- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (NasdaqGS:TXN) Partners With Derivita to Transform Math Classrooms

Reviewed by Simply Wall St

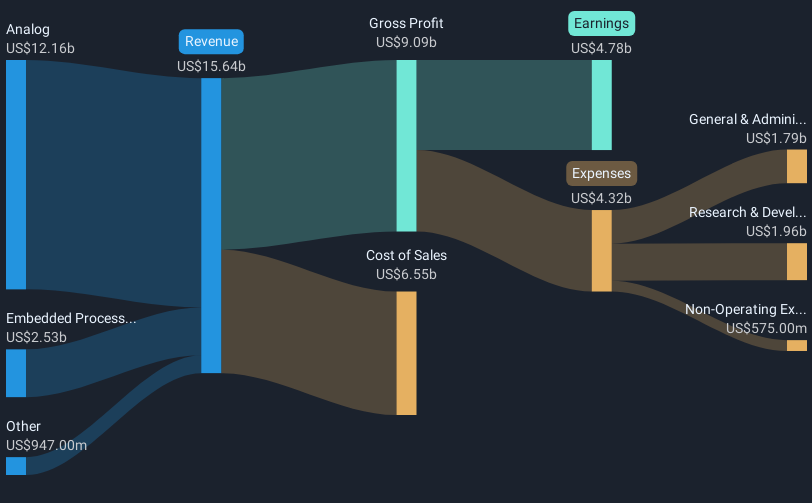

Texas Instruments (NasdaqGS:TXN) recently announced a strategic partnership with Derivita aimed at enhancing math education through the integration of its TI-Nspire CX II graphing calculator with Derivita's SpotCheck feature. This move, which focuses on fostering student engagement, aligns with the company’s broader commitment to educational technology. Concurrently, Texas Instruments' announcement of $1.2 billion in debt financing provides a strong foundation for future growth initiatives. Over the past month, the company’s shares have risen 14.33%, a move largely consistent with the broader market's yearly growth trajectory, suggesting these events complement existing market trends rather than oppose them.

Find companies with promising cash flow potential yet trading below their fair value.

The recent partnership between Texas Instruments and Derivita aims to enhance educational technology, which could bolster Texas Instruments’ commitment to innovation and potentially increase revenue streams by attracting educational institutions. Meanwhile, the company's $1.2 billion debt financing underscores its strategy for growth, providing fiscal flexibility. However, the geopolitical tensions and tariffs highlighted in the analysis could counterbalance these positive developments by pressuring supply chains and margins, especially in affected regions like China. Despite challenges, the integration of product features with educational initiatives might drive marginal revenue increases against these headwinds.

Over a longer five-year term, Texas Instruments' total returns, including dividends, amounted to 63.75%, reflecting a robust performance. However, the company underperformed the broader US market, which achieved a 12.6% return over the past year. Similarly, it lagged behind the US Semiconductor industry, which returned 11.7% in the same period.

Considering the company's earnings forecast and consensus analyst views, Texas Instruments' current share price stands at a discount to the consensus price target of $178.60, offering potential upside if market expectations align with bullish projections. However, uncertainties in semiconductor cycles and geopolitical factors may impact revenue and earnings forecasts. The automotive and industrial recovery signs are promising but may not be sufficient to offset broader challenges without an uplift in global demand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion