- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

The Bull Case For Texas Instruments (TXN) Could Change Following TD Cowen Upgrade on Industrial Demand – Learn Why

Reviewed by Simply Wall St

- TD Cowen recently upgraded Texas Instruments to Buy, highlighting the company's strong position for a recovery in industrial chip demand.

- This change in analyst sentiment has drawn heightened investor attention, especially as the company had not announced major operational updates prior to the upgrade.

- We'll explore how renewed optimism in industrial demand recovery, as cited by TD Cowen, could reshape Texas Instruments' investment narrative.

Texas Instruments Investment Narrative Recap

To be a Texas Instruments shareholder, you have to believe in the company’s ability to ride out market cycles and deliver as industrial and automotive demand recovers. The recent TD Cowen upgrade may have boosted optimism, but with no operational surprises ahead of earnings, near-term catalysts and risks, such as volatile end-market demand and supply chain pressures, remain mostly unchanged for now.

Among recent developments, the board’s continued commitment to a growing dividend, now at US$1.36 per share, stands out. This steady dividend policy offers some confidence for income-focused investors even as the company awaits visibility on earnings momentum and end-market inventory trends.

But keep in mind, despite improving sentiment, the unpredictable impact of sudden shifts in customer inventory or global supply chain disruptions is something every investor should be aware of...

Read the full narrative on Texas Instruments (it's free!)

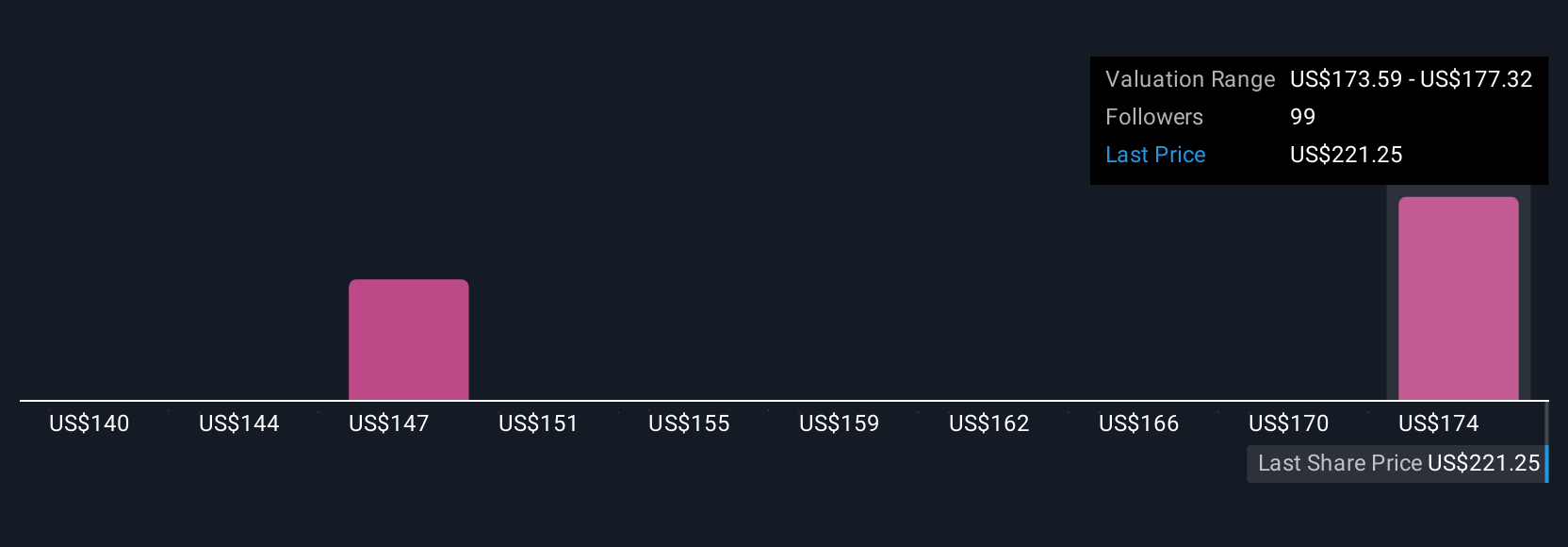

Texas Instruments is projected to reach $21.9 billion in revenue and $7.5 billion in earnings by 2028. This outlook is based on analysts’ expectations of 10.9% annual revenue growth and an increase in earnings of $2.7 billion from the current $4.8 billion.

Exploring Other Perspectives

Contrast that with the most pessimistic analysts, who expect revenue to climb just 3.5 percent per year and earnings to hit US$5.6 billion by 2028. These lowest estimates focus on how tariffs, supply chain challenges, and capital spending could limit any potential benefits from recent upgrades, serving as a reminder that opinions on Texas Instruments’ outlook can vary widely. Explore what these differences could mean for your view.

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives