- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Wolfspeed (NYSE:WOLF) Reports Q3 Sales Decline To US$185M

Reviewed by Simply Wall St

Wolfspeed (NYSE:WOLF) recently appointed David Emerson as Chief Operating Officer, focusing on enhancing operational efficiency in their silicon carbide manufacturing. The company also welcomed two new board members, Mark Jensen and Paul V. Walsh, Jr., known for their expertise in financial governance and the semiconductor industry. These leadership changes occur amid challenging financial results, with Q3 sales declining to $185.4 million and an increased net loss of $285.5 million. These factors, against a backdrop of a market gaining 2%, could have amplified Wolfspeed's 17% share price decline over the past week.

The recent leadership changes at Wolfspeed may influence its ongoing efforts to improve operational efficiency and financial performance. With David Emerson stepping in as Chief Operating Officer, the focus is expected to sharpen on enhancing silicon carbide manufacturing operations. Combined with the new board members' expertise, these changes could support Wolfspeed's plan to close inefficient facilities and leverage U.S. government support, potentially driving improvements in operating margins and liquidity. However, given the company's recent financial challenges, the impact of these changes on revenues and earnings remains uncertain.

Over the past year, Wolfspeed's total shareholder return was very large as it dropped 95.49%. This severe decline far exceeded the company's short-term market loss of 17% following the latest financial reports. Over the same year, Wolfspeed underperformed the broader U.S. market, which recorded an 11.9% gain, and the U.S. Semiconductor industry, which saw an 11.6% increase. This stark comparison highlights the company’s struggles despite having the potential for revenue growth in sectors like EVs and renewable energy.

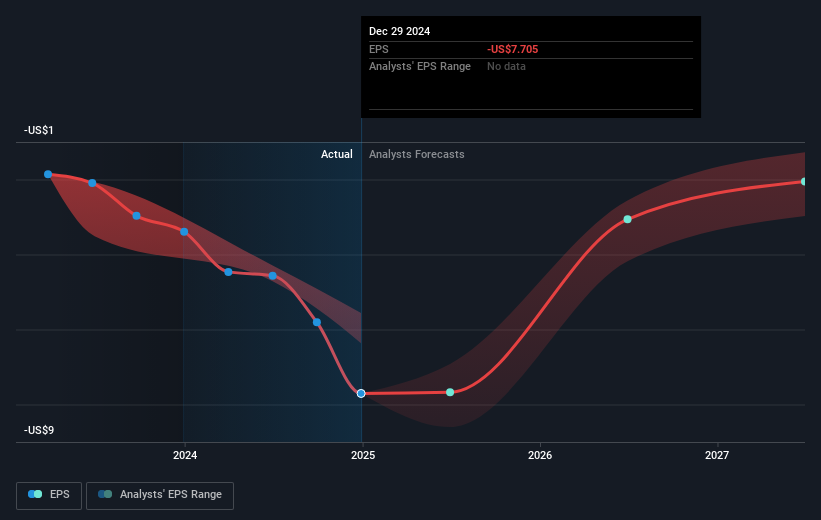

Looking ahead, the share price currently stands at US$3.47, significantly undervalued compared to the consensus analyst price target of US$5.7—a 39.1% potential increase. Nonetheless, achieving this target could be challenging given the company's forecasted continued unprofitability over the next three years. The ability to leverage advancements in 200-millimeter technology and secure CHIPS Act funding will be crucial for improving revenue and earnings forecasts.

Gain insights into Wolfspeed's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WOLF

Wolfspeed

Operates as a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives