- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

How Anticipation for July Earnings Will Impact Texas Instruments (TXN) Investors

Reviewed by Simply Wall St

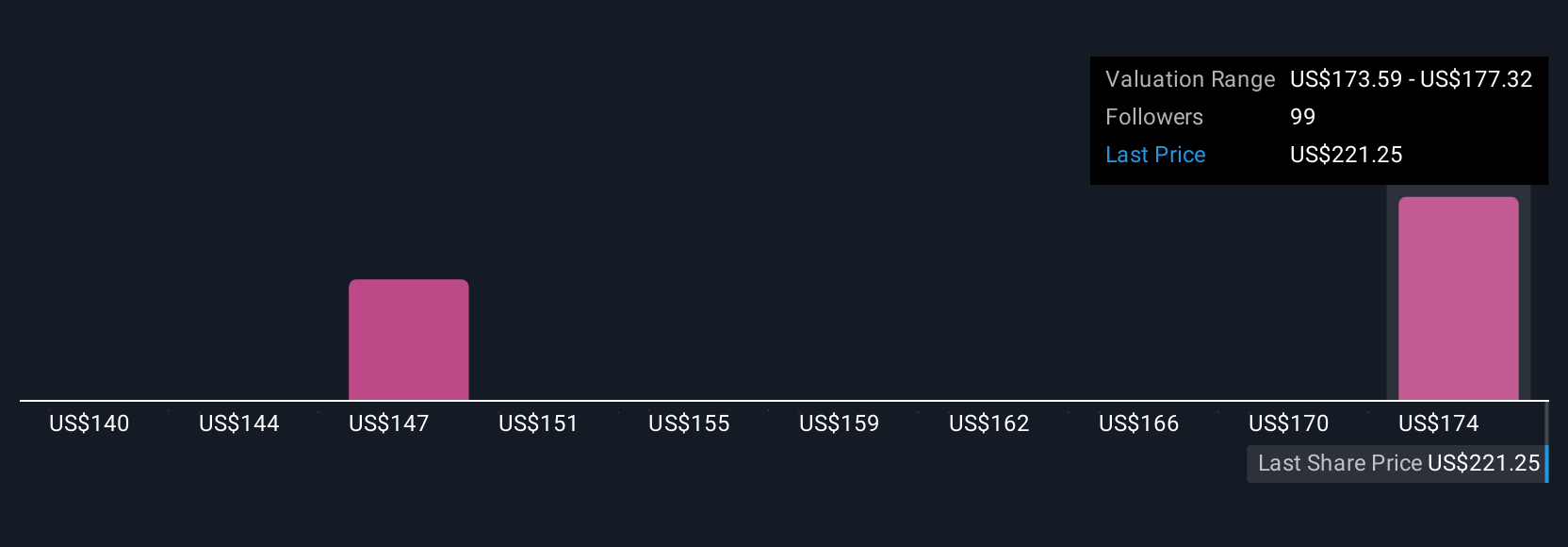

- Texas Instruments recently drew increased attention ahead of its July 22, 2025 earnings announcement, with market observers weighing its premium valuation against peers and a generally optimistic outlook for future earnings.

- Investors are closely watching how ongoing expectations for earnings growth balance with concerns around the stock's current pricing and sector positioning.

- We'll examine how growing anticipation for Texas Instruments’ upcoming earnings may influence its longer-term investment narrative and perceived valuation risks.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Texas Instruments Investment Narrative Recap

To be a Texas Instruments shareholder, you need to see promise in the company’s disciplined capital management, strong position in automotive and industrial chip markets, and its ability to generate cash across cycles. The recent surge in share price and anticipation around the upcoming July 22 earnings announcement haven’t meaningfully shifted the main near-term catalyst: evidence of sustained recovery in core end-markets. However, the valuation premium stays top-of-mind as the primary risk, with resilient revenue forecasts still facing pressure from sector competition and evolving global conditions.

Among recent company actions, the June 2025 announcement to invest over US$60 billion in seven US semiconductor fabs stands out. This bold expansion aligns with Texas Instruments’ push to bolster its US manufacturing base, potentially supporting a more dependable supply chain if geopolitical risks or tariff changes arise. As investors weigh upcoming earnings, these capacity investments may play a key role in discussions about long-term growth and resilience.

By contrast, investors should be aware of the company’s premium valuation, particularly if sector headwinds or cost concerns suddenly intensify...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' narrative projects $21.9 billion in revenue and $7.5 billion in earnings by 2028. This requires 10.9% yearly revenue growth and a $2.7 billion earnings increase from the current $4.8 billion.

Exploring Other Perspectives

Some of the lowest analyst estimates before the recent news saw Texas Instruments’ revenue growing by just 3.5% per year and assigned a price target as low as US$125. This more pessimistic view highlights concerns around supply chain complexity and margin pressure. It’s important to remember that views differ sharply, so consider how recent developments might shift both optimistic and cautious perspectives going forward.

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives