- United States

- /

- Semiconductors

- /

- NYSE:WOLF

Potential Upside For Wolfspeed, Inc. (NYSE:WOLF) Not Without Risk

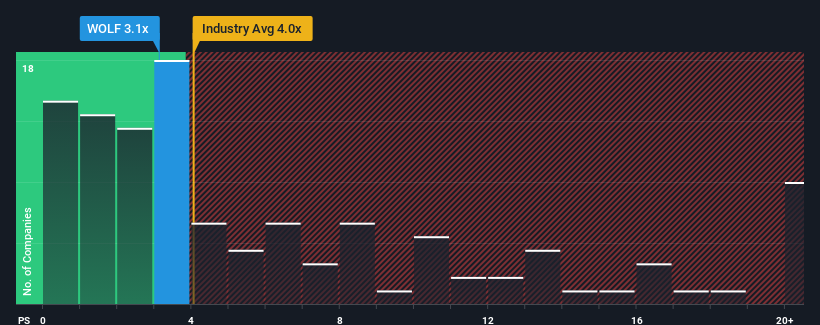

With a price-to-sales (or "P/S") ratio of 3.1x Wolfspeed, Inc. (NYSE:WOLF) may be sending bullish signals at the moment, given that almost half of all the Semiconductor companies in the United States have P/S ratios greater than 4x and even P/S higher than 11x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Wolfspeed

How Has Wolfspeed Performed Recently?

Recent times haven't been great for Wolfspeed as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wolfspeed will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wolfspeed's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Pleasingly, revenue has also lifted 99% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 31% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 29% each year growth forecast for the broader industry.

In light of this, it's peculiar that Wolfspeed's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Wolfspeed's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Wolfspeed currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Wolfspeed is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wolfspeed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WOLF

Wolfspeed

Operates as a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives