- United States

- /

- Software

- /

- NasdaqCM:ABTC

American Bitcoin (ABTC) Is Down 42.4% After Lock-Up Expiration Volatility Hit Trump-Linked Miner – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early December 2025, American Bitcoin Corp., a Trump-linked Bitcoin miner, faced intense volatility after a lock-up expiration allowed early pre-merger investors to sell previously restricted shares, triggering heavy trading, multiple halts, and profit-taking amid a weak backdrop for crypto-related equities.

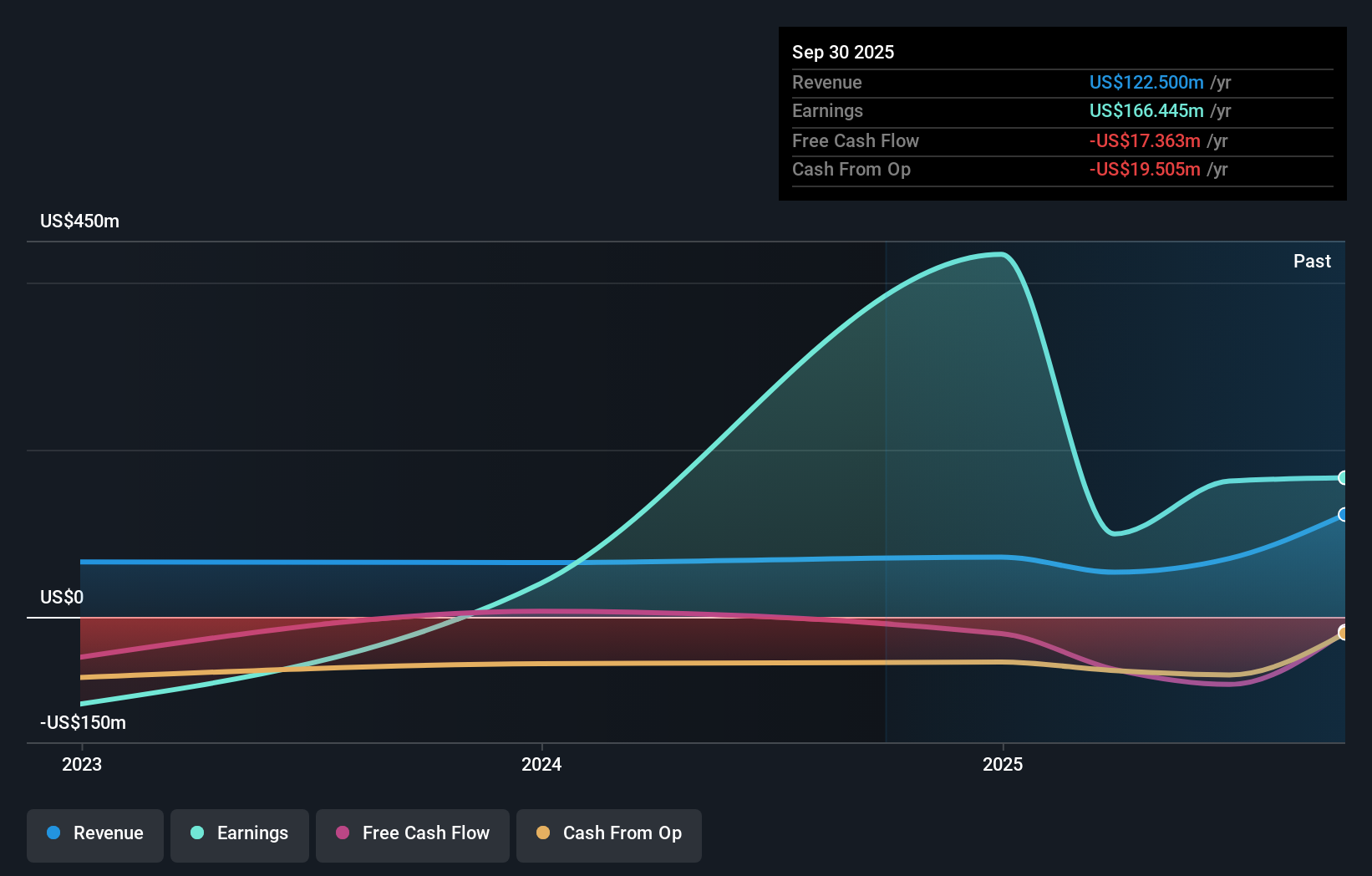

- Despite the turbulence and heightened scrutiny over its China-made mining rigs, company leaders emphasized their long-term commitment, continued Bitcoin accumulation, and a recent swing from a large prior-year loss to a net profit with substantially higher revenues.

- With the recent share price rebound over one day but decline over seven days, we’ll examine how the lock-up expiration and early investor selling shape American Bitcoin’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is American Bitcoin's Investment Narrative?

To own American Bitcoin after this kind of swing, you have to believe in two things at once: that its Bitcoin mining and accumulation model can turn recent revenue growth and Q3 profitability into something durable, and that you can live with extreme stock price volatility along the way. The early-December lock-up expiry put that volatility front and center, as pre-merger investors finally took profits and exposed how fragile sentiment around Trump-linked, crypto-exposed names can be. In the near term, the key catalysts still look tied to Bitcoin prices, mining efficiency and access to capital, but the episode adds a new layer: future equity unlocks and large overhangs may become events in their own right. It also sharpens existing risks around governance, dilution, and ongoing scrutiny of its China-made rigs.

But the bigger concern is what future share unlocks might mean for existing holders. Despite retreating, American Bitcoin's shares might still be trading 20% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on American Bitcoin - why the stock might be worth just $3.02!

Build Your Own American Bitcoin Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Bitcoin research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Bitcoin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Bitcoin's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABTC

American Bitcoin

A Bitcoin accumulation platform company, focuses on building Bitcoin infrastructure platform.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026