- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe Inc. (NASDAQ:ADBE) P/E Remains Elevated Regardless of Weaker Growth Projections

Adobe Inc.(NASDAQ:ADBE) has been a consistent performer, missing a single revenue projection in the last several years.

Unsurprisingly, stock price followed that performance, becoming a six-bagger over just 4 years.

At a 53.4x P/E ratio, one could argue that the stock looks a bit pricey and requires digging below the surface to evaluate the underlying trends.

A few days ago, Adobe announced a strategic partnership with Walmart. With Adobe Commerce, Walmart’s marketplace plans to integrate online and in-store fulfillment, aiming to enhance its 2-day nationwide shipping with Adobe’s cloud services.

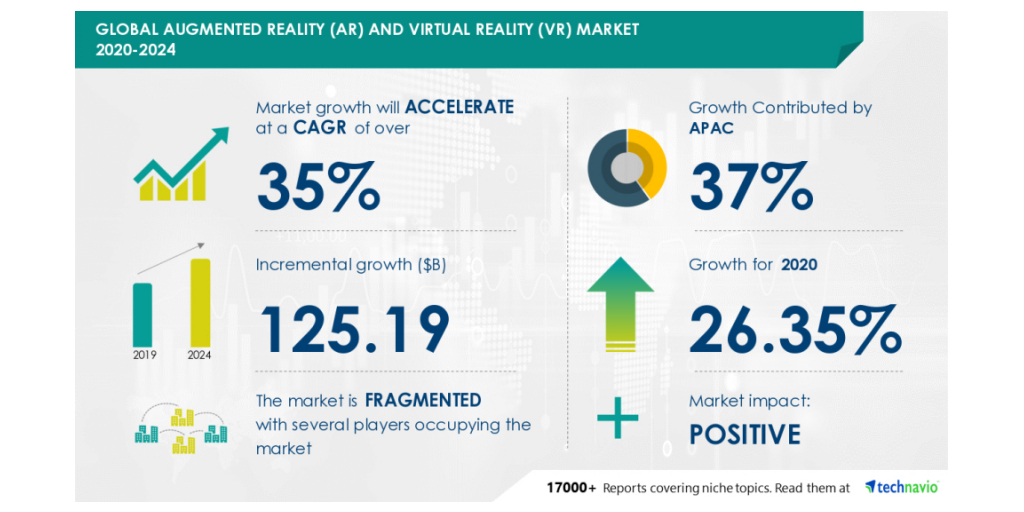

While the June results were just another in line with continuous positive earnings, annualized recurring revenues rose for US$518m to US$11.21b. While this is a lot, there is still room for growth as the company is taking a solid position in the fast-growing AR/VR industry. From that perspective, Adobe is a strong thematic investing candidate.

Interestingly, an established SaaS player is a good hedge against potential inflation. With an established user base and billions in recurring revenues, Adobe has been successful in slowly rising subscription prices without damaging the market share.

View our latest analysis for Adobe

Want the complete picture of analyst estimates for the company? Then our free report on Adobe will help you uncover what's on the horizon.

Does Growth Match The High P/E?

The only time you'd be genuinely comfortable seeing a P/E as steep as Adobe is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 52% last year. EPS has also lifted 165% in aggregate from three years ago, thanks to the previous 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the company analysts suggest earnings should grow by 6.6% each year over the next three years. The company is positioned for a weaker earnings result, with the market predicted to deliver 13% growth per annum.

In light of this, it's alarming that Adobe's P/E sits above most other companies. Many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within specific industries, but it can be a powerful business sentiment indicator.

Our examination of Adobe's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now, we are increasingly uncomfortable with the high P/E as the expected future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present specter of investment risk. We've identified 1 warning sign with Adobe, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)