- United States

- /

- Software

- /

- NasdaqGS:ADBE

We Think Adobe (NASDAQ:ADBE) Can Manage Its Debt With Ease

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Adobe Inc. (NASDAQ:ADBE) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Adobe

How Much Debt Does Adobe Carry?

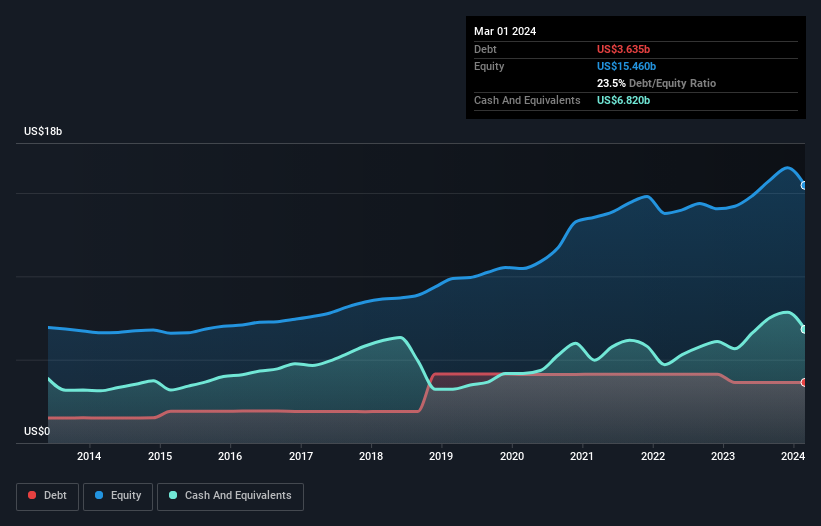

As you can see below, Adobe had US$3.64b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. But it also has US$6.82b in cash to offset that, meaning it has US$3.19b net cash.

How Healthy Is Adobe's Balance Sheet?

According to the last reported balance sheet, Adobe had liabilities of US$9.54b due within 12 months, and liabilities of US$3.75b due beyond 12 months. Offsetting these obligations, it had cash of US$6.82b as well as receivables valued at US$2.06b due within 12 months. So it has liabilities totalling US$4.41b more than its cash and near-term receivables, combined.

Since publicly traded Adobe shares are worth a very impressive total of US$212.1b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Adobe also has more cash than debt, so we're pretty confident it can manage its debt safely.

And we also note warmly that Adobe grew its EBIT by 14% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Adobe's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Adobe has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Adobe actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Adobe has US$3.19b in net cash. The cherry on top was that in converted 109% of that EBIT to free cash flow, bringing in US$6.5b. So is Adobe's debt a risk? It doesn't seem so to us. We'd be very excited to see if Adobe insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADBE

Adobe

Operates as a technology company worldwide.

Outstanding track record and undervalued.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

Tesla, Inc. (TSLA): The Autonomy Transition – From "Car Maker" to "AI Utility" in 2026.

Comfort Systems USA Inc. (FIX): The Data Center Vanguard – Powering the AI Physical Layer in 2026.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks