- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Shareholders Are Thrilled That The Automatic Data Processing (NASDAQ:ADP) Share Price Increased 106%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the Automatic Data Processing, Inc. (NASDAQ:ADP) share price has soared 106% in the last half decade. Most would be very happy with that. Meanwhile the share price is 2.0% higher than it was a week ago.

Check out our latest analysis for Automatic Data Processing

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

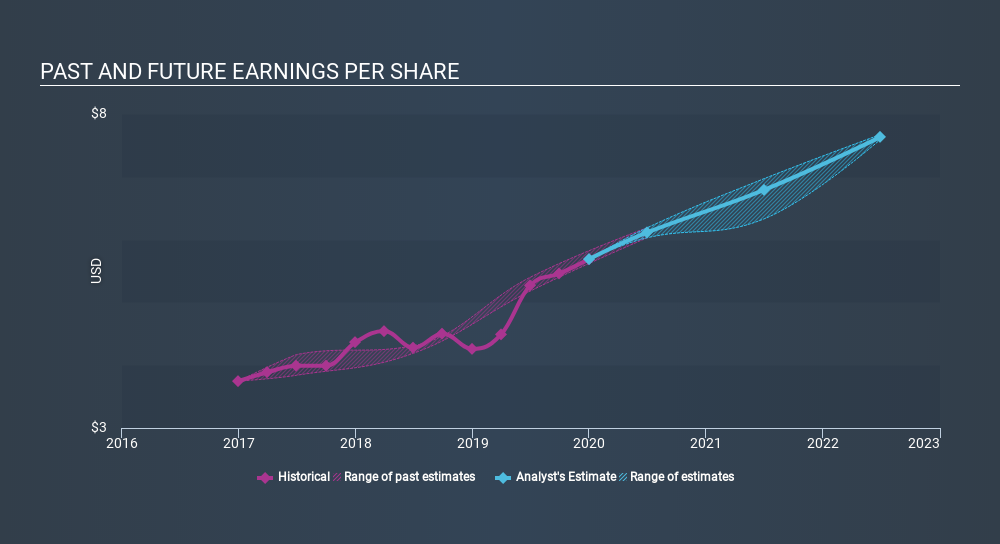

Over half a decade, Automatic Data Processing managed to grow its earnings per share at 16% a year. That makes the EPS growth particularly close to the yearly share price growth of 16%. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Automatic Data Processing has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Automatic Data Processing the TSR over the last 5 years was 130%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Automatic Data Processing shareholders have received returns of 22% over twelve months (even including dividends) , which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 18%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. Before deciding if you like the current share price, check how Automatic Data Processing scores on these 3 valuation metrics.

We will like Automatic Data Processing better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ADP

Automatic Data Processing

Engages in the provision of cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives