- United States

- /

- Software

- /

- NasdaqGS:ADEA

Does Resolving Litigation and Expanding IP Licensing With Altice Change the Bull Case for Adeia (ADEA)?

Reviewed by Sasha Jovanovic

- Adeia announced it has entered a long-term intellectual property license agreement with Altice USA, supporting Optimum's nationwide internet, TV, and streaming platforms while resolving all outstanding litigation between the two companies.

- This collaboration not only extends the reach of Adeia's IP across Altice's services but also removes legal uncertainties, potentially providing greater stability for future licensing revenues and operational planning.

- We'll examine how resolving litigation with Altice USA and expanding licensing reach could influence Adeia's investment outlook.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Adeia Investment Narrative Recap

To be a shareholder in Adeia, you need to believe in the long-term value of its intellectual property portfolio and the company’s ability to grow recurring licensing revenues, despite regulatory pressures and patent maturation. The new Altice USA agreement meaningfully addresses litigation risk and could stabilize near-term revenues, although customer concentration and dependence on large deals remain significant short-term risks that this event only partially mitigates.

Among recent announcements, the multi-year license renewals with key global streaming and broadband providers, including SK Broadband and Roku, stand out as supporting catalysts. These renewals highlight Adeia’s traction in expanding recurring revenue streams from connected device and OTT platform adoption, complementing the Altice deal’s positive impact by lessening reliance on any single customer relationship.

However, despite these recent agreements, investors should also consider the ongoing regulatory uncertainty that could affect IP monetization and create new challenges for Adeia’s revenue model...

Read the full narrative on Adeia (it's free!)

Adeia's outlook anticipates $466.7 million in revenue and $124.5 million in earnings by 2028. This is based on a projected 7.2% annual revenue growth rate and an earnings increase of $40.6 million from current earnings of $83.9 million.

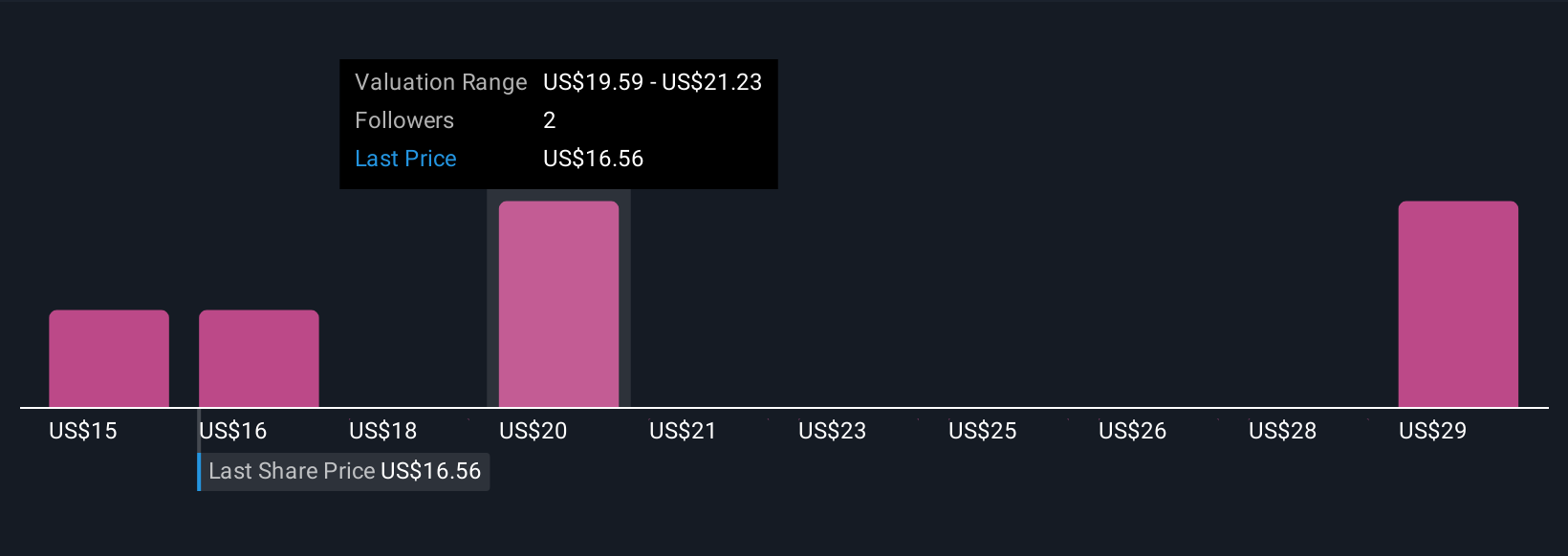

Uncover how Adeia's forecasts yield a $20.67 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$14.65 to US$31.00, indicating wide differences in expectations. While most see upside, the continued global push for IP regulatory reform remains a major factor that could reshape Adeia’s outlook, so explore these perspectives for a fuller picture.

Explore 4 other fair value estimates on Adeia - why the stock might be worth as much as 79% more than the current price!

Build Your Own Adeia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adeia research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adeia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adeia's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADEA

Adeia

Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives