- United States

- /

- Software

- /

- NasdaqGS:ADBE

Is Adobe's Decline an Opportunity After Shares Fall 30% in the Past Year?

Reviewed by Bailey Pemberton

If you are wondering what to do with Adobe stock after a stretch of sharp ups and downs, you are not alone. With an impressive history as a tech innovator, Adobe is a name investors know well, but the stock has not exactly rewarded patience lately. Even though shares ticked up 2.2% over the past week, the 30-day return sits at -6.1%, and the pain looks steeper over longer horizons, with year-to-date losses of -22.1% and a one-year slide of -30.4%. Over a five-year period, Adobe has actually fallen by -28.2%, something you do not often see with a company at the center of the creative software world.

A big reason for the turbulence is shifting sentiment around technology stocks in general. Investors have been weighing fresh competition in artificial intelligence and cloud software, areas where Adobe faces rising challengers. Regulatory developments about digital content and recurring product subscriptions have also cropped up, injecting more uncertainty into Adobe's outlook, even as its products remain vital across industries. Despite high-flying innovation, the market seems to be reconsidering how much risk it is willing to take on for that growth potential.

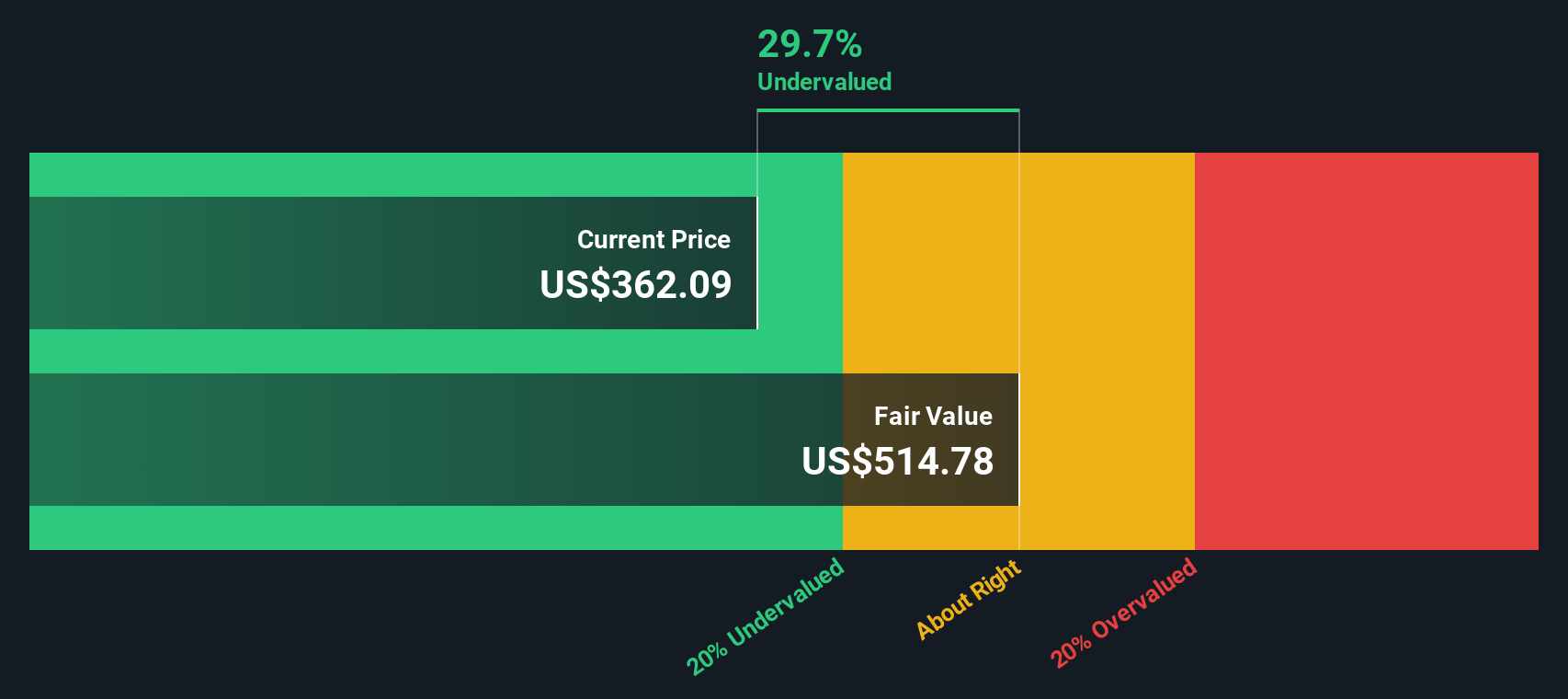

All that back-and-forth shows up in how the market values Adobe today. Based on widely-followed valuation checks, Adobe earns a value score of 5 out of 6, a strong sign of undervaluation by historical standards. But before you decide if the numbers tell the full story, let us dive deeper into the common valuation approaches and, ultimately, look at an even more insightful way to understand Adobe’s true worth.

Why Adobe is lagging behind its peers

Approach 1: Adobe Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today’s value using an appropriate rate. For Adobe, this involves looking at how much free cash the business is expected to generate going forward and what that is worth to investors right now.

Adobe currently reports an annual Free Cash Flow of $9.5 billion. Analyst projections suggest this figure will steadily increase, with estimates for Free Cash Flow reaching $12.5 billion by 2029. After that, further projections up to 2035, extrapolated by Simply Wall St, anticipate continued growth in the low single digits each year.

Using these forecasts, the DCF model arrives at an intrinsic value for Adobe shares of $517.63. This implies that Adobe is trading at a 33.7% discount compared to its fair value based on projected cash flows.

This substantial undervaluation suggests investors are pricing Adobe significantly below what its long-term cash generating ability may be worth, especially given its ongoing dominance in the creative software field.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Adobe is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

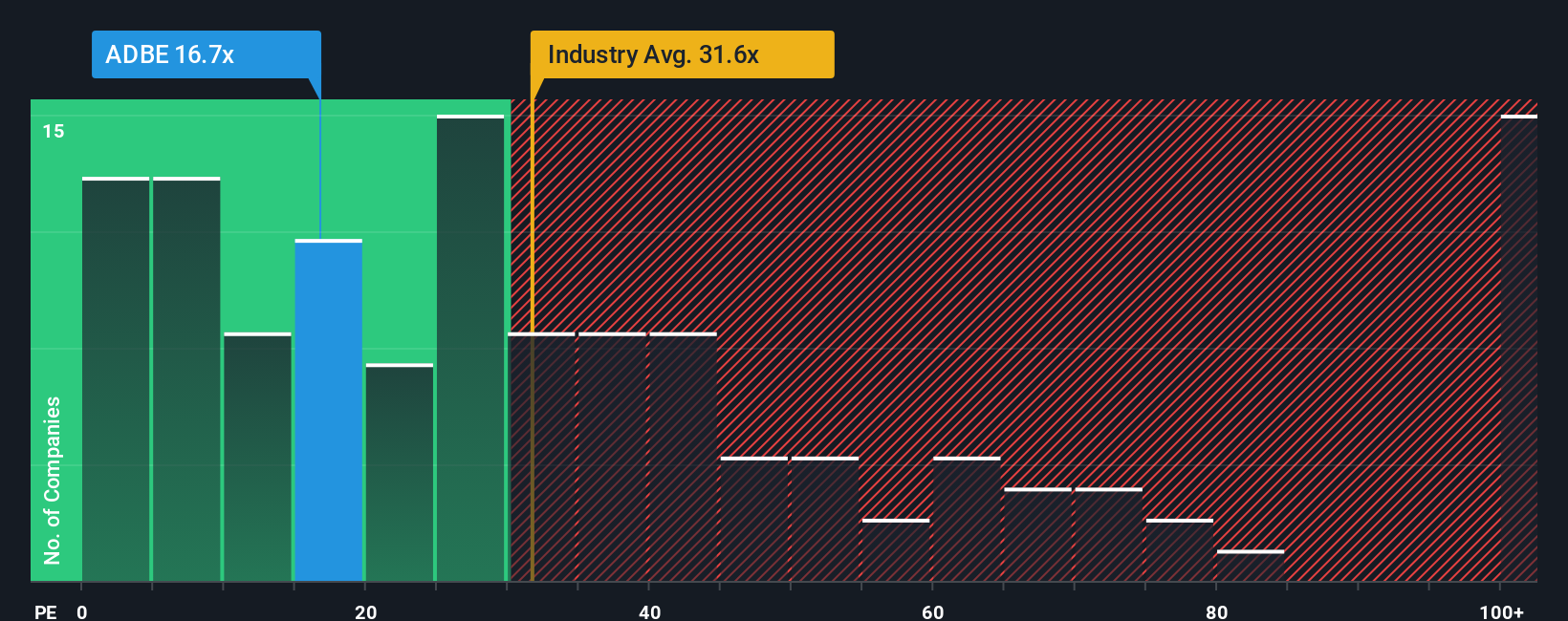

Approach 2: Adobe Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored metric for valuing profitable companies like Adobe, since it directly relates a company’s market price to its earnings power. When businesses generate consistent profits, the PE ratio acts as a snapshot of how much investors are willing to pay for each dollar of earnings. This reflects both current financial strength and future expectations.

Growth prospects and risk play a major role in what counts as a "normal" or "fair" PE ratio. Higher expected growth justifies a higher ratio, since investors are willing to pay more today for future earnings. By contrast, riskier companies typically trade at lower multiples.

Adobe currently trades at a PE of 20.7x, which is well below both the Software industry average of 35.3x and the peer average of 61.3x. This appears conservative when you consider Adobe's market position and steady profitability. However, these simple benchmarks do not account for the unique attributes of individual companies.

To address this, Simply Wall St introduces a “Fair Ratio.” This is the preferred multiple one might expect for a company of Adobe’s earnings growth, profit margin, risk profile, market cap, and industry. For Adobe, the Fair Ratio is calculated at 38.0x, significantly higher than its current multiple. The Fair Ratio is more meaningful than blunt peer or industry comparisons because it tailors the valuation to Adobe’s specific strengths and risk factors rather than relying on broad averages.

With the stock trading at 20.7x compared to a Fair Ratio of 38.0x, Adobe appears attractively undervalued based on its earnings power and company-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Adobe Narrative

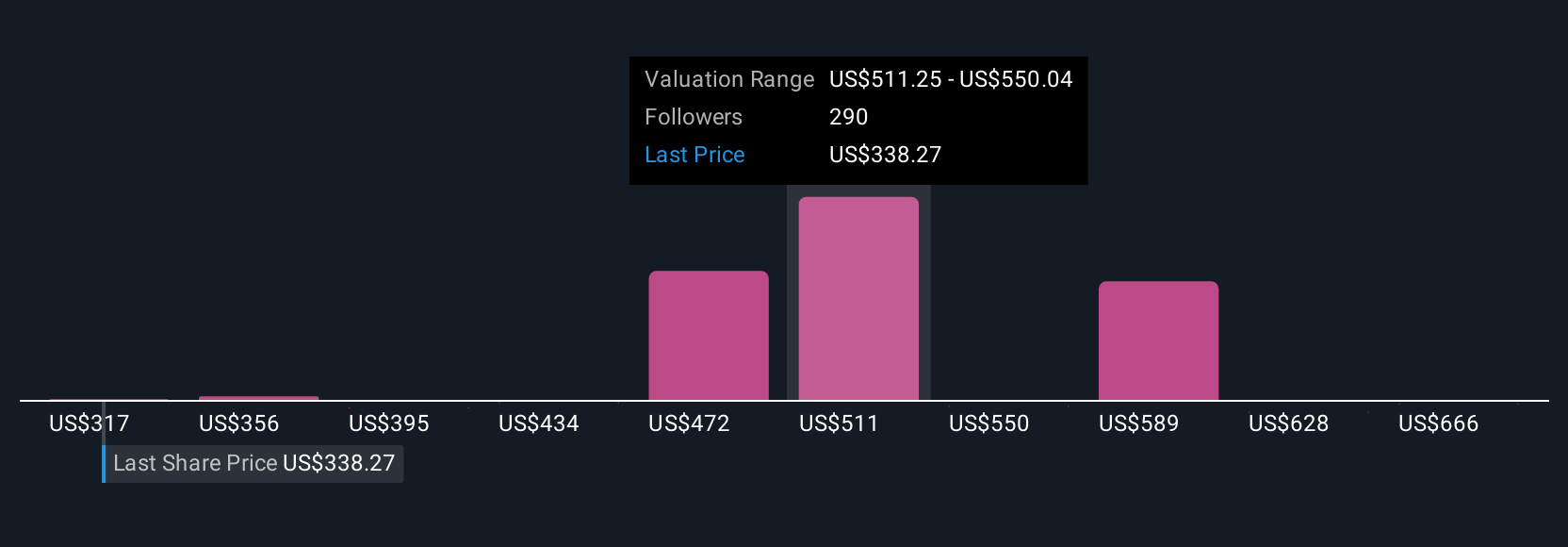

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative connects the company’s story, your personal perspective on Adobe’s future, with a tailored forecast of revenue, earnings, and margins that produces your own Fair Value estimate.

Rather than just relying on ratios or analyst targets, Narratives let you walk through the business logic behind the numbers: you define what you believe will drive Adobe’s performance, then immediately see how your assumptions translate into a fair price.

This approach is easy and accessible for everyone. Simply Wall St’s millions of users can create, compare, and discuss Narratives within the Community page by inputting their view on growth, profitability, and future risks or opportunities.

Narratives also keep you up to date automatically, dynamically updating your Fair Value when new news, data, or earnings arrive, helping you make smarter decisions as conditions change.

For example, some investors currently see Adobe’s fair value as high as $605 based on strong AI momentum and margin expansion, while more cautious views put it as low as $380, reflecting worries about new competition and slowing growth. With Narratives, you can build and track your own view side by side with the latest market thinking.

Do you think there's more to the story for Adobe? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives