- United States

- /

- Semiconductors

- /

- NasdaqGS:VECO

Veeco Instruments (NASDAQ:VECO) shareholders are still up 69% over 3 years despite pulling back 5.2% in the past week

Veeco Instruments Inc. (NASDAQ:VECO) shareholders might be concerned after seeing the share price drop 27% in the last quarter. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. After all, the share price is up a market-beating 69% in that time.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Veeco Instruments

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

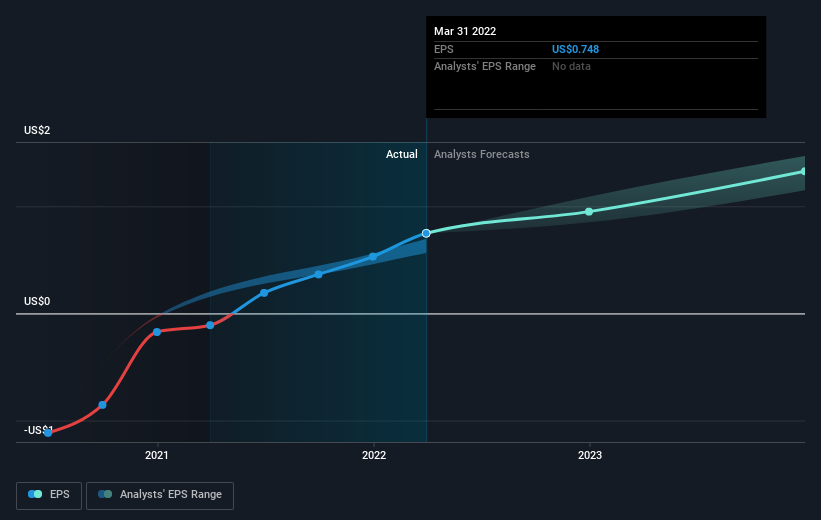

During three years of share price growth, Veeco Instruments moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Veeco Instruments' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

The total return of 12% received by Veeco Instruments shareholders over the last year isn't far from the market return of -14%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 6% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. It's always interesting to track share price performance over the longer term. But to understand Veeco Instruments better, we need to consider many other factors. Even so, be aware that Veeco Instruments is showing 2 warning signs in our investment analysis , you should know about...

Veeco Instruments is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VECO

Veeco Instruments

Develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026