- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Wolfspeed (WOLF): Is the Current Valuation a Bargain for Investors?

Reviewed by Simply Wall St

Wolfspeed (WOLF) shares have been trending sideways over the past week, despite recent fluctuations in the broader chip sector. Investors seem to be watching for clearer signals on the company’s direction as quarterly results approach.

See our latest analysis for Wolfspeed.

Wolfspeed has shaken off some of the chip sector’s volatility this year, climbing 36.1% in year-to-date share price returns. Last week’s slide highlighted the ongoing tug-of-war between renewed optimism about growth potential and investor caution over near-term headlines.

If Wolfspeed’s swings have you thinking more broadly, it could be the perfect moment to explore other standout tech and AI stocks. See the full list for free with See the full list for free..

With Wolfspeed’s strong year-to-date gains, the big question for investors is whether recent momentum signals further upside or if all the good news is already reflected in the current price. This could leave little room for a bargain opportunity.

Price-to-Sales of 1x: Is it justified?

Wolfspeed’s shares are trading at a price-to-sales (P/S) ratio of 1x, well below both its direct peers and the broader US Semiconductor industry. With a last close price of $30.08, the discount is hard to ignore.

The price-to-sales ratio compares a company’s stock price to its revenues. It is commonly used for fast-growing tech and semiconductor companies that are not currently profitable. For Wolfspeed, this low ratio implies the market is highly skeptical about the company’s ability to turn its sales into future profits, despite ongoing revenue growth.

Compared to the peer average of 2.7x and the US Semiconductor industry’s 5.6x, Wolfspeed appears deeply undervalued on this measure. If sentiment or results turn, there is significant room for the company’s valuation to move towards industry levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1x (UNDERVALUED)

However, slowing net income growth and persistent market skepticism could quickly overshadow Wolfspeed’s revenue gains if sentiment sours or if operational challenges emerge.

Find out about the key risks to this Wolfspeed narrative.

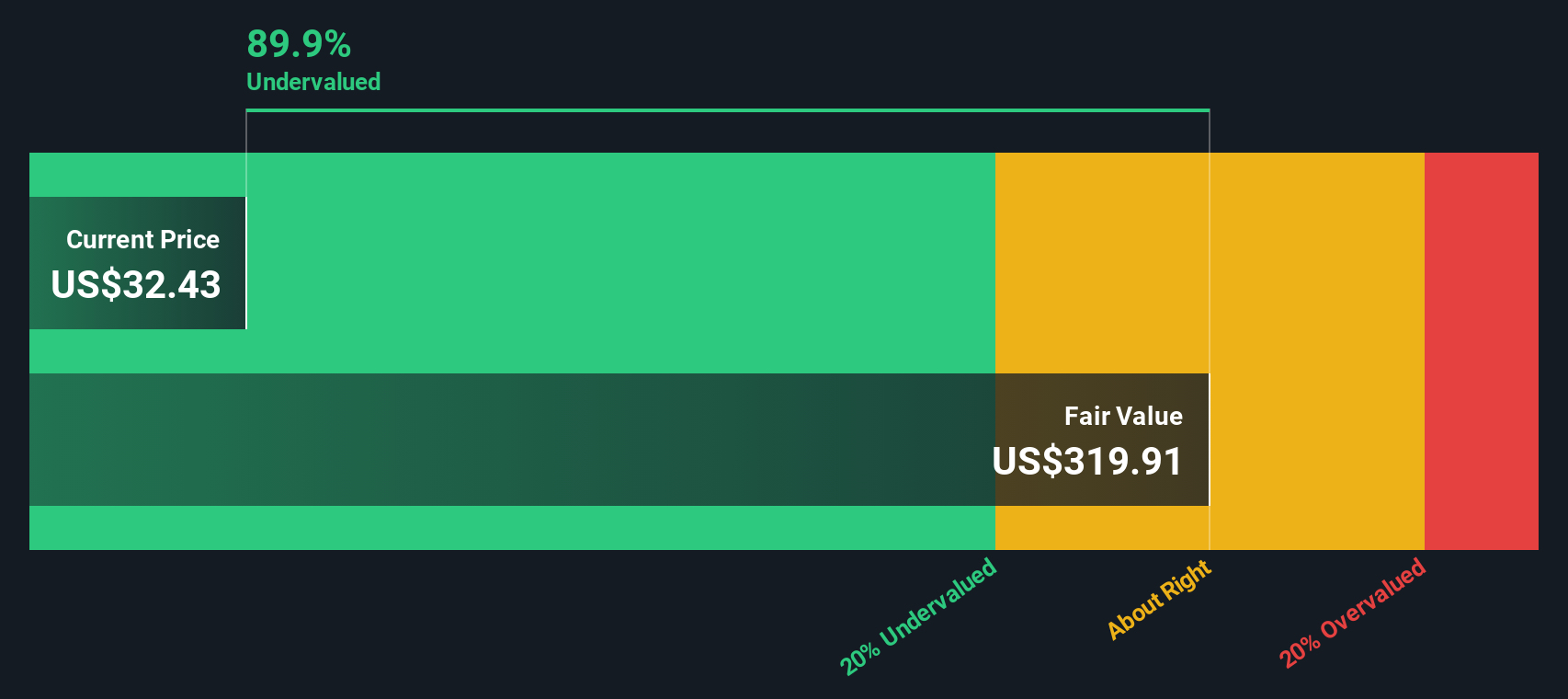

Another View: SWS DCF Model Puts Undervaluation in Perspective

Taking a different angle, our DCF model values Wolfspeed at $319.91, which is far above its current share price of $30.08. This method suggests an even greater undervaluation compared to the price-to-sales ratio alone. Does the market see real risk ahead, or is opportunity knocking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wolfspeed for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wolfspeed Narrative

If you see things differently or want to dig into the data on your own, you can build your own narrative from scratch in just a few minutes with Do it your way.

A great starting point for your Wolfspeed research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for yesterday’s winners when new opportunities are just a click away? Challenge your investing approach by searching for stocks that match your goals and strategy using the powerful Simply Wall Street screener tools below. These ideas could be the spark your portfolio needs.

- Strengthen your income potential and uncover companies with reliable yields by checking out these 17 dividend stocks with yields > 3% offering returns above 3%.

- Capture the next big shift in artificial intelligence trends when you scan these 24 AI penny stocks for fast-rising contenders shaping tomorrow’s markets.

- Capitalize on real value by searching these 877 undervalued stocks based on cash flows for stocks trading below their intrinsic worth, before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOLF

Wolfspeed

A semiconductor company, focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia Pacific, the United States, and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives