Adeia Inc. (NASDAQ:ADEA) has announced that it will pay a dividend of $0.05 per share on the 17th of September. The dividend yield will be 1.8% based on this payment which is still above the industry average.

Check out our latest analysis for Adeia

Adeia's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last dividend was quite easily covered by Adeia's earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

Over the next year, EPS is forecast to expand by 42.1%. If the dividend continues on this path, the payout ratio could be 31% by next year, which we think can be pretty sustainable going forward.

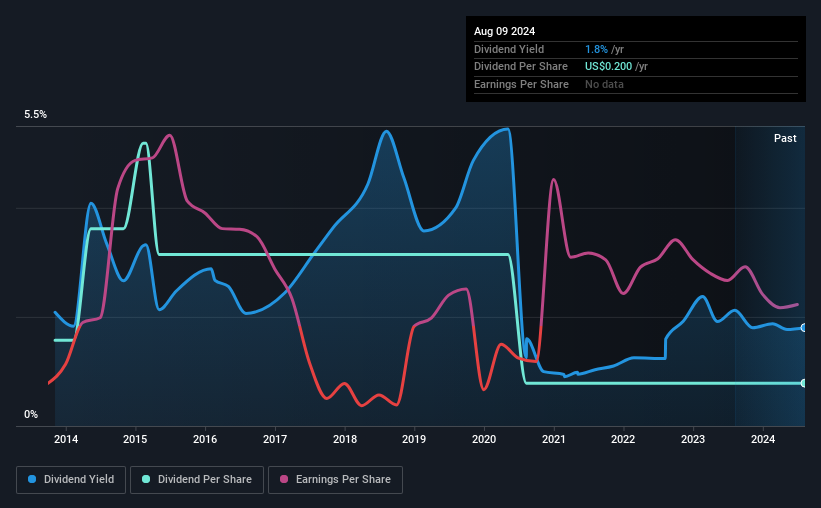

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was $0.40 in 2014, and the most recent fiscal year payment was $0.20. Doing the maths, this is a decline of about 6.7% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Is Doubtful

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. It's not great to see that Adeia's earnings per share has fallen at approximately 7.2% per year over the past five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Our Thoughts On Adeia's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Adeia's payments, as there could be some issues with sustaining them into the future. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 4 warning signs for Adeia (1 can't be ignored!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADEA

Adeia

Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026