- United States

- /

- Software

- /

- NasdaqGS:ADBE

Did Webflow’s AI-Powered Integrations Just Redefine Adobe’s (ADBE) Marketing Ecosystem Ambitions?

- Webflow recently announced a new integration with Adobe Marketo Engage and showcased its expanded collaboration with Adobe Express at Adobe Summit 2025, bringing advanced AI-driven image creation and marketing personalization tools directly into the Webflow platform for marketing teams.

- This integration is designed to help marketers leverage audience data and generative AI-powered content creation to enhance website personalization and improve campaign optimization within a unified ecosystem.

- We'll explore how this expanded integration with Webflow highlights Adobe's efforts to strengthen its ecosystem and AI-driven product offerings.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Adobe Investment Narrative Recap

At its core, owning Adobe stock is about believing in the company’s ability to stay ahead in creative and marketing software through innovation, especially by expanding its AI ecosystem. The latest Webflow integration showcases Adobe’s push to boost its relevance for marketers, but is unlikely to meaningfully sway the most immediate catalysts, such as third-quarter earnings, or fully resolve competitive risks from low-cost AI rivals.

Of Adobe’s recent announcements, the launch of Acrobat Studio stands out for its direct connection to the integration trend seen with Webflow. This move weaves AI deeper into document management via Express and Acrobat, helping Adobe maintain its cross-cloud synergy, a key factor for attracting and retaining enterprise customers at scale.

Yet, investors should be aware that, despite these integrations, the intensifying competition in AI-powered creative tools remains a pressing risk to Adobe’s market share and long-term pricing power...

Read the full narrative on Adobe (it's free!)

Adobe's outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This implies a 9.0% annual revenue growth rate and an earnings increase of $1.8 billion from current earnings of $6.9 billion.

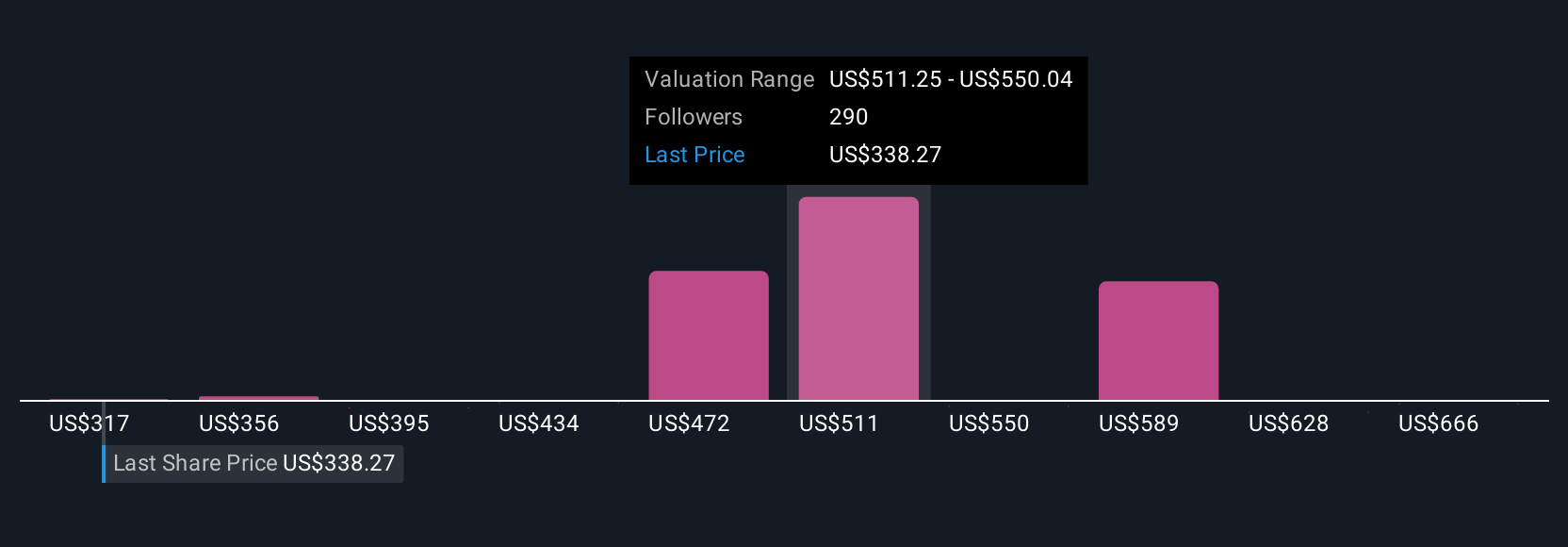

Uncover how Adobe's forecasts yield a $472.15 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Interestingly, some of the most optimistic analysts projected Adobe’s annual revenue could reach US$31.2 billion with earnings of US$11.4 billion by 2028. These bullish views bank on Adobe’s ability to double its AI business, yet they may shift if competitive pressures persist. There’s never just one perspective, so it’s worth considering how both risks and opportunities could evolve from here.

Explore 84 other fair value estimates on Adobe - why the stock might be worth over 2x more than the current price!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion