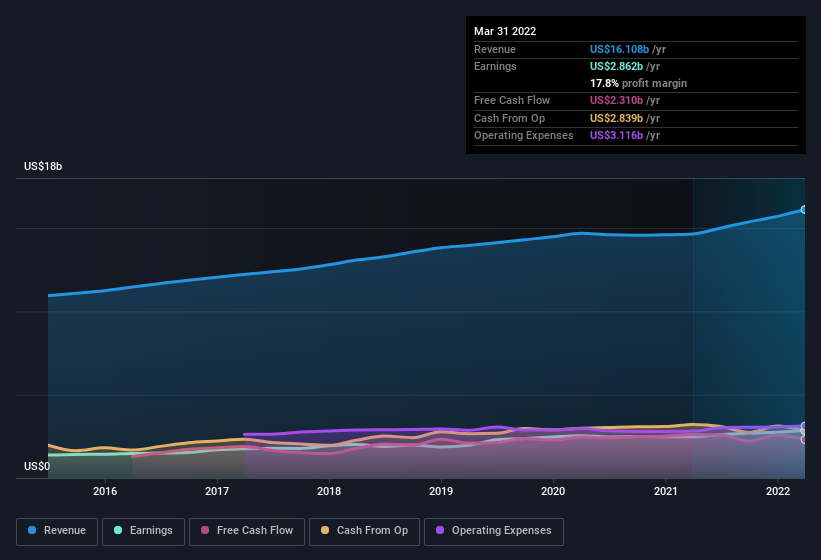

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Automatic Data Processing's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Automatic Data Processing achieved similar EBIT margins to last year, revenue grew by a solid 10.0% to US$16b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Automatic Data Processing's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Automatic Data Processing Insiders Aligned With All Shareholders?

Owing to the size of Automatic Data Processing, we wouldn't expect insiders to hold a significant proportion of the company. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$106m. While that is a lot of skin in the game, we note this holding only totals to 0.1% of the business, which is a result of the company being so large. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Should You Add Automatic Data Processing To Your Watchlist?

One positive for Automatic Data Processing is that it is growing EPS. That's nice to see. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. If you think Automatic Data Processing might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks