- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Why Texas Instruments (NASDAQ:TXN) is a Well-Rounded Stock, with a Dedication to Cash Flows

Texas Instruments Incorporated (NASDAQ:TXN) has been a good investment in the past five years, as the stock gained 185% in that period. If we account for dividends, the performance is even better, with a 225.2% return. While there are market forces that have put the company's products in high demand, we will examine how good the business is at making profit and returning cash.

View our latest analysis for Texas Instruments

The company's management outlines a few key metrics that make Texas I.I. stand out:

- 12% free cash flow per share annual growth (2004-2020)

- 17 consecutive years of dividend increases, 26% CAGR (2004-2020)

- 46% share count reduction (2004-2020)

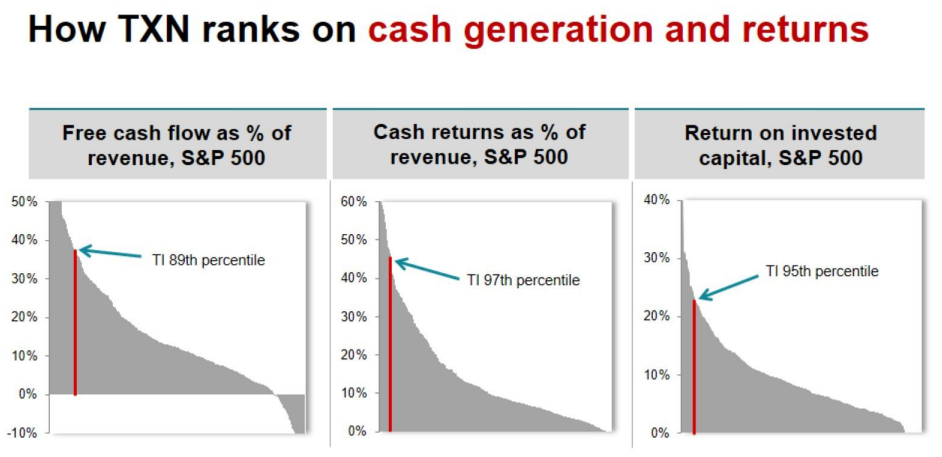

- 89th percentile in S&P 500 free cash flow margin (2020)

- 97th percentile in S&P 500 cash returns as percent of revenue (2020)

- 95th percentile in S&P 500 return on invested capital (2020)

In the charts below, we can also see how the returns stack in comparison to other companies:

It is also quite encouraging to know that at least the stated commitments of the company fully aligned with the interests of shareholders. Management stresses that their commitment is to the growth of free cash flow per share as the primary driver of long-term value. The traditional-fundamental approach to profits is something that many companies have recently forgone at the expense of shareholders, that is why it is invigorating to see a company dedicated to investors.

If you want to be up-to-date on Texas I.I., keep an eye for the next earnings call scheduled for the 206th of October.

Fundamentals: Profitability

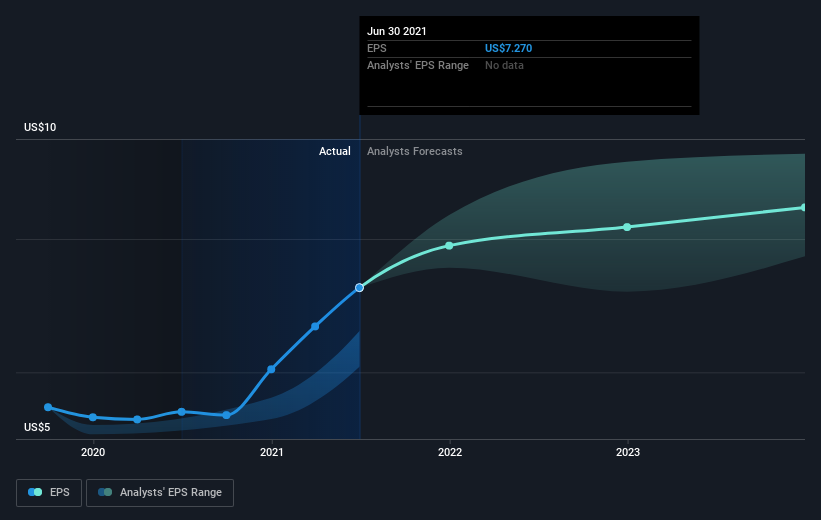

Over half a decade, Texas Instruments managed to grow its earnings per share at 19% a year. This EPS growth is slower than the share price growth of 23% per year, over the same period. This suggests that market participants hold the company in higher regard, possibly anticipating even more positive developments in the semiconductor industry.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This level of profitability amounts to a net income margin of 40%, which is also projected to increase in the following years. Companies like this are rare to find and are usually too expensive for investors.

Interestingly, while TXN is trading at a 27x P/E (price to earnings) ratio, the company does not appear to be overly expensive based on our model, and appears to be some 22% overvalued.

One can argue, that the returns, profits and general quality of the company may justify taking the risk of buying Texas I.I. at a higher price.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return, with the latter including dividends.

We note that for Texas Instruments, the TSR over the last 5 years was 225%, which is better than the share price return mentioned above. It also seems that the company has a long history of dividend payments and rate increases, which puts the current dividend yield at 2.4%. As we have seen, the company is expected to increase profitability in the future, which gives us a good foundation to assume that dividends will at-least retain their current levels.

Key Takeaways

Texas Instruments shareholders have received a total shareholder return of 33% over the last year. Of course, that includes the dividend. That's better than the annualized return of 27% over half a decade, implying that the company is doing better recently.

The company seems to be a well-rounded option for investors, with a good balance of returns, dividends, EPS and not trading too far from intrinsic value. Sometimes investors need more stability instead of explosive growth, and if you are one who is currently looking for a moneymaker, dedicated to providing free cash flows to investors, you might want to take a better look at Texas Instruments.

Also, don't forget about risks. We've spotted 2 warning signs for Texas Instruments you should know about.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives