- United States

- /

- Semiconductors

- /

- NasdaqGS:VECO

What Does the CEO’s Share Sale Reveal About Insider Sentiment at Veeco Instruments (VECO)?

Reviewed by Simply Wall St

- William Miller, CEO and Director of Veeco Instruments, recently sold approximately US$625,000 worth of shares, representing 4.4% of his holdings, at an average price of US$25.00, marking the largest insider sale by the company in the past year and executed below the current stock price.

- This sale, combined with the absence of insider purchases and a relatively low insider ownership level, has drawn increased investor attention and scrutiny regarding insider sentiment at Veeco Instruments.

- We'll examine how the CEO's significant insider sale may influence the outlook for Veeco Instruments within its broader investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Veeco Instruments Investment Narrative Recap

For someone considering Veeco Instruments as an investment, the central idea to believe in is the company's ability to capitalize on strong long-term demand for advanced semiconductor manufacturing equipment, particularly in fast-growing applications like AI, advanced packaging, and 3D memory. The recent insider sale by the CEO and the low level of insider ownership do not materially change the key short-term catalyst, which remains the pace of new orders for Veeco’s differentiated equipment. However, the sale does highlight ongoing questions about management’s confidence in the immediate outlook. The main risk now is the company's exposure to industry cycles and customer concentration, which could affect revenue if major buyers delay orders or shift technology preferences. The CEO’s transaction may increase short-term volatility but does not alter the core business opportunity or primary risk profile.

The most directly relevant recent announcement is Veeco’s second-quarter earnings report, which showed sales of US$166.1 million and net income of US$11.73 million, both lower than the prior year. The report also gave third-quarter guidance for revenue between US$150 million and US$170 million. While these results reflect some softness in orders compared to a year ago, they reinforce how Veeco’s near-term results are directly tied to spending cycles at large chipmakers, one of the catalysts analysts see as crucial for future performance. The CEO’s share sale came just after these figures were published, prompting questions about how leadership views the company’s positioning amid this cycle, but the most important catalyst remains progress in winning and fulfilling new equipment orders for advanced node manufacturing.

Yet, in contrast to the optimism around growth drivers, investors should be aware of the elevated risk tied to concentrated revenue from a small group of customers…

Read the full narrative on Veeco Instruments (it's free!)

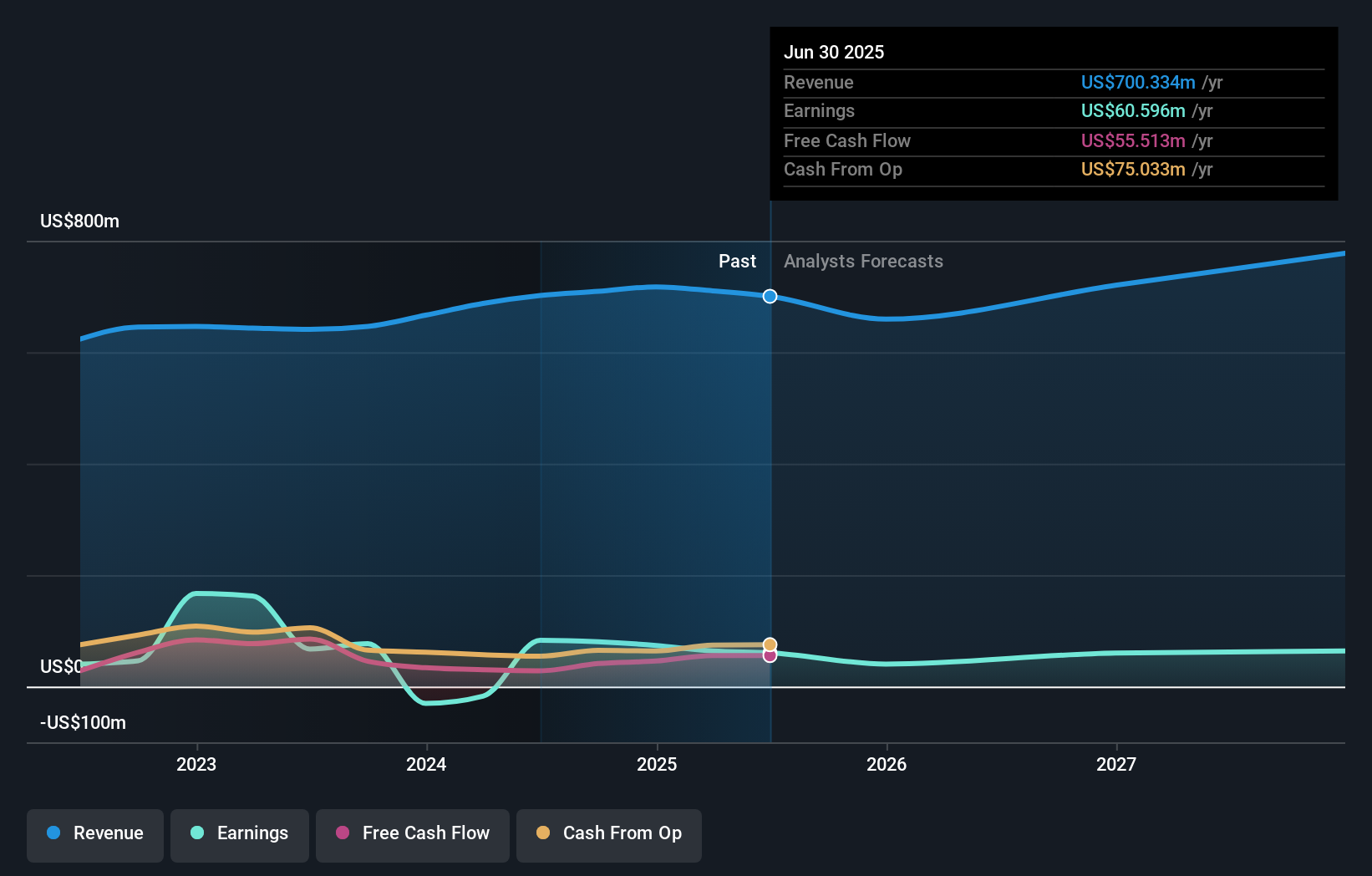

Veeco Instruments is projected to reach $782.0 million in revenue and $66.0 million in earnings by 2028. This outlook is based on a 3.7% annual revenue growth rate and a $5.4 million increase in earnings from the current $60.6 million.

Uncover how Veeco Instruments' forecasts yield a $27.00 fair value, in line with its current price.

Build Your Own Veeco Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veeco Instruments research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veeco Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veeco Instruments' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VECO

Veeco Instruments

Develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives