- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

A Fresh Look at Texas Instruments (TXN) Valuation Following Dividend Boost and Shifting Earnings Sentiment

Reviewed by Kshitija Bhandaru

Texas Instruments (TXN) just announced a 4% dividend increase, extending its long tradition of rewarding shareholders. This signals management’s optimism about future cash generation, even as industry demand remains uncertain.

See our latest analysis for Texas Instruments.

Despite Texas Instruments’ steady approach to dividends, its recent share price action tells a cautious story. TSR is down 8.4% over the past year, reflecting continued investor wariness around mixed demand signals and anticipation of earnings. Still, with industry demand hinting at stabilization and management showing confidence, some see early signs of momentum for the long haul.

If you’re curious to spot other semiconductor names with potential, now’s your chance to explore the full tech and AI landscape with See the full list for free.

With Texas Instruments preparing to report earnings and sentiment wavering, the question remains: does the current valuation offer a compelling entry point for long-term investors, or has the market already accounted for a turnaround?

Most Popular Narrative: 12.2% Undervalued

With Texas Instruments closing at $180.32, the dominant narrative sets a fair value estimate of $205.42. This positions the stock at a noticeable discount and highlights optimism for future growth and profitability.

The ongoing acceleration of industrial automation and digital transformation across diverse industrial sectors is driving sustained recovery and above-average growth in TI's core industrial end market, which increased by double digits year over year. As automation and digitalization continue to proliferate globally, demand for robust analog and embedded chips is expected to boost revenue and support stable, high-margin sales.

Want to discover what’s fueling this bullish vision? Behind the premium price target are bold revenue projections, margin expansions, and industry-defining shifts. If you want to know which metrics set this story apart, see the core assumptions shaping that upside.

Result: Fair Value of $205.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed competition in analog chips or underutilized new manufacturing sites could put pressure on Texas Instruments' margins and weaken the optimistic earnings outlook.

Find out about the key risks to this Texas Instruments narrative.

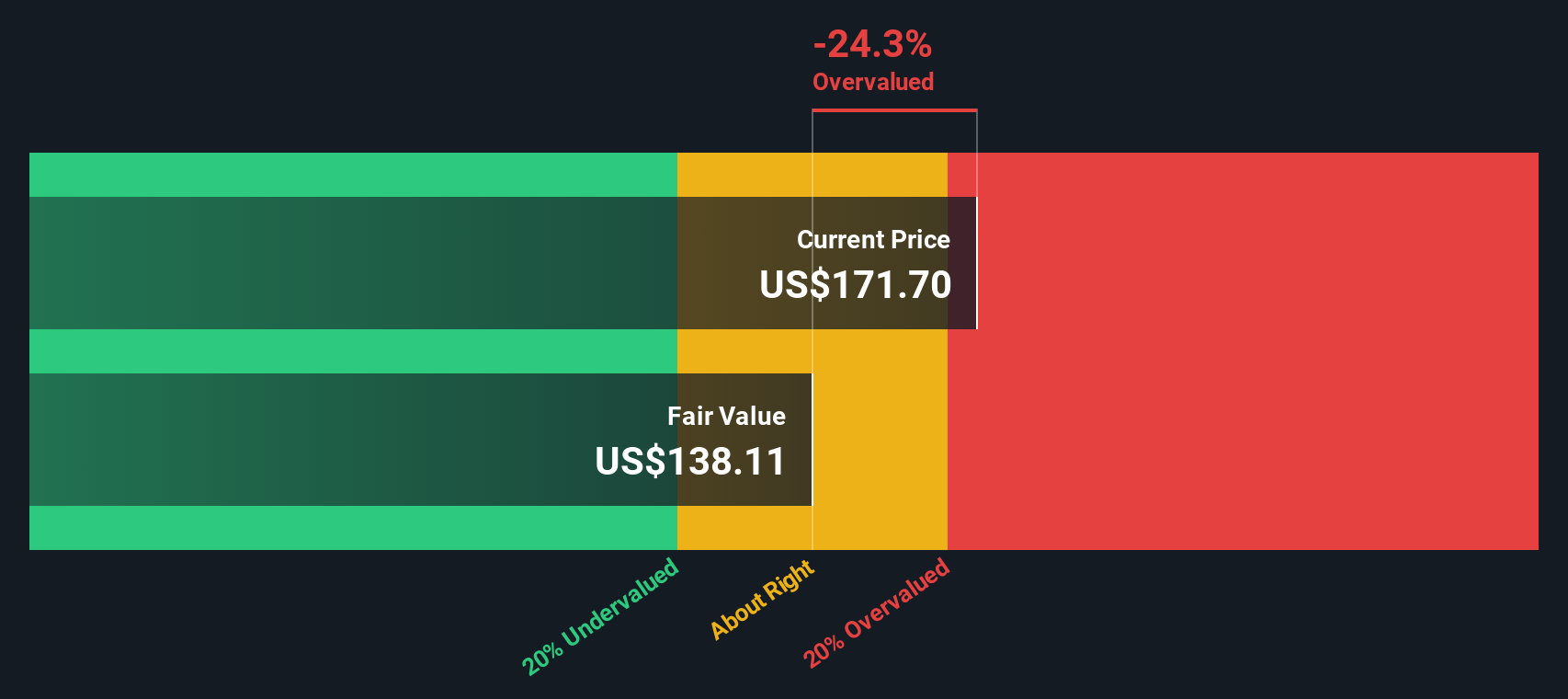

Another View: Discounted Cash Flow Perspective

Looking at Texas Instruments through the lens of the SWS DCF model tells a slightly different story. The model estimates a fair value of $138.79, which is below the current share price. This suggests the market may have already factored in much of the expected growth and raises important questions about risk and reward at today’s prices.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Instruments Narrative

If you have your own perspective or want to dive deeper into the numbers, why not craft your own Texas Instruments story in just a few minutes? Do it your way

A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always a step ahead by considering what’s next. Use these focused lists to seize fresh opportunities and uncover under-the-radar stocks before everyone else jumps in.

- Capture consistent income growth and stability by scanning for top-yielding companies using these 19 dividend stocks with yields > 3%.

- Tap into the next wave of healthcare innovation by exploring these 32 healthcare AI stocks, which highlights early-stage AI solutions powering medical breakthroughs.

- Spot hidden gems with outsized potential by focusing on these 3567 penny stocks with strong financials, featuring smaller companies with strong fundamentals flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives