- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Consistent Dividend Growth and Industry Recovery Might Change The Case For Investing In Texas Instruments (TXN)

Reviewed by Sasha Jovanovic

- Texas Instruments recently extended its two-decade streak of dividend increases and highlighted stabilizing industrial and automotive end-markets, with management pointing to emerging revenue strength and higher manufacturing utilization.

- This combination of consistent dividend growth and signals of recovery in key sectors underpins growing confidence in Texas Instruments’ underlying business strategy despite mixed analyst views.

- We'll examine how Texas Instruments’ ongoing dividend increases and end-market stabilization influence its investment outlook and future earnings potential.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Texas Instruments Investment Narrative Recap

To be a Texas Instruments shareholder, you need confidence in the company’s ability to deliver stable returns from industrial and automotive chip markets while weathering industry cycles and competitive pressures. The latest dividend increase and news of strengthening end-markets support optimism for core business recovery, but the most important short-term catalyst remains a clear upturn in demand across these segments. The biggest current risk is underutilization of Texas Instruments’ substantial manufacturing investments, especially if industrial recovery falters, the recent news underscores improvement, but does not materially change the capacity risk in the near term.

The fresh dividend hike, marking more than twenty consecutive years of increases, directly ties into the company’s message of resilience and shareholder value, providing a visible signal of financial strength. This, in combination with management highlighting stabilizing revenue trends and improving factory utilization, frames Texas Instruments’ effort to assure investors during a period of cautious optimism around the timing and strength of an end-market rebound. Despite this recovery, investors should still pay close attention to manufacturing utilization, as a prolonged demand slowdown could...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' outlook projects $22.3 billion in revenue and $7.9 billion in earnings by 2028. This scenario assumes annual revenue growth of 10.1% and a $2.9 billion increase in earnings from the current $5.0 billion.

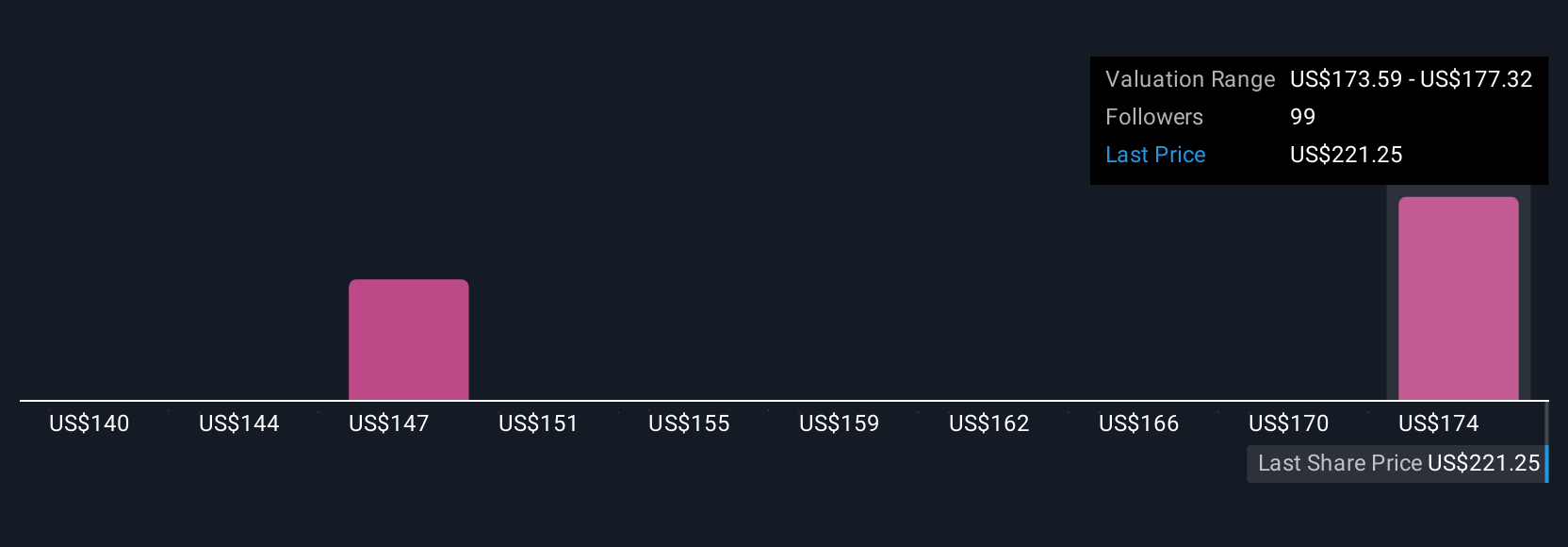

Uncover how Texas Instruments' forecasts yield a $205.42 fair value, a 13% upside to its current price.

Exploring Other Perspectives

While the baseline view is cautiously optimistic, the most pessimistic analysts previously projected annual revenue growth of only 6.5 percent and further margin pressure. They argue that as Texas Instruments’ core analog and embedded markets mature, risks like intensifying competition and regulatory costs could weigh on future profits. These divergent opinions highlight that investor expectations, especially in light of new developments, can shift sharply and are worth exploring in depth.

Explore 7 other fair value estimates on Texas Instruments - why the stock might be worth as much as 13% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives