- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

How Much Did Automatic Data Processing's (NASDAQ:ADP) CEO Pocket Last Year?

Carlos Rodriguez has been the CEO of Automatic Data Processing, Inc. (NASDAQ:ADP) since 2011, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Automatic Data Processing

Comparing Automatic Data Processing, Inc.'s CEO Compensation With the industry

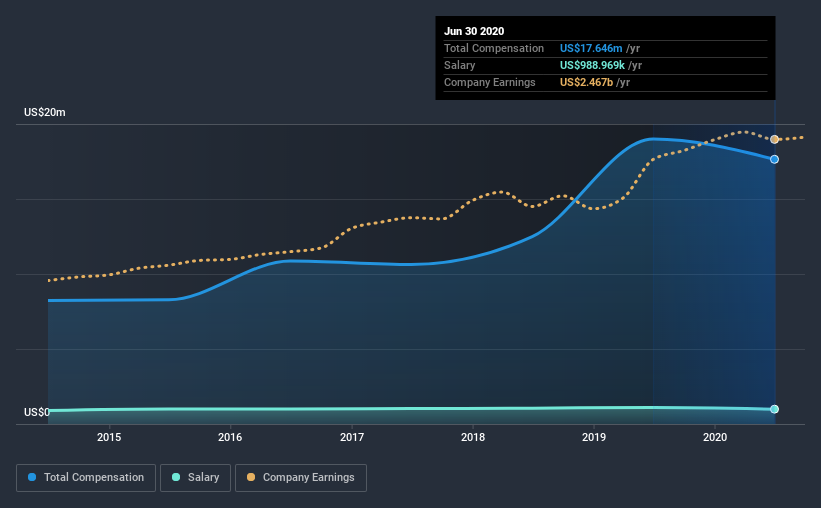

According to our data, Automatic Data Processing, Inc. has a market capitalization of US$73b, and paid its CEO total annual compensation worth US$18m over the year to June 2020. That's a slightly lower by 7.1% over the previous year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$989k.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$11m. Hence, we can conclude that Carlos Rodriguez is remunerated higher than the industry median. Moreover, Carlos Rodriguez also holds US$16m worth of Automatic Data Processing stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

On an industry level, around 14% of total compensation represents salary and 86% is other remuneration. Automatic Data Processing pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Automatic Data Processing, Inc.'s Growth

Automatic Data Processing, Inc.'s earnings per share (EPS) grew 13% per year over the last three years. Its revenue is up 1.9% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Automatic Data Processing, Inc. Been A Good Investment?

We think that the total shareholder return of 54%, over three years, would leave most Automatic Data Processing, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Automatic Data Processing, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, Automatic Data Processing has produced strong EPS growth and shareholder returns over the last three years. Considering such exceptional results for the company, we'd venture to say CEO compensation is fair. Given the strong history of shareholder returns, the shareholders are probably very happy with Carlos's performance.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Automatic Data Processing (free visualization of insider trades).

Switching gears from Automatic Data Processing, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Automatic Data Processing, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

The $200 Billion Gamble: Can AWS Outrun the AI Capex Monster?

Investment Case: Sotkamo Silver (SOSI)

The "AI Fear" Arbitrage Opportunity

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion