- United States

- /

- Software

- /

- NasdaqGS:ADEA

A Look at Adeia’s (ADEA) Valuation Following Analyst Upgrade and Strong Buy Signals

Reviewed by Kshitija Bhandaru

Adeia (ADEA) just found itself in the spotlight, thanks to a recent upgrade to Zacks Rank #1 (Strong Buy) and a notably optimistic shift in earnings outlook from analysts. If you are watching for signals in the crowded Business Services sector, this renewed confidence from research desks is tough to ignore. Analyst enthusiasm often attracts fresh capital, and the improved outlook for Adeia could be setting off ripple effects among investors trying to decide whether to ride the trend or play it safe.

Looking at the numbers, Adeia’s latest analyst-driven buzz comes on the back of a strong year. The stock has returned over 34% in the past 12 months and has comfortably outpaced its sector’s modest gains since January. Gains have accelerated in the most recent quarter as well, which suggests investor momentum is building alongside the upgraded sentiment. For those who care about long-haul performance, the three and five-year returns have also been impressive, supporting the view that Adeia is not just catching a short-lived wave.

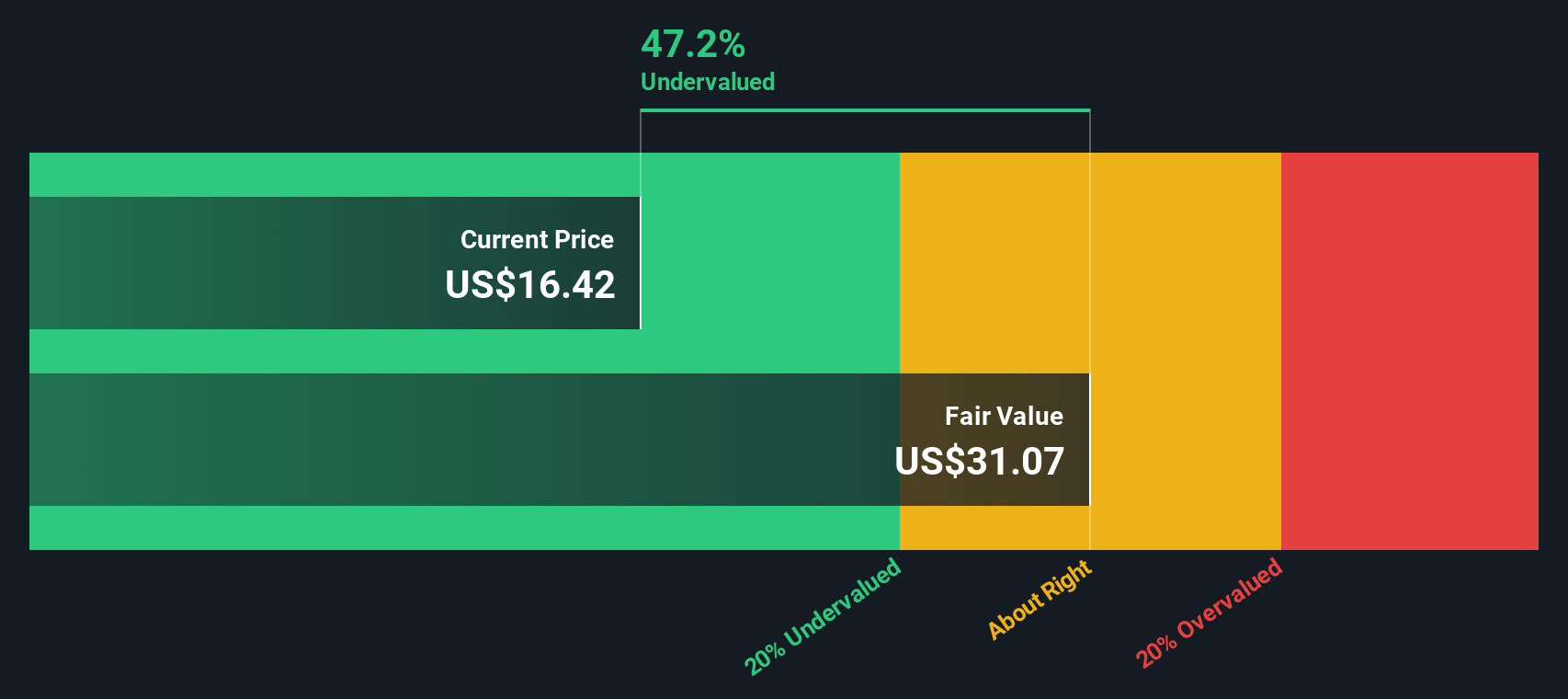

But with all this attention and recent price strength, is Adeia still trading at an attractive valuation, or is the market getting ahead of itself by pricing in more growth than is realistic?

Most Popular Narrative: 19.5% Undervalued

According to the most widely followed narrative, Adeia is currently trading below its estimated fair value, making it appear attractively positioned from a valuation standpoint compared to its projected growth.

The company's ability to sign new multi-year agreements with blue-chip customers (e.g., STMicroelectronics and prominent OTT/e-commerce platforms), with over 40% of recent license deals being new customers, signals successful execution on its growth strategy, contributes to a broader and more diversified royalty base, and supports longer-term revenue and EBITDA growth.

Curious how Adeia’s bold strategy and blockbuster licensing wins might fuel an even higher valuation? The key to this narrative lies in aggressive growth assumptions, a robust margin outlook, and a future earnings multiple that the market rarely grants without good reason. If you want to uncover exactly what’s included in this compelling price target, the numbers behind this story may challenge what you thought possible for this sector.

Result: Fair Value of $20.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, even with this optimism, Adeia’s heavy dependence on its patent portfolio and rising litigation costs could challenge the upbeat narrative if conditions shift.

Find out about the key risks to this Adeia narrative.Another View: What Does Our DCF Model Say?

Taking a step back from market multiples, our SWS DCF model points to a different story. This approach could suggest Adeia is even more attractively valued, but it hinges on longer-term cash flow assumptions. Does this shift the narrative or strengthen the case?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Adeia Narrative

If you are the type who likes to dig deeper or challenge the prevailing view, you can dive into the numbers and assemble your own outlook in just a few minutes. Do it your way.

A great starting point for your Adeia research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Opportunities are everywhere when you look in the right places. Set yourself apart from the crowd by chasing ideas others haven't noticed yet and positioning yourself for smarter investing moves.

- Uncover strong income potential by targeting stocks with generous yields through our dividend stocks with yields > 3%. This may help boost your portfolio returns.

- Capitalize on the next big innovation trend by tracking companies pushing boundaries in artificial intelligence with our AI penny stocks.

- Spot hidden value and snap up shares trading below their fair worth using our forward-looking undervalued stocks based on cash flows for strategic bargains others might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADEA

Adeia

Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives