- United States

- /

- Semiconductors

- /

- NYSE:JKS

JinkoSolar (JKS) Is Down 15.7% After Reporting Weaker Q3 Results and Significant Impairment Charges

Reviewed by Sasha Jovanovic

- JinkoSolar Holding Co., Ltd. recently reported third quarter 2025 earnings showing a decline in sales to CNY 16,158.5 million and a net loss of CNY 749.79 million, alongside substantial impairment charges totaling over CNY 555 million.

- This shift from profit to loss, coupled with rising asset impairments, highlights the growing financial pressures the company faces in a changing solar market landscape.

- Next, we'll examine how these weaker results and increased impairments may alter the investment narrative for JinkoSolar Holding.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

JinkoSolar Holding Investment Narrative Recap

To be a shareholder in JinkoSolar Holding right now, you need to believe in the long-term global adoption of solar technology and the company’s ability to recover from recent setbacks. The latest drop in sales and sizable net loss underscores immediate financial headwinds, intensifying the focus on JinkoSolar’s gross margin pressure and the ongoing risk of market share loss, currently the most important short-term catalyst and the biggest risk to the business.

Among the recent announcements, JinkoSolar's fourth quarter shipment guidance stands out, projecting 18.0 GW to 33.0 GW. This shipment outlook remains crucial, as it offers insight into whether the company can stabilize operations in the face of declining sales and rising impairments, which will be closely watched as an indicator of near-term momentum.

In contrast, investors should be aware of the company’s exposure to negative gross margins and its reliance on stabilizing demand as...

Read the full narrative on JinkoSolar Holding (it's free!)

JinkoSolar Holding's outlook envisions CN¥124.9 billion in revenue and CN¥382.9 million in earnings by 2028. This projection relies on 14.6% annual revenue growth and a CN¥2.3 billion increase in earnings from the current CN¥-1.9 billion.

Uncover how JinkoSolar Holding's forecasts yield a $37.42 fair value, a 45% upside to its current price.

Exploring Other Perspectives

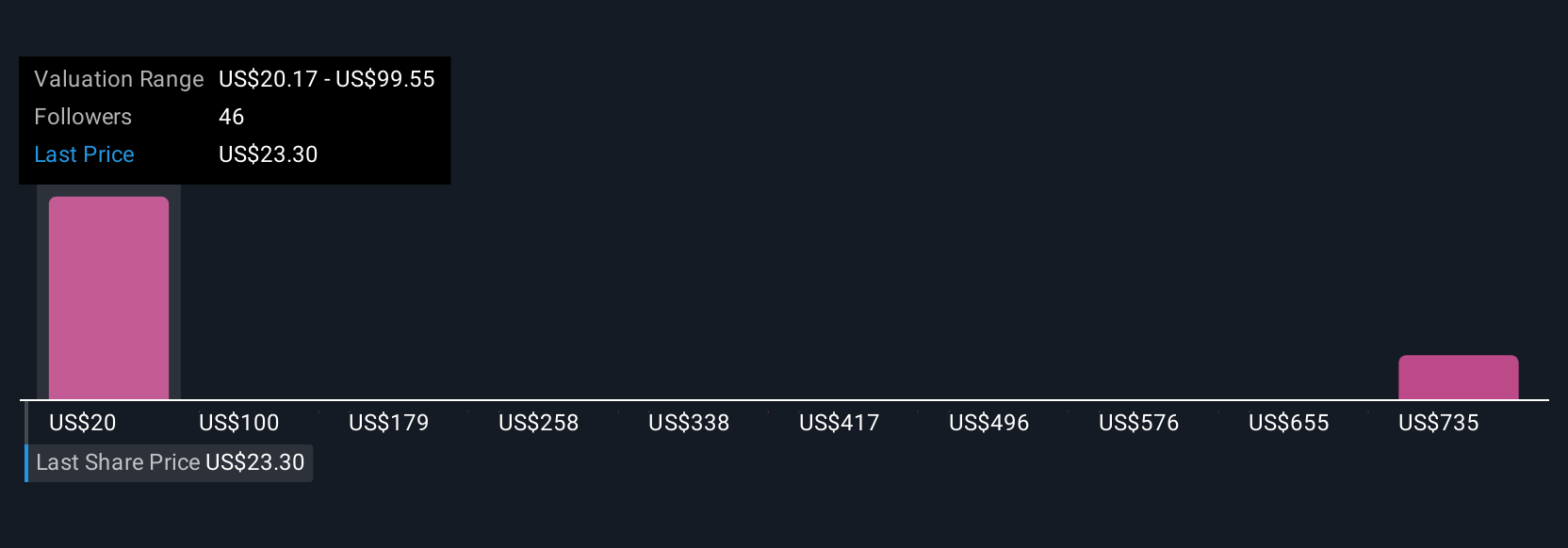

Four fair value estimates from the Simply Wall St Community currently span from US$20.17 to US$81.67 per share. The recent sharp loss and margin pressure highlight why opinions on future performance often diverge widely, explore several viewpoints to understand what may shape JinkoSolar's outcomes.

Explore 4 other fair value estimates on JinkoSolar Holding - why the stock might be worth over 3x more than the current price!

Build Your Own JinkoSolar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JinkoSolar Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JinkoSolar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JinkoSolar Holding's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026