- United States

- /

- Semiconductors

- /

- NYSE:TSM

Assessing TSMC's (NYSE:TSM) Valuation as Momentum Continues in 2024

Reviewed by Kshitija Bhandaru

Taiwan Semiconductor Manufacturing (NYSE:TSM) continues to draw investor attention as it remains a critical supplier within the global semiconductor industry. The company’s performance over the past month has kept momentum steady, even as sector dynamics continue to evolve.

See our latest analysis for Taiwan Semiconductor Manufacturing.

Momentum has been building for Taiwan Semiconductor Manufacturing, with the stock’s 12.3% share price return over the past month accelerating an already impressive climb this year. Notably, its 46.4% year-to-date share price gain and remarkable 48.6% total return over the past twelve months have far outpaced most industry peers, signaling a growing confidence around its growth prospects.

If you’re interested in seeing what other leading tech and semiconductor names are achieving, consider checking out See the full list for free..

These strong returns prompt a key question for investors. Namely, does Taiwan Semiconductor Manufacturing’s current share price reflect its future potential, or is there still real upside for those considering a new position?

Price-to-Earnings of 23.9x: Is it justified?

With a current Price-to-Earnings (P/E) ratio of 23.9x, Taiwan Semiconductor Manufacturing trades at a notable discount to its industry peers and the broader sector landscape. Its latest closing price of $295.08 suggests the stock is valued below both the industry average and what some would call its “fair ratio.”

P/E ratios compare a company’s share price to its per-share earnings, serving as a common gauge for value across the tech and semiconductor space. For TSM, this relatively low multiple signals that despite its leadership in innovation and rapid earnings growth, the market is not pricing in the same degree of optimism as for many competitors.

The contrast becomes clear when compared to the US Semiconductor industry average of 35.9x and the peer set’s hefty average of 67x. Even more striking, TSM’s ratio sits well below an estimated Fair Price-to-Earnings Ratio of 43.5x, which may indicate substantial upside if sentiment pushes valuations to more typical sector levels.

Explore the SWS fair ratio for Taiwan Semiconductor Manufacturing

Result: Price-to-Earnings of 23.9x (UNDERVALUED)

However, risks such as shifting global demand or supply chain disruptions could challenge Taiwan Semiconductor Manufacturing’s momentum and could impact near-term performance.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: What Does the DCF Model Say?

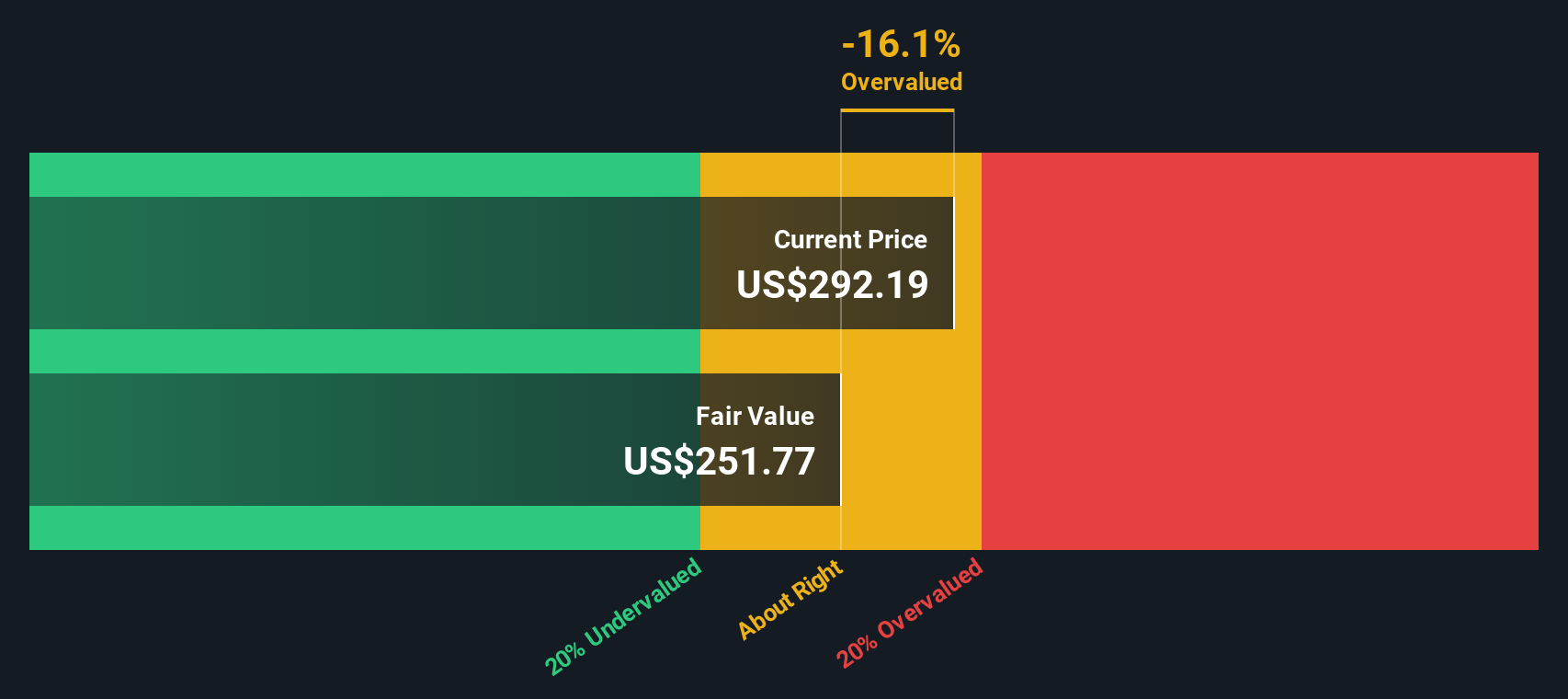

While the current price-to-earnings ratio paints Taiwan Semiconductor Manufacturing as undervalued, our SWS DCF model offers a different angle. According to the DCF, the stock trades slightly above our estimate of fair value, suggesting less upside than the multiples approach might imply. Which perspective holds more weight for investors: the story told by earnings or the big picture drawn by cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiwan Semiconductor Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you want to dig into the numbers yourself and shape your own market story, you can easily put together your perspective in just a few minutes: Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Track where momentum, value, and innovation are heading next with these curated stock ideas from Simply Wall Street:

- Spot companies shaking up the artificial intelligence space and seize potential with these 24 AI penny stocks before everyone else catches on.

- Find hidden gems trading below their intrinsic value by reviewing these 877 undervalued stocks based on cash flows that could deliver your next big win.

- Generate steady income streams and tap into global trends with these 18 dividend stocks with yields > 3% offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives