- United States

- /

- Software

- /

- NasdaqGS:ADBE

Exploring Three High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

Global markets have been buoyed by the Federal Reserve's recent decision to cut rates, with U.S. stocks reaching new highs and smaller-cap indexes like the Russell 2000 showing notable outperformance despite remaining below previous peaks. This positive market sentiment creates an opportune environment for investors to consider high-growth tech stocks, which often exhibit strong potential in such bullish conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Adobe (NasdaqGS:ADBE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adobe Inc., along with its subsidiaries, operates as a diversified software company worldwide and has a market cap of $231.59 billion.

Operations: Adobe Inc. generates revenue primarily through its Digital Media and Digital Experience segments, with the former contributing significantly via subscriptions to Creative Cloud and Document Cloud services. The company also benefits from a high gross profit margin, which was 87.74% in the latest fiscal year.

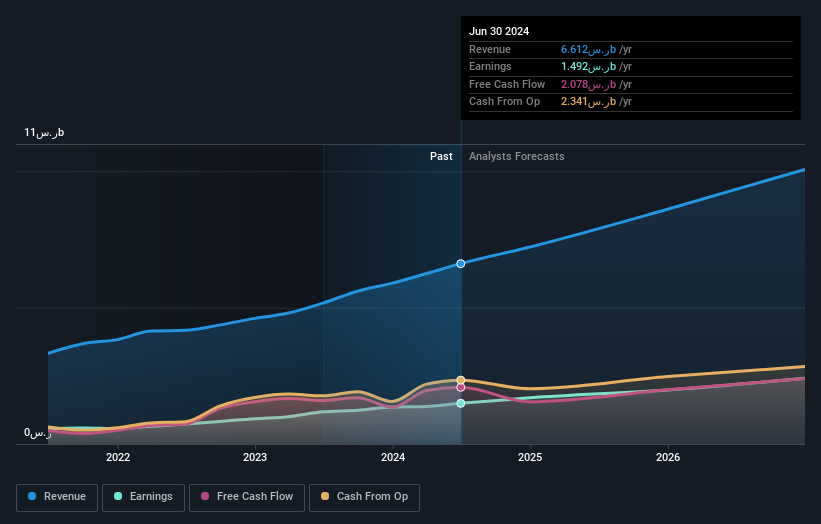

Adobe's recent advancements in AI-driven content generation within Adobe Experience Cloud underscore its strategic pivot towards enhancing digital marketing efficacy. The company's R&D commitment, reflected in a substantial increase to 16.6% of revenue, underscores its focus on innovation, particularly in real-time content optimization and analytics—a move that aligns with the growing demand for personalized marketing solutions. Financially, Adobe demonstrated robust growth with a third-quarter revenue surge to $5.41 billion from $4.89 billion year-over-year and net income rising to $1.68 billion from $1.40 billion, reflecting a solid execution of its business model amidst dynamic market conditions. Additionally, the company's proactive approach in share repurchases, buying back shares worth approximately $2.78 billion recently, signals confidence in its future trajectory and commitment to shareholder value.

- Click here to discover the nuances of Adobe with our detailed analytical health report.

Examine Adobe's past performance report to understand how it has performed in the past.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elm Company offers ready-made and customized digital solutions in Saudi Arabia, with a market cap of SAR82.05 billion.

Operations: Elm generates revenue through three primary segments: Digital Business (SAR4.69 billion), Professional Services (SAR152.67 million), and Business Process Outsourcing (SAR1.77 billion). The company's focus is on providing a range of digital solutions tailored to client needs in Saudi Arabia.

Elm's recent performance and strategic agreements highlight its growth trajectory in the tech sector. With a reported 26.4% earnings growth surpassing the IT industry's 15.5%, Elm demonstrates robust financial health, particularly with second-quarter sales rising to SAR 1.77 billion from SAR 1.40 billion year-over-year. The company's R&D investment remains a cornerstone of its strategy, crucial for sustaining innovation and competitiveness in a rapidly evolving market. Additionally, the recent leadership change with Mr. Mohammad Abdulaziz Alomair stepping in as CEO could signal continued emphasis on digital transformation and product development, aligning with Elm's long-term contracts like the one signed with SDAIA, which already contributes to 42% of annual revenues.

- Unlock comprehensive insights into our analysis of Elm stock in this health report.

Gain insights into Elm's past trends and performance with our Past report.

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Talkweb Information System Co., Ltd. offers education services and mobile games in China, with a market capitalization of CN¥17.42 billion.

Operations: Talkweb Information System Co., Ltd. generates revenue primarily from Information Technology Services and Software (CN¥1.62 billion) and Computer, Communications, and Other Electronic Equipment Manufacturing (CN¥2.19 billion).

Talkweb Information System Co., Ltd. has shown a notable uptick in revenue, reporting a significant increase to CNY 1.73 billion in the first half of 2024 from CNY 1.07 billion in the prior year, reflecting a growth rate of 17.2%. Despite this revenue surge, net income dramatically dropped to CNY 3.34 million from CNY 57.81 million, hinting at potential challenges in cost management or investment strategies that need addressing to harness full growth potential. The company's commitment to innovation is evident from its R&D spending trends which are crucial for sustaining competitiveness; however, specific financials on R&D expenditures were not disclosed for this period.

Taking Advantage

- Reveal the 1295 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Flawless balance sheet and undervalued.