- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Is Automatic Data Processing (NASDAQ:ADP) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Automatic Data Processing, Inc. (NASDAQ:ADP) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Our analysis indicates that ADP is potentially overvalued!

What Is Automatic Data Processing's Net Debt?

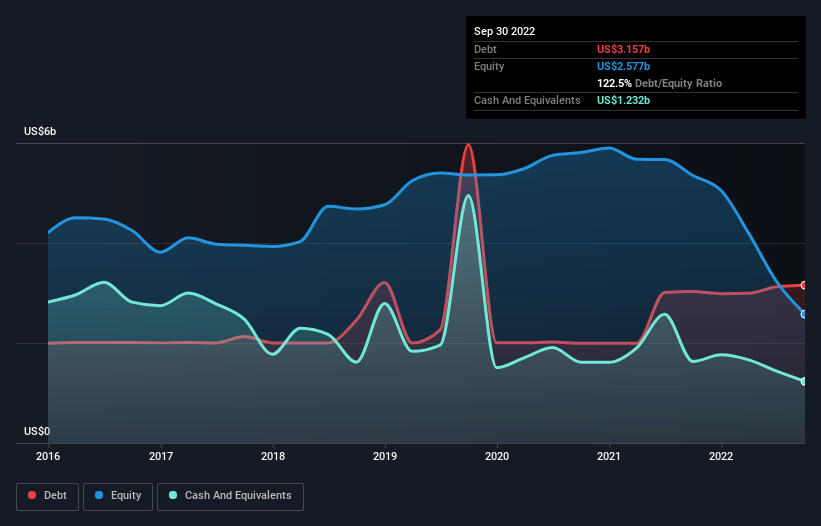

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Automatic Data Processing had US$3.16b of debt, an increase on US$3.03b, over one year. However, because it has a cash reserve of US$1.23b, its net debt is less, at about US$1.92b.

A Look At Automatic Data Processing's Liabilities

The latest balance sheet data shows that Automatic Data Processing had liabilities of US$39.2b due within a year, and liabilities of US$4.62b falling due after that. On the other hand, it had cash of US$1.23b and US$2.94b worth of receivables due within a year. So it has liabilities totalling US$39.6b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Automatic Data Processing is worth a massive US$103.4b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Automatic Data Processing's net debt is only 0.43 times its EBITDA. And its EBIT covers its interest expense a whopping 74.3 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. And we also note warmly that Automatic Data Processing grew its EBIT by 14% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Automatic Data Processing can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Automatic Data Processing recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Automatic Data Processing's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Zooming out, Automatic Data Processing seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Automatic Data Processing has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Circle Internet Group (CRCL): The Programmable Dollar Powerhouse – Post-IPO Momentum and Stablecoin Dominance.

TTM Technologies (TTMI): The Backbone of the AI Tsunami and Defense Modernization.

Bloom Energy Corp (BE): The AI "Bridge-to-Power" – Scaling to 2GW Capacity for the Next-Gen Data Center.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026